In a post on X, one analyst now claims traditional fiat-backed stablecoins like USDT and USDC should prepare for a “major” attack due to the increasing popularity of Ethena’s USDe. The warning follows Ethena and USDe’s integration with Bybit, a crypto exchange allowing perpetual trading.

Ethena Partners With ByBit

USDe is not fiat-backed like other popular stablecoins. Instead, it is a “synthetic dollar” backed by diverse assets, mainly staked ETH derivatives and short positions posted on centralized exchanges like Binance.

Related Reading: Market Expert Says Bitcoin Is Getting Ready To Rally As Major Indicators Cool Off

Announcing the partnership, Ethena, the issuer of USDe, took to X to celebrate the deal and its potential to transform the crypto trading scene. The platform said traders could earn a yield on USDe, which can be used as collateral for futures trading.

Additionally, Ethena noted that users can use their stablecoin in spot trading pairs like Bitcoin and Ethereum without paying fees.

Will This Reduce USDT’s Dominance?

However, while the partnership is bullish for ENA, the native token of the Ethena platform, and could drive demand for USDe, one analyst is doubtful. The observer said the deal constitutes a “direct” attack on the more dominant stablecoins, USDT and USDC, which traders widely use in almost all crypto perpetual trading platforms.

The analyst pointed out offers Ethena dangles via the Bybit integration that could entice traders away from USDT and USDC. For one, traders earning nothing whenever they trade perpetually will receive a yield.

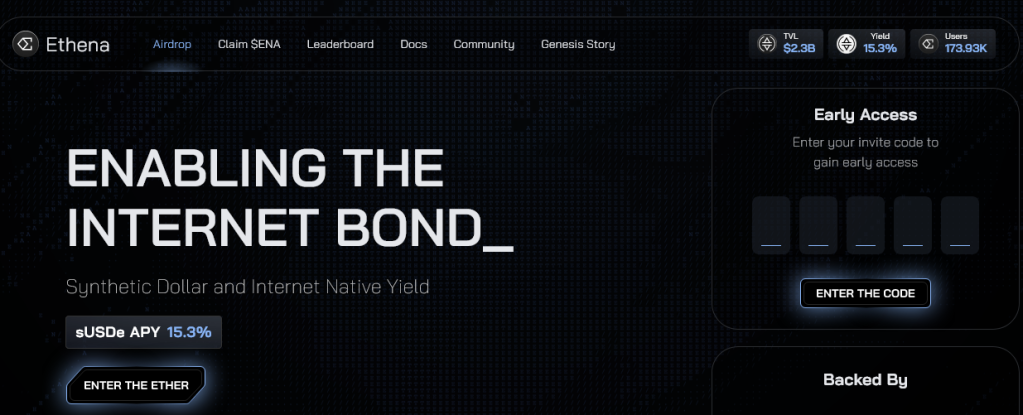

This yield, in turn, will be used to negate funding fees if they choose USDe over USDT or USDC as their margin. Given the high double-digit yield currently standing at 15%, the decision to dish out “free money” for holding USDe, as expected, would impact the dominance of USDT and USDC.

Even so, there are questions about the high yields, with some saying the model is unsustainable. Critics add that the $10 million Reserve Fund placed as a safety net won’t be enough to prevent a depeg when yields fall.

Currently, USDT is the third most valuable cryptocurrency after Bitcoin and Ethereum. When writing, it had a market cap of over $111 billion. As crypto finds adoption and prices recover from the recent plunge, the stablecoin will likely cement its position in the leaderboard.

On the other hand, USDe has a TVL of over $2.5 billion. From Ethena’s homepage, there are over 175,000 holders.