Bitcoin has continued to struggle recently, and its price even briefly fell below $60,000. Here’s what the whales are doing while the market panics.

How The Bitcoin Whales Are Behaving At The Moment

In a new post on X, the market intelligence platform IntoTheBlock revealed how the Bitcoin whales have been behaving recently, given the struggle the asset’s price has been going through.

Whales popularly refer to BTC investors carrying at least 1,000 tokens in their wallets. At the current exchange rate, this amount is worth about $63.5 million. Due to this massive scale of holdings, the whales can influence the network.

Thus, their behavior can naturally be worth following. First, the analytics firm has discussed the largest entities, even among the whales: the “Large Holders.” IntoTheBlock categorizes Large Holders as those who own 0.1% or more of the entire circulating Bitcoin supply.

Currently, almost 19.7 million tokens are in circulation, so these large holders would be those holding around 19,700 BTC, which is worth a whopping $1.25 billion.

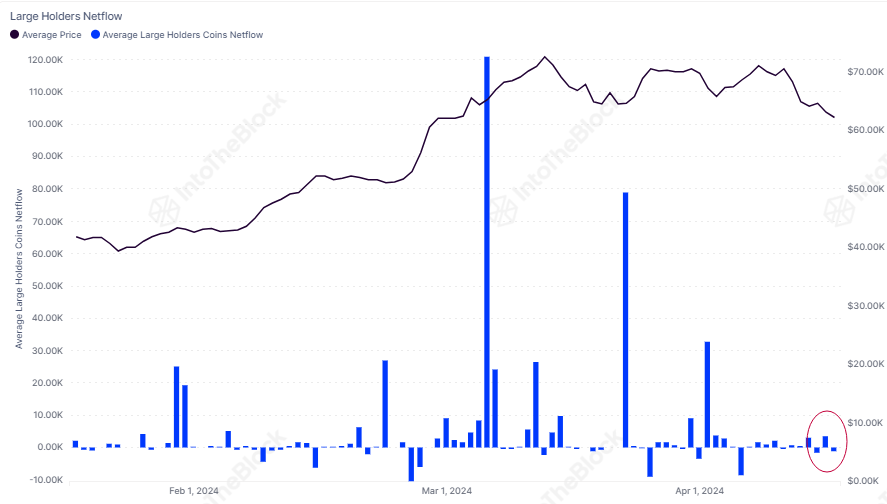

To track the behavior of the large holders, the analytics firm has referred to its “Large Holders Netflow” metric, which uses on-chain data to track the net amount of BTC entering into or exiting the wallets of these humongous entities.

Below is the chart for the indicator that shows how its value has changed over the last few months.

As displayed in the graph, the Bitcoin Large Holders Netflow observed some notable positive spikes during March, suggesting that these massive investors had participated in the accumulation.

The metric’s value has recently stayed near the neutral level, with neither distribution nor accumulation showing any particular dominance. This would mean that the latest price drawdown hasn’t been an enticing buy-the-dip opportunity for this cohort yet.

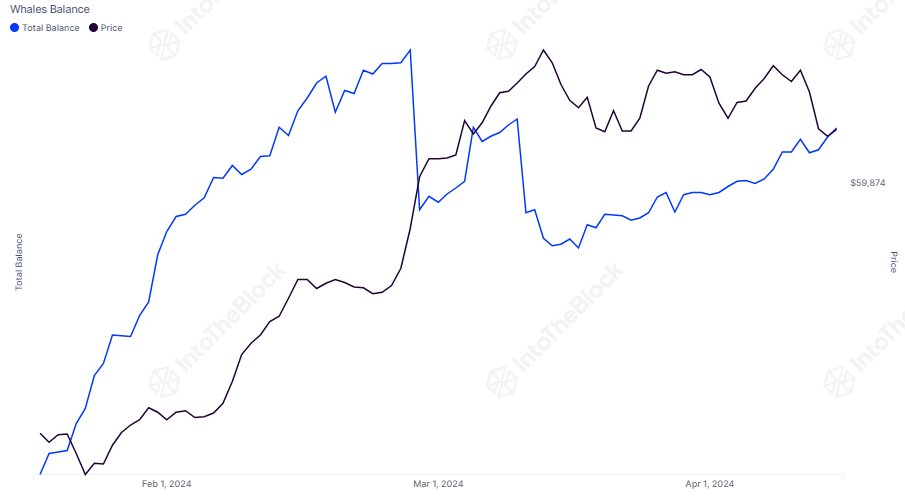

The whales, though, have been buying at these recent low prices. The chart below shows the combined balance held by members of this group.

As the graph shows, the Bitcoin whales made notable selling moves as the cryptocurrency’s price rose to a new all-time high (ATH) last month.

Following Bitcoin’s drawdown from this ATH, though, the whales started buying again. As prices have gone lower recently, they have ramped up their rate of accumulation. IntoTheBlock said these investors had bought 16,300 BTC (almost $1.04 billion) over the past week.

Overall, the fact that the whales are accumulating while the large holders have at least not been selling anything significant can perhaps provide a neutral to slightly bullish picture for Bitcoin.

BTC Price

At the time of writing, Bitcoin is trading at around $63,400, down 10% over the past week.