At the recent MicroStrategy’s Bitcoin For Corporations event, Neel Maitra, a partner at Dechert and a seasoned former fintech and crypto specialist at the SEC, offered a deep dive into the judicial complexities currently entangling crypto regulations, with a special focus on the ongoing Ripple litigation. His insights are particularly noteworthy given his extensive background in both regulatory bodies and private legal practice, including his time at Sullivan & Cromwell.

Will Ripple Vs. SEC ‘Inevitably’ Go To The Second Circuit?

During the Legal & Regulatory Panel, Maitra discussed the divergent judicial opinions on how secondary trading of cryptocurrencies like XRP should be legally classified. He emphasized that this disparity in judicial opinion, especially within the Southern District of New York, illustrates the uncertainty and complexity of current crypto regulations. “It’s funny because three of the judges relevant here were in the Southern District of New York. So in a single federal district the judges can’t agree on how these secondary trading of crypto should be treated,” Maitra observed.

The primary issue at hand, as explained by Maitra, revolves around whether transactions conducted on cryptocurrency exchanges constitute securities transactions under US law. Judge Analisa Torres, overseeing the Ripple case, differentiated between primary and secondary transactions. In primary transactions, purchasers buy directly from Ripple and rely on Ripple’s efforts for potential profits, clearly categorizing such transactions as securities under the Howey Test.

However, Judge Torres argued that secondary transactions, which occur anonymously on exchanges, do not automatically qualify as securities transactions. She termed these as “blind transactions,” where the buyers are often unsophisticated investors unaware of whom they are buying from or the intricacies of the underlying business operations of Ripple.

In contrast, Judge Jed Rakoff and Judge Katherine Polk Failla in separate cases (Terra Luna and Coinbase, respectively) adopted a broader view. They posited that the aggressive marketing strategies employed by crypto companies could influence both primary and secondary market transactions, thereby potentially categorizing even secondary transactions as securities.

“The differing opinions among these judges underscore the nuances and the evolving nature of cryptocurrency regulation,” Maitra explained. He predicted, “It’s inevitable that this [the Ripple vs SEC case] is going to the second circuit and maybe even further, who knows, but there’s a lot left to go in this particular decision just like with Coinbase.” His remark highlights the ongoing debate and the likely progression of the case through the higher judicial echelons.

Maitra also shed light on the SEC’s interpretation of the outcomes of these cases. Despite the setbacks in some rulings, the SEC does not view these as a repudiation of its overall stance on cryptocurrencies as securities. “The SEC doesn’t necessarily see the Ripple case as being a failure of its theory that secondary trading of crypto is securities trading. They just see it as maybe we couldn’t put forward the evidence sufficiently well to convince the court and we’ll fix that at the second circuit level,” he stated.

𝗦𝗘𝗖 𝘃𝘀. 𝗥𝗶𝗽𝗽𝗹𝗲

Neel Maitra, Partner at Dechert / Former Fintech and Crypto Specialist at the @SECGov / Formerly at Sullivan & Cromwell

"𝘛𝘩𝘦 𝘚𝘌𝘊 𝘥𝘰𝘦𝘴𝘯'𝘵 𝘯𝘦𝘤𝘦𝘴𝘴𝘢𝘳𝘪𝘭𝘺 𝘴𝘦𝘦 𝘵𝘩𝘦 𝘙𝘪𝘱𝘱𝘭𝘦 𝘤𝘢𝘴𝘦 𝘢𝘴 𝘣𝘦𝘪𝘯𝘨 𝘢… pic.twitter.com/DL4lksMoF6

— Subjective Views (@subjectiveviews) May 5, 2024

This perspective suggests that the SEC is preparing to refine its arguments and evidence in anticipation of further judicial reviews. This ongoing litigation not only affects Ripple and other individual firms but also sets critical precedents that could shape the regulatory landscape for the entire cryptocurrency market in the United States.

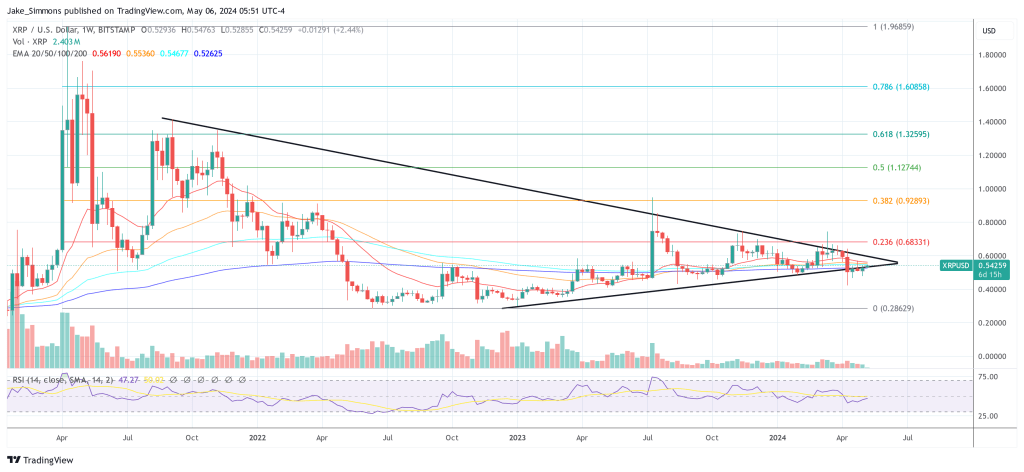

At press time, XRP traded at $0.54259.