The recent dip in the price of Bitcoin below the $59,000 support level has sent jitters through the cryptocurrency market. While the price drop triggered liquidations in futures markets, analysts warn that a more significant decline could be on the horizon in the absence of a full-blown market capitulation.

Measured Retreat, Not Mass Exodus

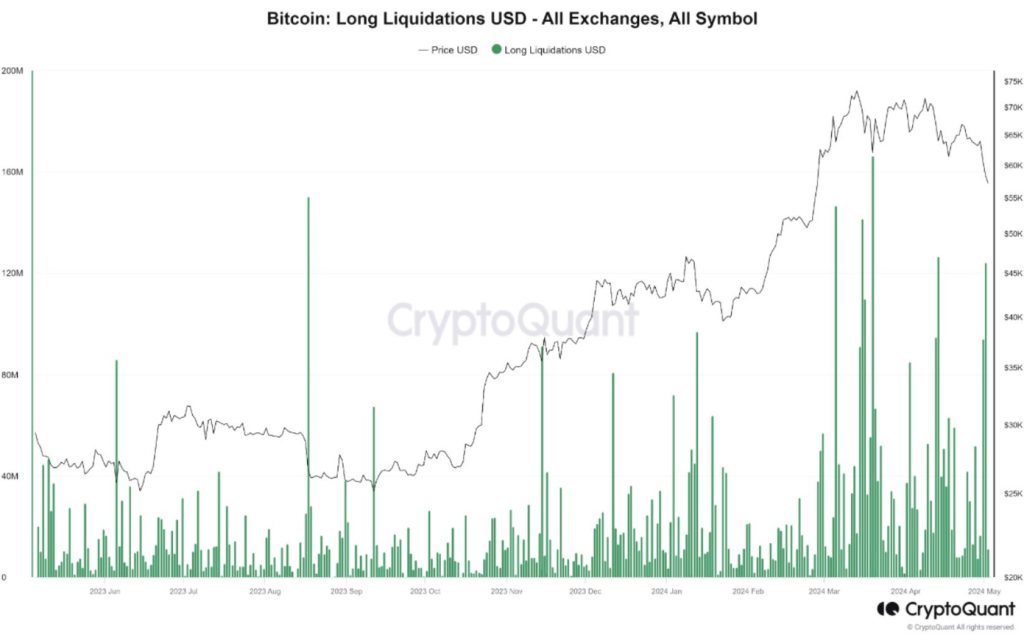

Following the price drop, CryptoQuant, a cryptocurrency analysis platform, reported roughly $120 million in liquidated long positions (bets that the price would go up). This liquidation is noteworthy, but unlike previous selloffs at the same support level, it doesn’t signal a panicked exodus from investors. Investors seem to be taking a more measured approach, suggesting a possible short-term correction rather than a long-term bear market.

$BTC Futures Market Not Yet Signaling Capitulation

“Given the relatively small amount of long position liquidation and the lack of dramatic negative funding ratios, we believe that a ‘capitulation’ has not yet occurred in the futures market.” – By @MAC_D46035

Link

… pic.twitter.com/xqArLQiITf

— CryptoQuant.com (@cryptoquant_com) May 2, 2024

A Glimmer Of Hope For Long-Term Investors

While the short-term outlook appears cautious, there are reasons for long-term investors to remain optimistic. On-chain metrics, which analyze data directly on the Bitcoin blockchain, offer hints of a potential future upswing.

Metrics like MVRV (Market Value to Realized Value) suggest there’s a chance for an upward move in the larger market cycle. This information empowers strategic investors to view the current situation as a potential buying opportunity, particularly if a significant capitulation event unfolds in the futures market.

Navigating The Bitcoin Maze: Data-Driven Decisions Are Key

The current market volatility presents a complex challenge for investors. Understanding market sentiment is crucial for making informed decisions. The funding rate, an indicator of sentiment in futures contracts, has dipped into negative territory at times.

Traditionally, this suggests a stronger presence of bears (investors betting on a price decline) than bulls. However, the negativity hasn’t reached the extremes witnessed during past significant downturns, leaving the overall sentiment somewhat unclear.

Bitcoin’s Long-Term Narrative Remains Unwritten

Closely monitoring futures markets for signs of capitulation, along with analyzing other market indicators like the funding rate, is essential for success in this dynamic environment. Sharp investors armed with a strategic understanding of market dynamics are likely to profit from any future moves.

Bitcoin’s recent price drop has caused short-term volatility, but the long-term story remains unwritten. While the coming weeks might test investor resolve, those who can analyze market data and make strategic decisions could be well-positioned to capitalize on future opportunities.

Featured image from Pixabay, chart from TradingView