Arthur Hayes, co-founder and former CEO of the cryptocurrency exchange BitMEX, took to X to provide a detailed analysis of the US economic landscape and its potential effects on the crypto market. With a reputation for incisive commentary and a deep understanding of both traditional and digital finance, Hayes’s insights are closely watched by industry participants.

Why The Crypto Bull Run Will Return As Soon As Monday

In a post, Hayes noted a significant increase in the Treasury General Account (TGA), which he attributed to an influx of approximately $200 billion from tax receipts. “As expected tax receipts added roughly $200bn to TGA,” Hayes stated, setting the stage for a broader discussion on potential implications for financial markets.

Hayes then shifted focus to upcoming decisions by US Treasury Secretary Janet Yellen concerning the management of the TGA. With a tone mixing respect and sternness, he outlined several potential scenarios, each with profound implications for market liquidity. “Forget about the May Fed meeting. The 2Q24 refunding announcement comes out next week. What games will [Janet] Yellen play, here are some options,” Hayes remarked.

Firstly, he suggested that by “stopping issuing treasuries by running down the TGA to zero,” Yellen could unleash a $1 trillion liquidity injection into the economy. This strategy would involve using the accumulated funds in the TGA for federal spending without issuing new debt, thus directly boosting the money supply.

Secondly, Hayes speculated about “shifting more borrowing to T-bills, which removes money from RRP,” resulting in a $400 billion liquidity boost. This maneuver would involve the Treasury opting for shorter-duration debt instruments, which typically carry lower interest rates but increase the turnover of government securities. This could potentially draw funds away from the overnight reverse repo market, where financial institutions temporarily park their excess cash.

Combining these two approaches, according to Hayes, could lead to “a $1.4 trillion injection of liquidity” if Yellen decides to both cease long-term bond issuance and ramp up the issuance of bills while depleting both TGA and RRP accounts. Hayes emphatically noted, “The Fed is irrelevant, Yellen is a bad bitch, you best respect her.” This statement underscores his belief in the significant impact of Treasury actions over Federal Reserve policies in the current economic setup.

Hayes predicted that these actions could lead to a bullish response in the stock market and, more crucially, a rapid acceleration in the crypto market. “If any of these three options happen, expect a rally in stonks and most importantly a re-acceleration of the crypto bull market,” he explained.

The implications of such fiscal strategies are significant. Increased liquidity typically diminishes the appeal of low-yield investments like bonds and encourages the pursuit of higher returns in riskier assets, including equities and cryptocurrencies. Moreover, a shift in market sentiment toward ‘risk-on’ could see substantial capital flows into the crypto space, perceived as a high-growth, albeit volatile, investment frontier.

In conclusion, Hayes’ analysis suggests that the coming week – the refunding announcement comes on Monday, April 29 – could be critical for market watchers. His perspective, drawing from deep financial expertise, points to a possible pivotal shift in US fiscal policy that could ripple through global markets. For crypto investors, these developments could signal important movements, underlining the need for vigilance and readiness to respond to new economic signals.

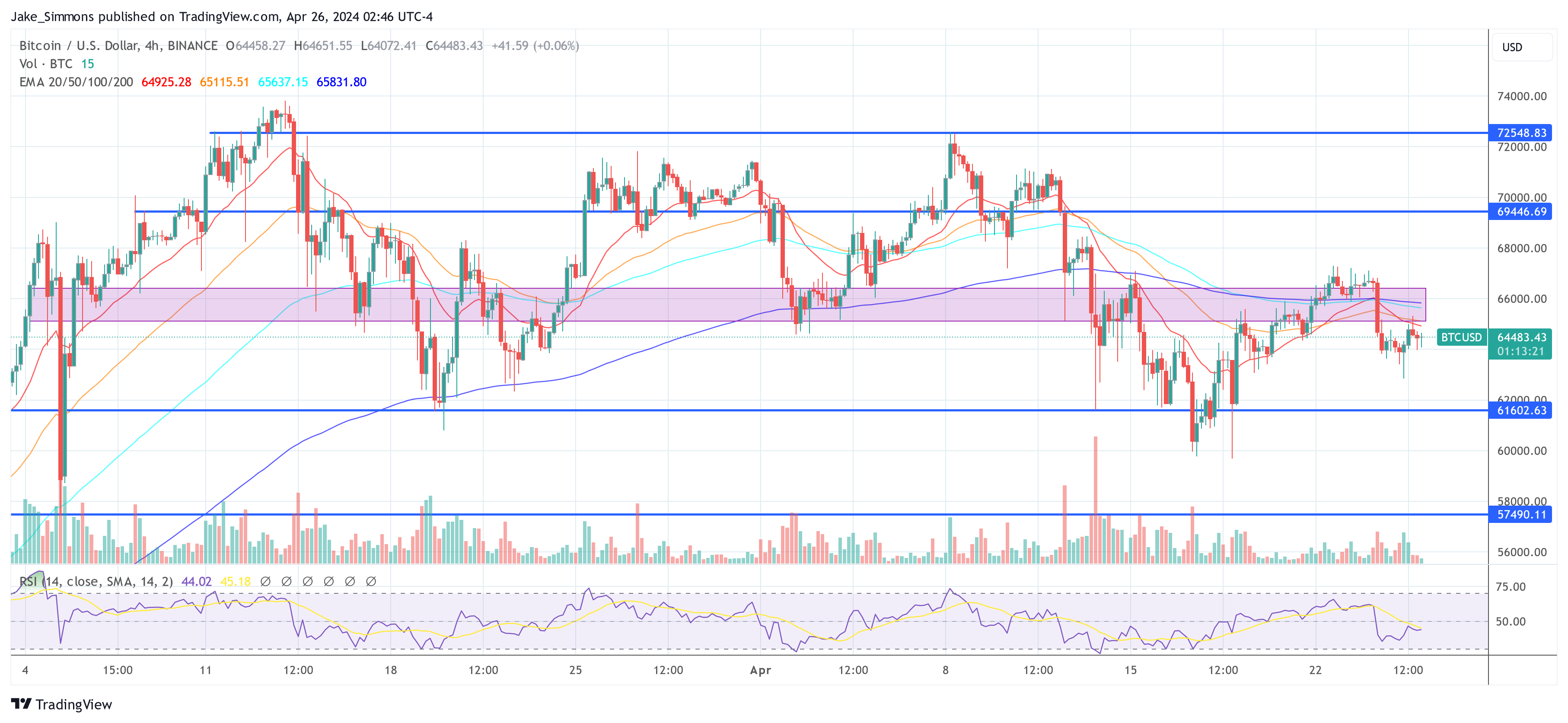

At press time, BTC traded at $64,483.