On-chain data shows the Bitcoin exchange inflow trend has been at its lowest in almost a decade recently, a sign that may be bullish for the asset.

Bitcoin Exchange Inflows Have Been On The Decline Recently

As pointed out by CryptoQuant author Axel Adler Jr in a post on X, the BTC exchange inflows have been heading down for a while now. The “exchange inflow” is an on-chain indicator that keeps track of the total amount of Bitcoin the investors deposit to wallets attached to centralized exchanges.

When this metric’s value is high, it means that holders are transferring a large number of coins to these platforms right now. As one of the main reasons why investors might deposit coins in the exchanges’ custody is for selling purposes, this kind of trend can be bearish for the asset.

On the other hand, the low indicator implies the exchanges aren’t receiving many deposits currently. Depending on the trend in the opposite metric, the exchange outflow, such a trend can be either bullish or neutral for the cryptocurrency’s price.

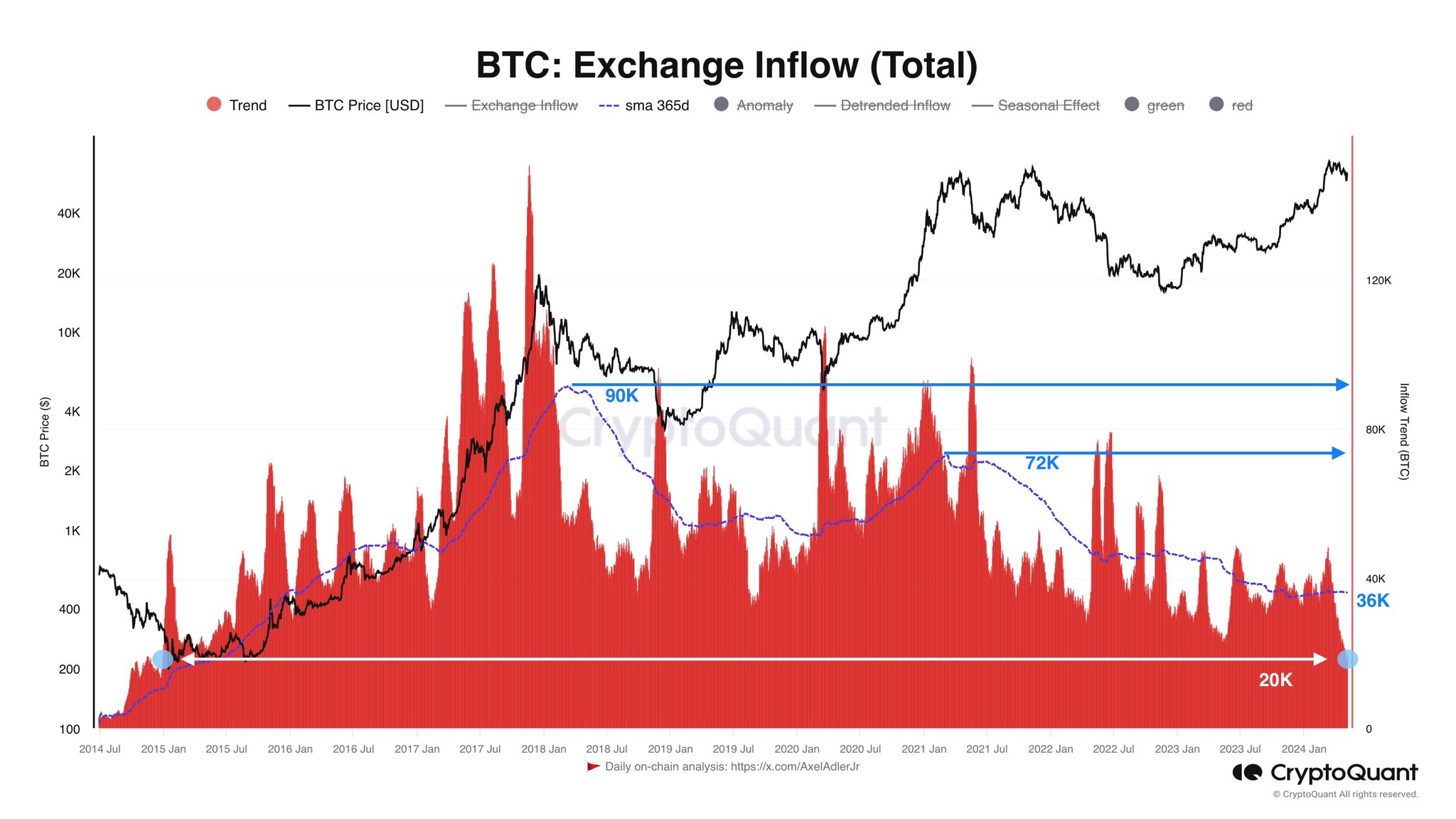

Now, here is a chart that shows the trend in the Bitcoin exchange inflow over the past decade:

As displayed in the above graph, the trend of the Bitcoin exchange Inflow is sitting at 20,000 BTC right now, the lowest value the market has seen since 2015.

The analyst has also attached the data for the indicator’s 365-day moving average (MA) to the same chart. This line has been on the decline since February 2018, dropping from 90,000 BTC to 36,000 BTC today.

The decline in the exchange inflows could indicate that the appetite for selling the cryptocurrency has reduced. If so, due to how supply-demand dynamics work, the price could naturally benefit from a bullish effect from this pattern.

However, there could be another explanation for this long-term trend, and it’s the fact that the exchanges haven’t played a constant role in the market throughout these years.

In the 2017 cycle, the exchanges were relevant in the market, so they actively received huge deposits. Still, during the 2021 cycle, new ways to invest in Bitcoin popped up, which may explain why the drop-off occurred between the two periods.

Today, Bitcoin finds itself in an era when spot exchange-traded funds (ETFs) have gained approval and are attracting considerable demand.

With these ETFs, cryptocurrency exchanges are bound to have lost more relevance, hence why it looks like this cycle will see even fewer deposits than the 2021 epoch.

BTC Price

Bitcoin had recovered beyond $65,000 earlier during the past day, but the asset seems to have slipped, as it’s now back down to $63,100.