A strategic trader has made the most of his money after making over 1,000x profit with PEPE. Despite the recent frog-themed token slump, the memecoin investor gained millions. Similarly, whales have continued accumulating PEPE while it resumes its upward trajectory.

Memecoin Trader Makes Millions

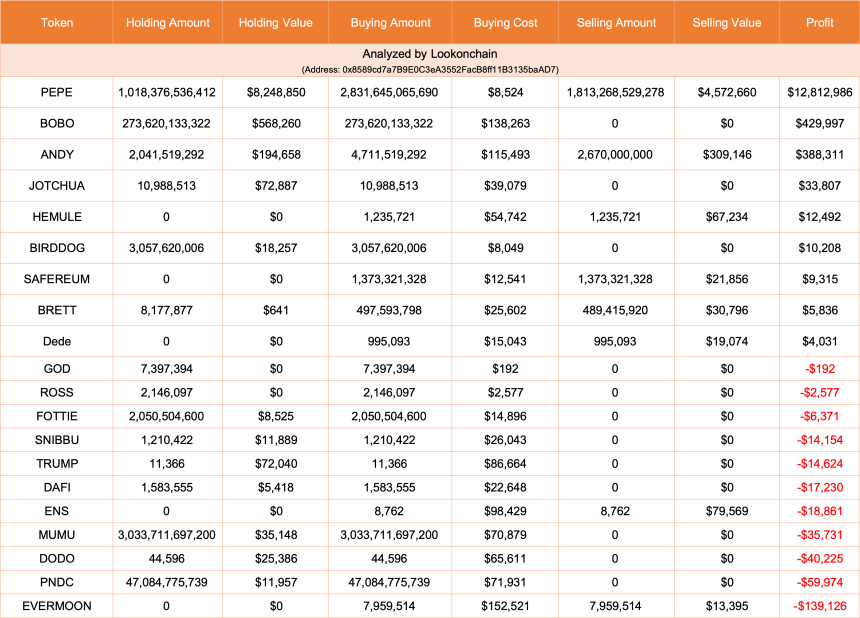

According to Lookonchain data, a memecoin trader named James Wynn multiplied its PEPE investment by 1,503. Wynn bought the token in its earlier stages, acquiring 2.83 trillion PEPE for $8,524. When the token started gaining momentum, he sold over half his holdings, 1.81 trillion tokens, for $4.57 million.

jwynn.eth(@JamesWynnReal) – A smart trader who made $12.8M(1,503x) on $PEPE.

He also traded $BOBO and $ANDY recently, making another $818K!

1/ Let’s dig into his trades.

pic.twitter.com/2vOkjObVPr

— Lookonchain (@lookonchain) April 24, 2024

After the frog-themed memecoin became a market sensation, the trader’s unrealized profits on his remaining bag exponentially increased. Currently, Wynn holds 1.02 trillion PEPE in three wallets worth $8.25 million.

The trader’s total profits from PEPE total $12.8 million. However, if he had held onto his tokens, the gains would have exceeded $20 million.

Per the blockchain research platform, Wynn’s feat doesn’t end with PEPE. He has also made over $800,000 trading other memecoins over the week. He recently bought five tokens, two of which remain profitable: BOBO and ANDY.

At the time of the report, the trader bought over 273.62 billion BOBO for $138.263, making a profit of $430,000. Similarly, he acquired 4.711 billion ANDY for $115.493, gaining over $338,000.

Nonetheless, not all of Wynn’s trades resulted in success. According to the X post, the trader has a 45% success rate, gaining over $13.7 million with nine memecoins and losing around $350,000 on eleven tokens, including some rug pulls.

Whales Go On PEPE Buying Spree

As reported by NewsBTC, recent data showed that PEPE’s price decline over the last month has reduced the number of addresses carrying gains. However, this has not stopped whales from accumulating the token.

This week, a whale accumulated 211.6 billion PEPE from Binance, Gateio, and Uniswap. The address bought the tokens at an average of $0.000007291, spending $1.54 million. The buying spree turned profitable as, some hours later, the token’s price increased by 17%.

According to Spot On Chain, the holdings’ worth surged to $1.72 million, making $173,000 in unrealized profits. Other reports suggest that whales have continued accumulating and taking profits from their PEPE holdings.

However, the token’s market activity decreased by 22.1% in the last 24 hours, with a $1.2 billion daily trading volume. PEPE’s market capitalization has also dropped 1.58%.

Despite this, the token has regained its spot as the third largest memecoin by this metric, as dogwifhat (WIF) lost 13.88% of its market cap on the last day. It’s worth noting that WIF flipped PEPE on March 28 after becoming the newest sensation in the crypto market.

As of this writing, PEPE is changing hands for $0.000007821, representing an 11.4% drop in the monthly timeframe. Nonetheless, the token continues recovering, registering a 52.2% surge in the last seven days.