Quick Take

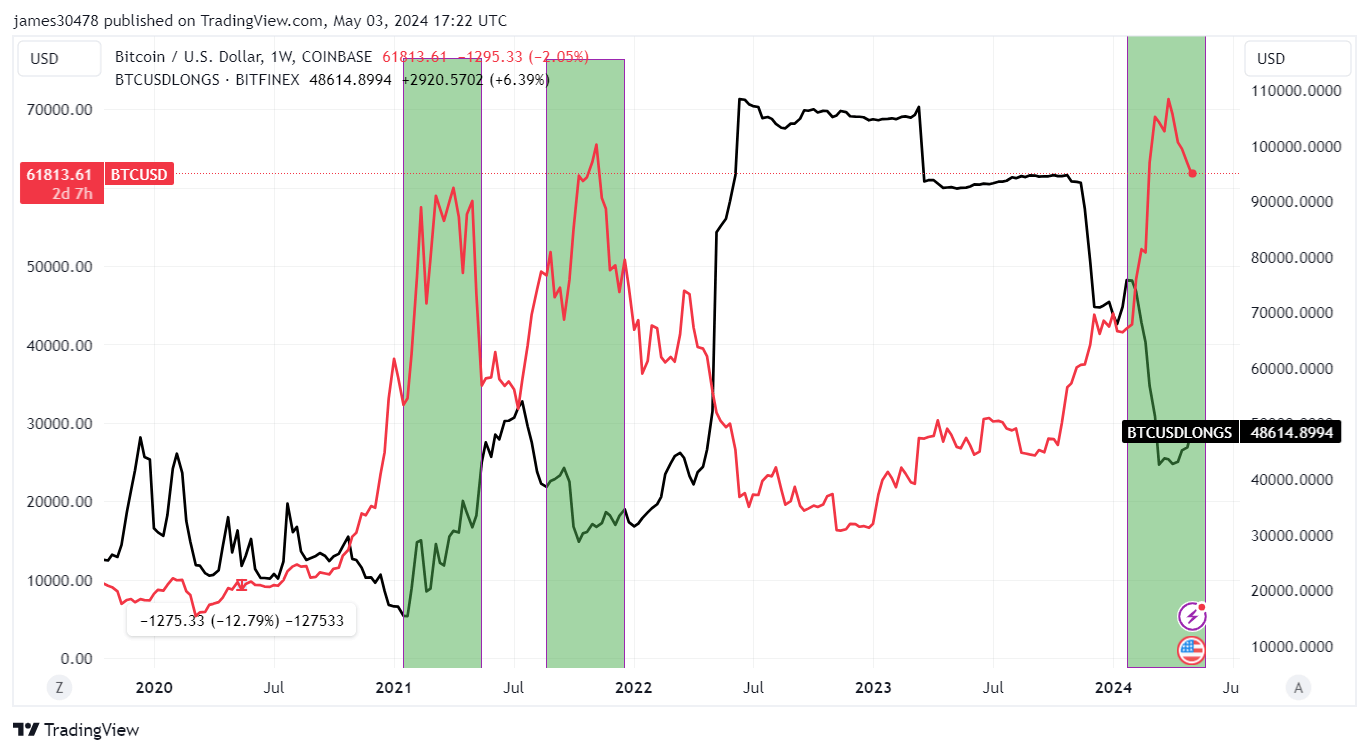

Over the past few days, Bitfinex has recorded a substantial 6% increase in Bitcoin (BTC) long positions held by whales — totaling a staggering 48,615 BTC.

Analyzing Bitfinex whale activity in 2024 reveals a clear pattern: On Feb. 10, these whales held over 76,000 BTC, but by March’s all-time high, the holdings had decreased to 42,000 BTC.

Notably, Bitfinex whales anticipated the flagship crypto’s subsequent decline from its peak of approximately $73,500 to $56,500 on May 1. Since hitting their lowest position on April 13, Bitfinex whales have steadily increased their holdings.

Amid BTC’s recent surge from $56,500 to $62,000 over the past two days, Bitfinex whales have continued to reinforce their positions.

Historical trends suggest that Bitfinex whale activity often serves as a reliable indicator of price direction. When Bitcoin prices peak, whale-long positions tend to bottom out, and these entities have capitalized on market dips to increase their position. Conversely, as prices ascend, whales gradually offload their positions.

The post Bitfinex whales bolster Bitcoin holdings by 6% amid recent price surge appeared first on CryptoSlate.