Quick Take

MicroStrategy, the business intelligence firm, has further solidified its position as a Bitcoin corporate treasury, holding approximately 1% of the total Bitcoin supply. During the first quarter of 2024, MicroStrategy acquired an additional $1.65 billion worth of Bitcoin, bringing its total holdings to a staggering 214,400 BTC.

While there was speculation that MicroStrategy would adopt the updated FASB (Financial Accounting Standards Board) rules, which streamline Bitcoin accounting, the company ultimately decided against it.

According to PunterJeff, a risk and capital advisor and long-standing MicroStrategy bull, due to the absence of FASB adjustments, MSTR incurred a $191 million asset impairment charge in accordance with GAAP accounting principles. This resulted in a bottom-line impact of approximately—$11 per share. Isolating this charge from the P&L statement transforms the EPS from (-$3) to +$8.

One standout highlight from the Q1 earnings presentation was the bullish trajectory of MSTR’s Bitcoin net asset value (Bitcoin NAV = Bitcoin Holdings Market Value minus Total Outstanding Debt).

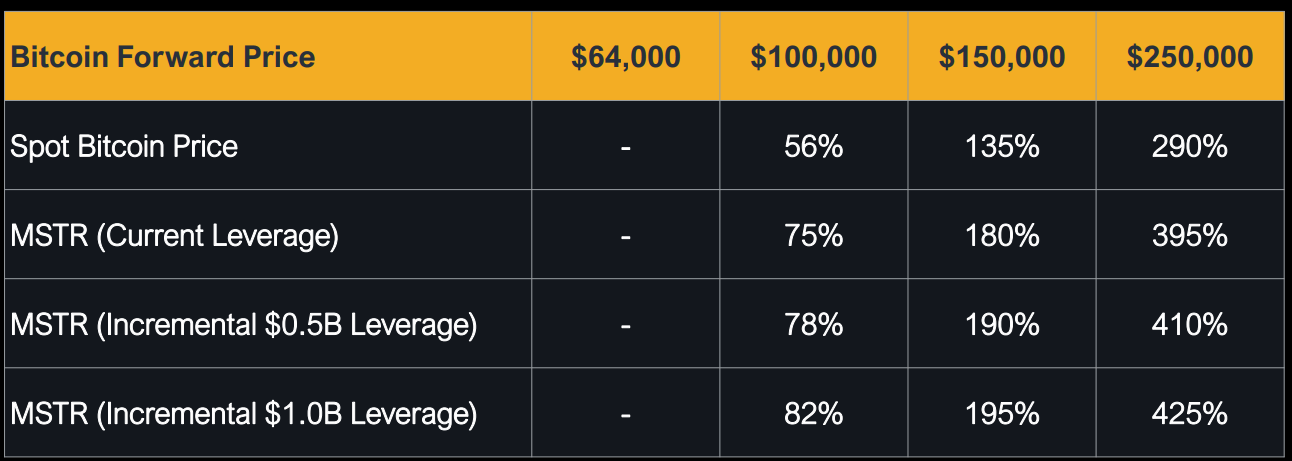

Exploring hypothetical scenarios with potential BTC price increases:

If BTC reached $100,000, this would signify a 56% increase. At $250,000 per coin, the appreciation would skyrocket to 290%. Considering MSTR’s current leverage, a $100,000 BTC price would lead to a 75% appreciation. This appreciation trajectory continues to grow incrementally with higher leverage.

As of April 30, the share price has declined by 15%, currently trading around $1,100.

The post 15% decline in MSTR share price amid non-adoption of new FASB Bitcoin standards appeared first on CryptoSlate.