Quick Take

Federal Reserve Chair Jerome Powell dismissed concerns about stagflation following the release of the latest US economic data. In his speech following the Fed’s decision to keep fed funds rates at 5.25%-5.50%, Powell stated:

“So I don’t see the ‘stag’ or the ‘flation’.”

Stagflation refers to a toxic combination of stagnant economic growth, high unemployment, and persistently high inflation – something the US has not experienced since the 1970s. However, recent data points suggest the situation may be more concerning than Powell let on.

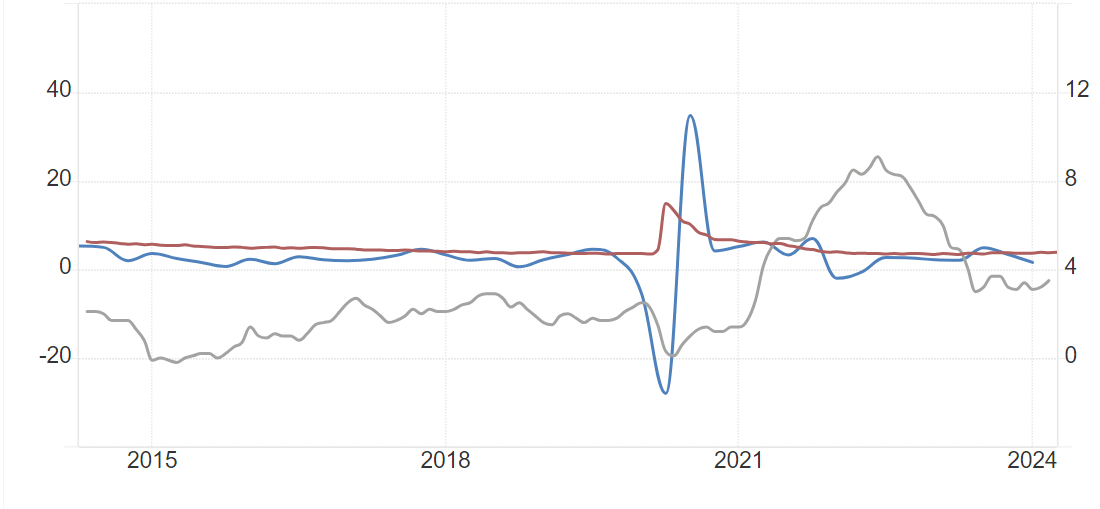

Data from Trading Economics shows that unemployment ticked up to 3.9% in April, 0.1% above expectations. While still below 4%, it has risen 0.5% from the lows as elevated interest rates strain the labor market.

Headline inflation remains stubbornly high at 3.5%, missing the 2% target for over three years now. Economic growth has significantly slowed, with GDP growing just 1.6% in the latest quarter after peaking at 4.9% in Q3 2023.

While the surface-level data may not scream stagflation yet, digging deeper raises red flags. The Fed may be losing its window to get inflation under control before unemployment spikes further.

The post Challenging the notion of ‘Stag’ or ‘Flation’ appeared first on CryptoSlate.