The futures market is a critical component of the Bitcoin market, enabling investors to hedge against price volatility or to speculate on future price movements. Open interest is particularly telling of market sentiment when analyzing futures, as it indicates the amount of money flowing into futures contracts.

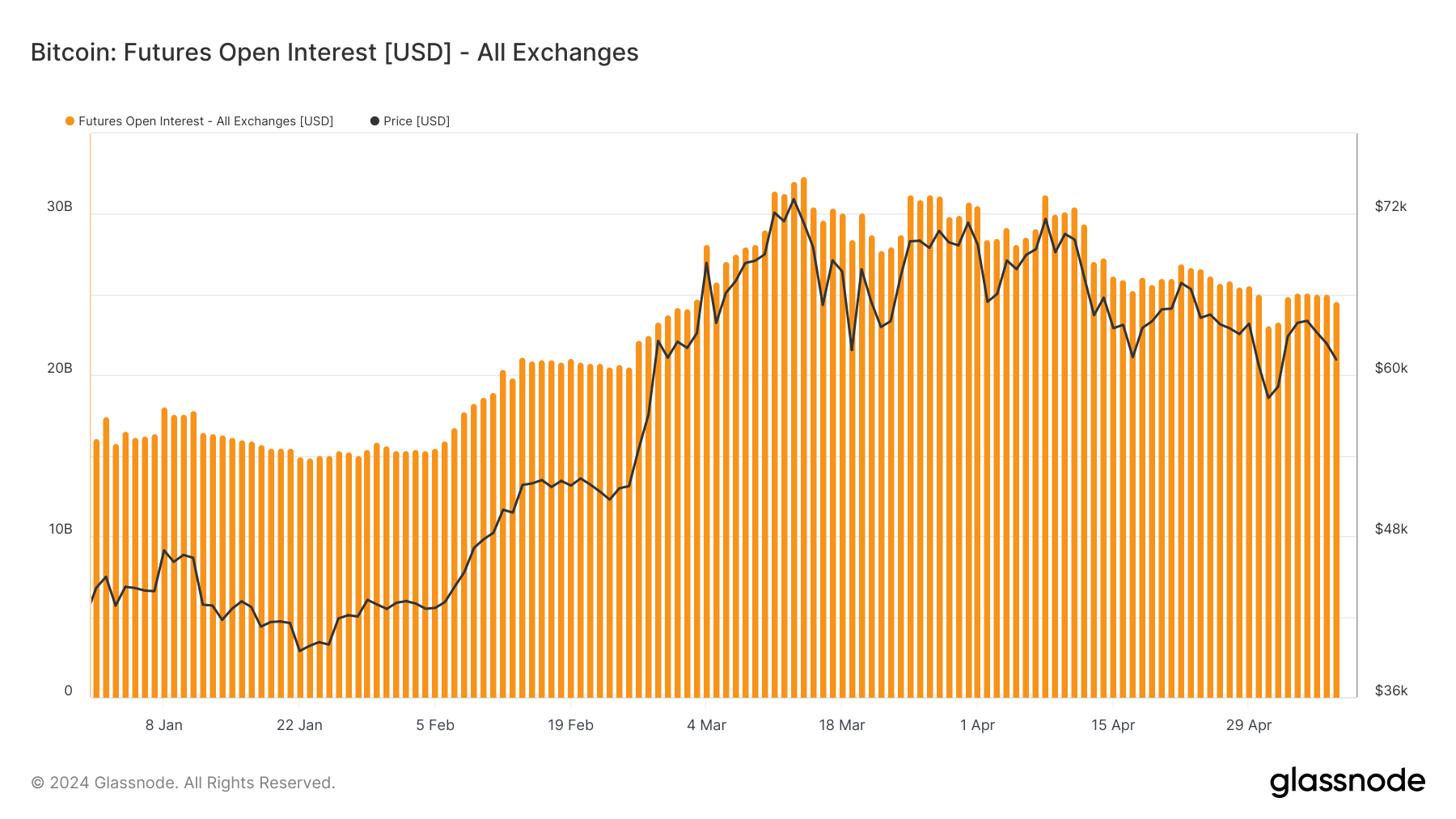

The futures market has had a very volatile year so far. Starting the year with an open interest of $16.087 billion, the market saw a significant uptick, leading to a peak of $32.366 billion by mid-March. It is the highest open interest recorded in the market’s history—unsurprising as it matched Bitcoin’s ascent to its new ATH of $71,400 at the time.

Following the peak in March, there was a noticeable decline in OI, which dropped to $23.119 billion by early May. As of May 8, OI stands at $24.692 billion. The slight recovery OI has seen since the beginning of the month follows BTC’s recovery from a low of $58,295 to around $61,300 at press time. While the amount of OI is very high historically, it still falls short of this year’s highs and broader market expectations.

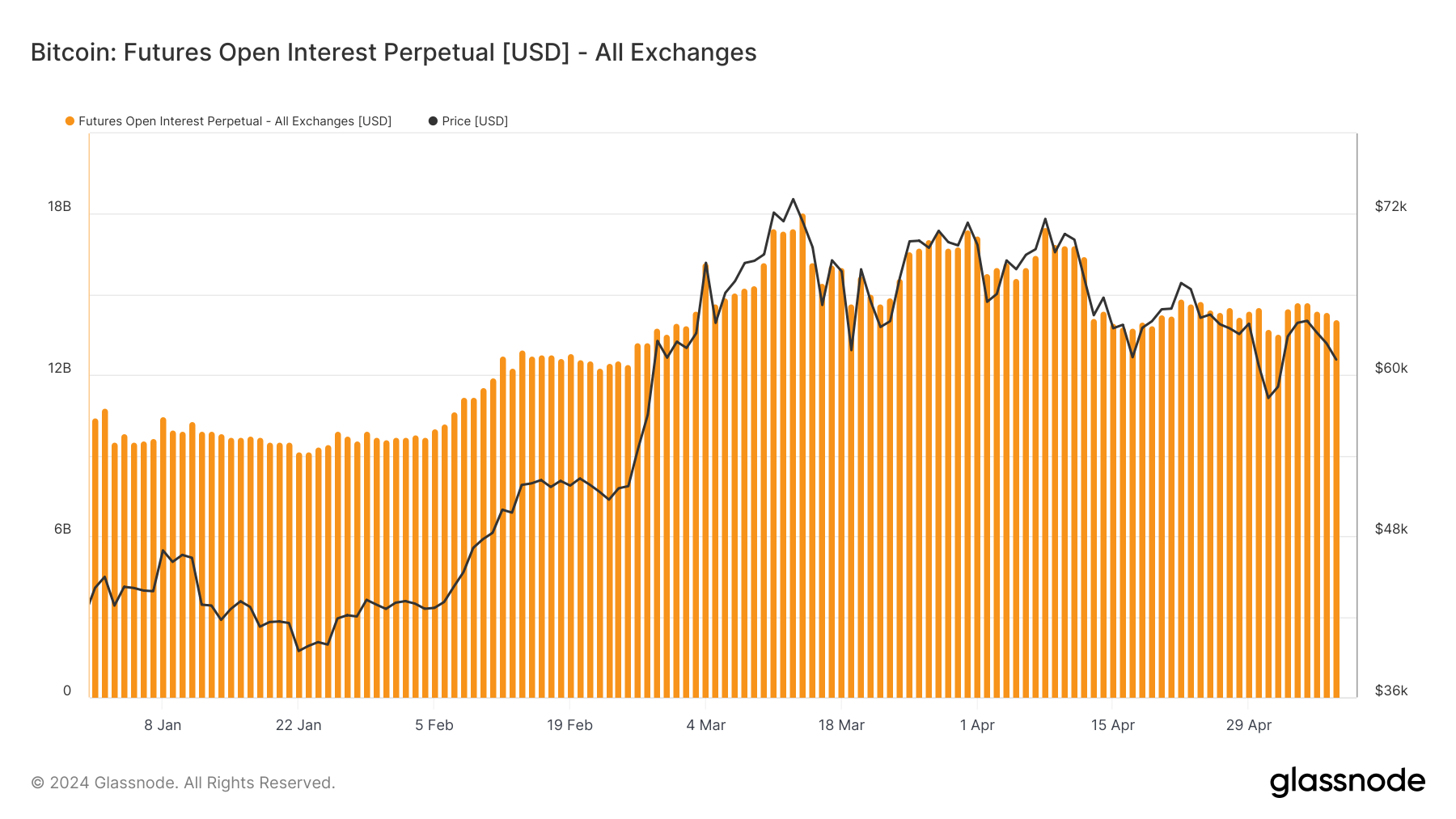

Perpetual futures followed a less volatile pattern. The OI in perpetual futures started at $10.441 billion, increased to $18.068 billion by mid-March, and then exhibited more volatility but remained robust, standing at just over $14 billion as of May 8. As perpetual futures do not have an expiration date and are often used for hedging, the lack of volatility in this part of the market highlights a continuous interest in the product going into May.

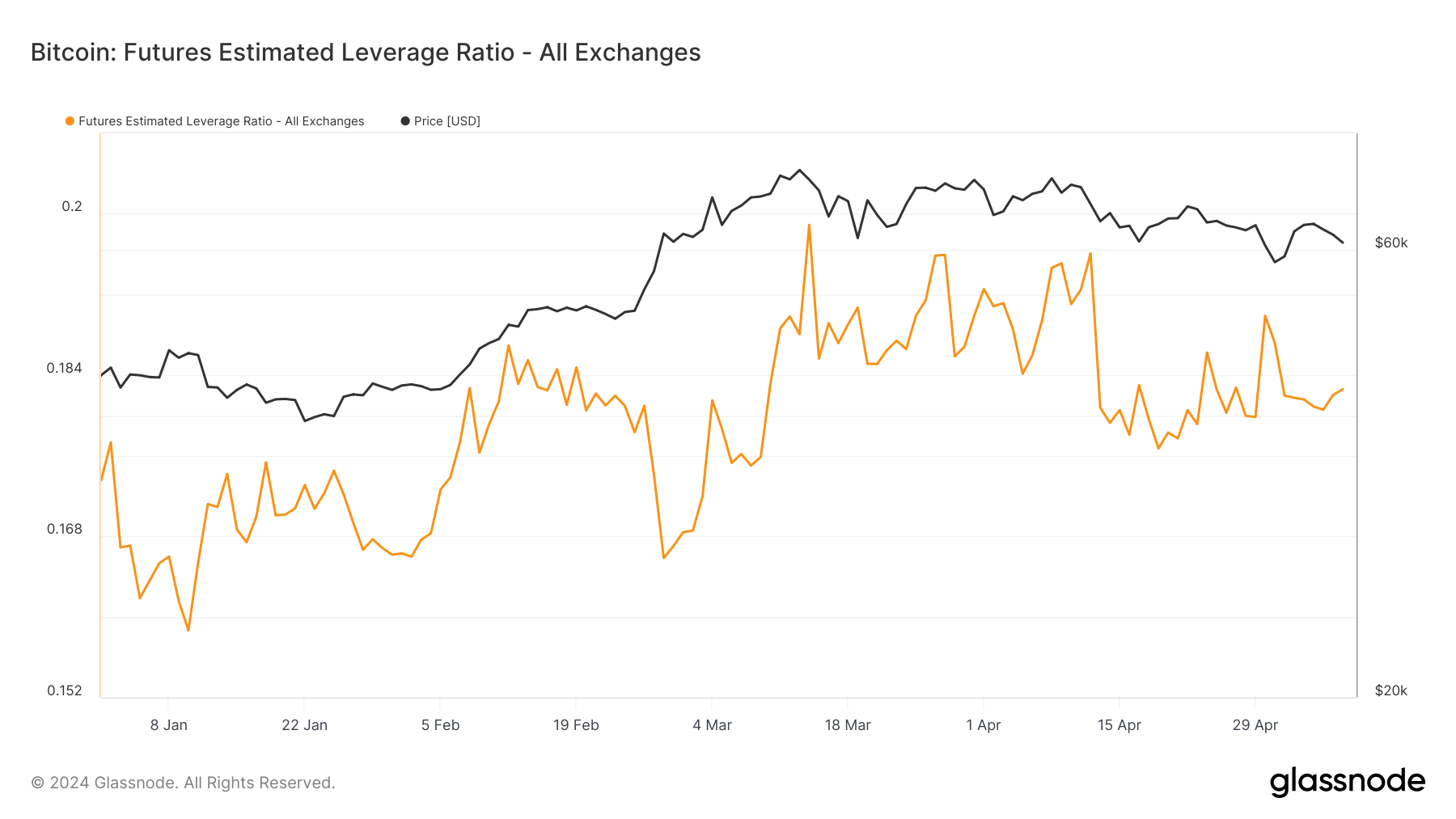

The sharp price fluctuations we’ve seen this year led to a very volatile leverage ratio. Glassnode’s estimated leverage ratio indicates the average leverage used in the open positions in the futures market. The higher the leverage, the higher the risk traders will take.

The leverage peaked at 0.1989 in mid-March when Bitcoin reached a new ATH, showing traders were willing to leverage their positions to bet on a continued upward movement. However, as BTC dropped, the leverage ratio also dropped, settling at around 0.1825 on May 8.

While this shows there’s still quite a bit of leverage in the market, it indicates traders are taking a more cautious approach.

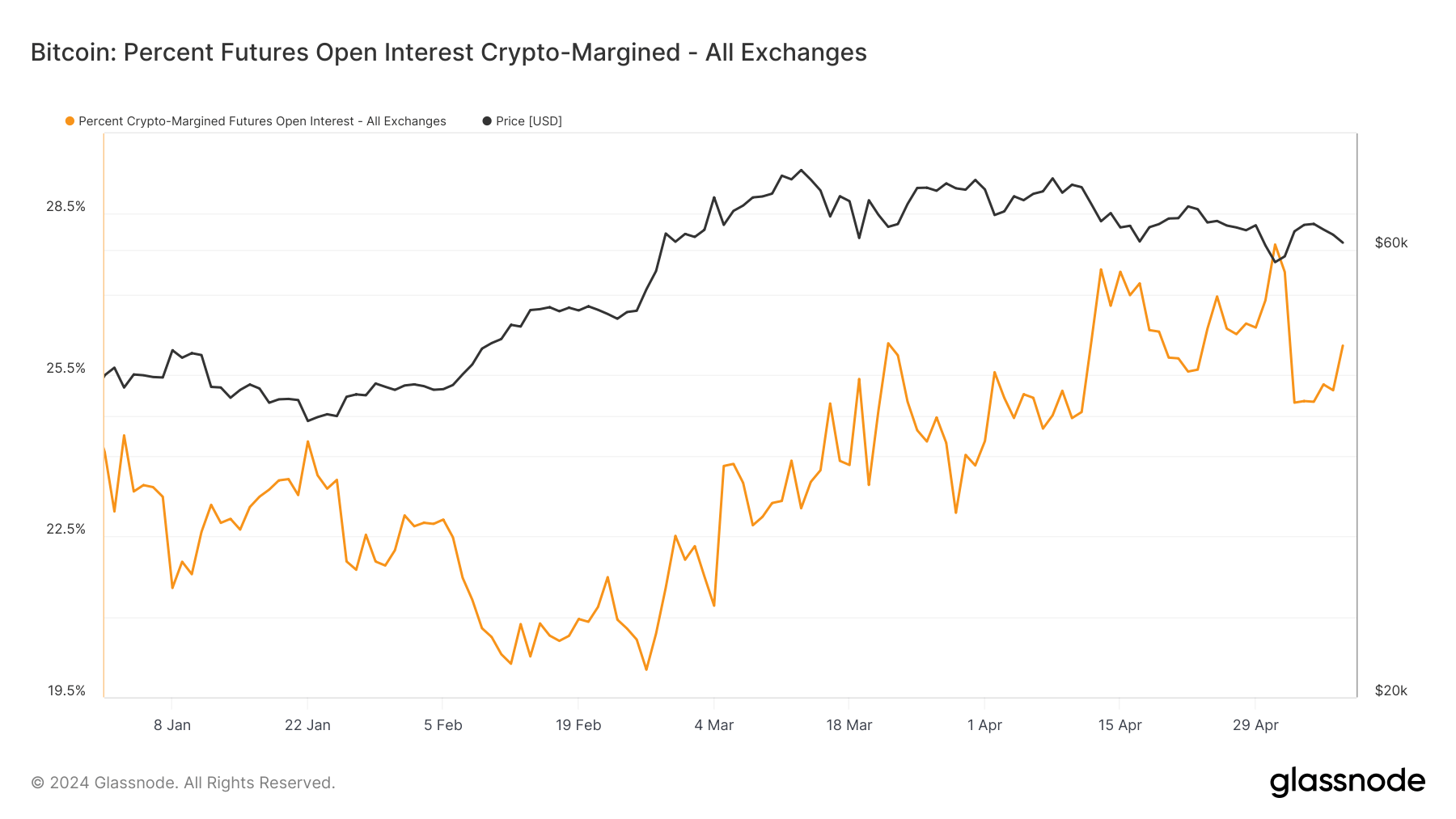

And while some traders might be more cautious when it comes to leverage, we’ve seen a significant increase in traders willing to use Bitcoin as a margin. Starting the year at 24.064%, the proportion of crypto-margined futures saw variations but generally trended upwards, reaching 27.931% by early May and 26.048% by late May.

Despite price volatility, the continuous growth in the percentage of crypto-margined futures shows the futures market has become more saturated with crypto-native traders and traders willing to take on sophisticated positions without using fiat as a margin. It is a sign of a maturing market where traders are more comfortable holding and using BTC despite price volatility.

If Bitcoin’s price continues its sideways chop at around $61,000, we will likely see a corresponding stabilization in OI. It could also lead to a slight adjustment in the current leverage levels, leading to a relatively steady ratio hovering around the 0.1805 to 0.1825 range observed in the past few weeks.

Price stability could also lead to an increase in the percentage of crypto-margined futures. While a stable price might lead to a stable OI for regular futures, perpetual futures might show significant interest in activity. The absence of an expiry date makes perpetual futures more attractive for traders looking to maintain positions without the need to roll over contracts.

On the other hand, any upward volatility will lead to an increase in OI for both types of futures. Bitcoin regaining its ATH could push the leverage ratio above its yearly high, and we could see an even higher percentage of crypto-margined contracts. Overall, a significant price increase in the coming weeks would amplify the trends set in early May but bring about more risk when it comes to liquidations and volatility.

The post What the current price stability means for the Bitcoin futures market appeared first on CryptoSlate.