On-chain data shows the Ethereum transaction fees is now at its lowest since October 2023. Here’s what it could mean for the cryptocurrency.

Ethereum Transfer Fees Has Recently Plunged To A Low Of $1.12

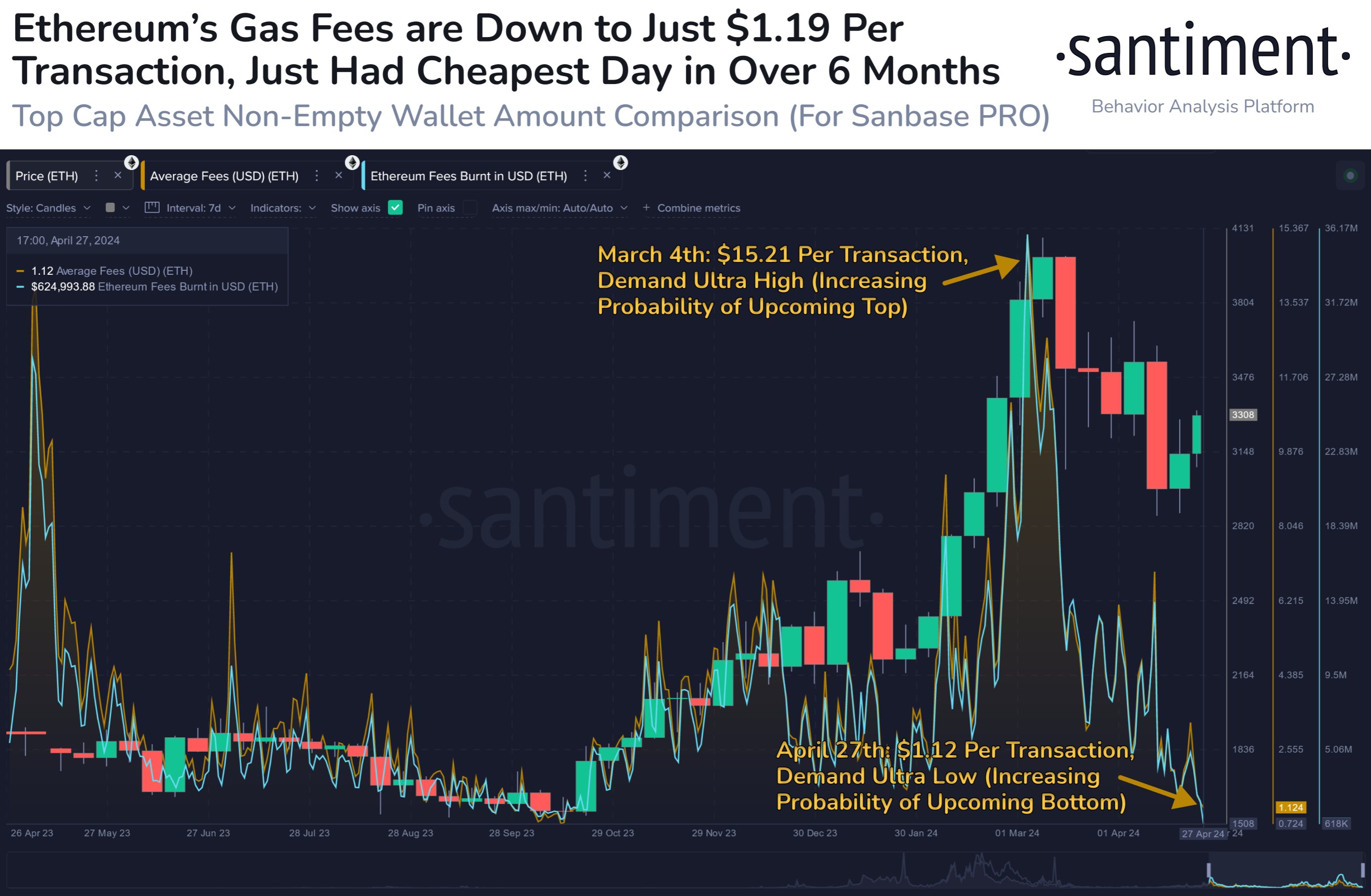

According to data from the on-chain analytics firm Santiment, the average fee on the Ethereum network has dropped to low levels recently. The fee here naturally refers to the amount that every sender has to attach to their transactions as compensation for the blockchain to process their move.

What fee an investor may have to attach in order for the transfer to swiftly go through depends on the network conditions at the time. During times of high activity, there can be high competition to get transactions through fast, so users who are in a rush may have to pay fees high enough to beat this traffic.

Therefore, the average fee tends to be high while such periods of congestion last. Similarly, in periods with little activity, the users can get away with paying only a low amount. Because of this relationship, the average fees can provide a look into the demand that’s present among the users for making use of the Ethereum network right now.

The chart below shows how the average fees on the Ethereum blockchain have changed over the past year:

As displayed in the graph, the Ethereum average fees had observed a surge alongside the rally this year and touched a high of $15.21 last month. Interestingly, this peak in the fees occurred near the top of the price of the asset itself.

“Traders historically move between sentimental cycles of feeling that crypto is going “To the Moon” or feeling that “It Is Dead”, which can be observed through transaction fees,” notes the analytics firm.

Historically, the market has tended to move against the expectations of the majority, so high fee periods, where FOMO is kicking in, tend to lead to tops in the price. As such, the pattern seen last month would be in-line with what has been observed in the past.

From the chart, it’s visible that the Ethereum fees observed a drawdown alongside the price following this top. Recently, the metric has continued this cooldown, now declining to a low of just $1.12.

This is the cheapest that the network has been since October of last year. Just like how high fees can lead to tops, low demand may result in bottoms for the cryptocurrency.

“With markets mainly retracing over the past 6 weeks, the lack of demand and strain on the network may help turn ETH and associated altcoins around sooner than many may expect,” explains Santiment.

ETH Price

Ethereum had recovered to as high as $3,350 yesterday, but the asset seems to have already retraced this surge, as it’s now down to just $3,170.