Identifying trends in DeFi requires analyzing activity on decentralized exchanges (DEXs). These DEXs are the cornerstone of the DeFi market, at the center of DeFi activity, and the main driving force of the sector. To understand what drives DeFi, we need to look at the volume, trader activity, and variety of trading pairs on DEXs.

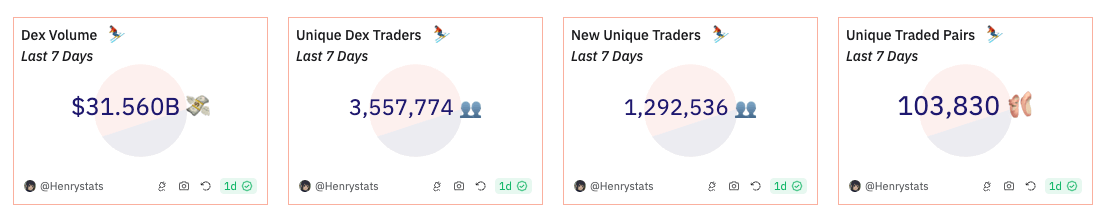

Over the last seven days, the DEX market has seen significant activity, with a total trading volume of $31.56 billion. According to data from Dune Analytics, there were 103,830 unique traded pairs during this period, and the market welcomed approximately 1.292 million new traders.

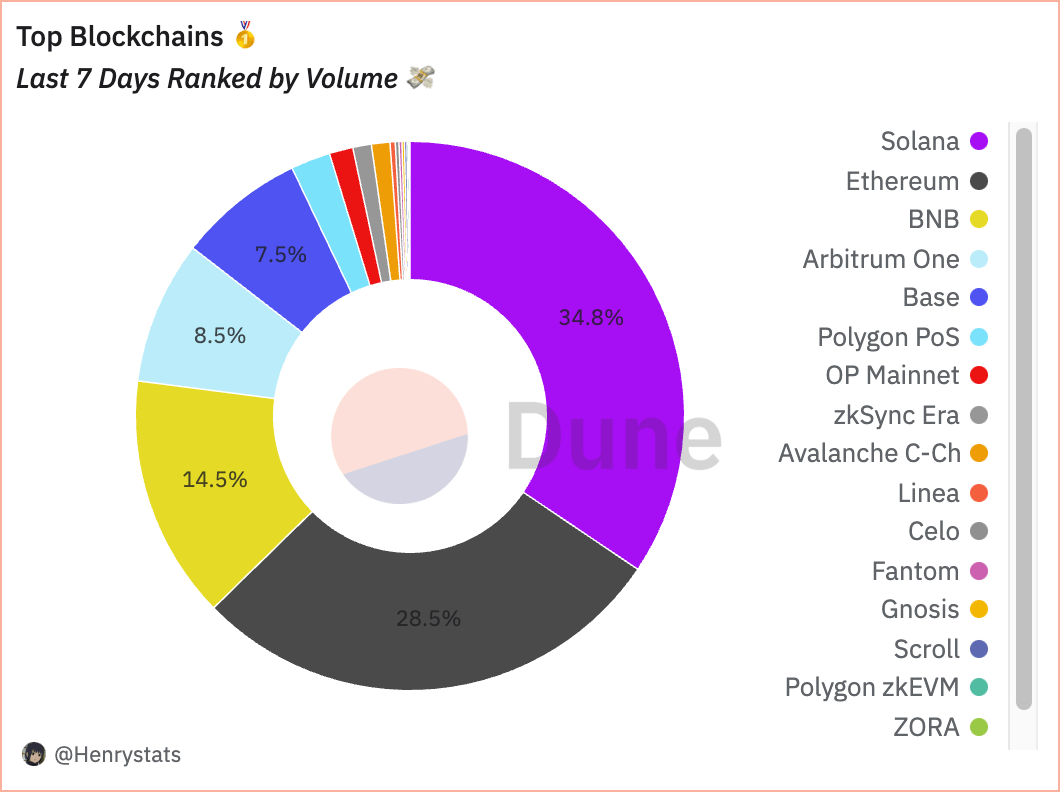

One of the most interesting developments in the DeFi market is Solana, which has dethroned Ethereum and positioned itself as the de facto king of DeFi. With a total trading volume of $10.98 billion over the last week, Solana accounts for 34.8% of the entire DEX market volume. This significant market share is a testament to Solana’s fast-growing ecosystem, which supports a wide range of DEXs, from niche swap markets to prominent players like Raydium.

Despite a slight decrease of 4.49% in volume over the period, Solana continues to lead in terms of active traders, hosting 2.542 million users. This is substantially higher than any other blockchain and significantly higher than the 470,704 users Ethereum has seen over the past week. Such a high discrepancy between Solana and Ethereum’s number of users highlights Solana’s appeal as a preferred trading platform. The blockchain also supported 50,707 active pairs, the highest in the market, which shows its users’ diverse range of trading options.

| Blockchain | Volume (USD) | % of Total Volume | Change Over Period | Active Traders | Active Pairs |

|---|---|---|---|---|---|

| Solana | $10.98B | 34.8% | -4.49% | 2.542M | 50,707 |

| Ethereum | $9.01B | 28.5% | -27.05% | 470,704 | 15,568 |

| BNB | $4.56B | 14.5% | +0.71% | 1M | 45,249 |

| Arbitrum One | $2.67B | 8.5% | -28.04% | 336,072 | 2,952 |

| Base | $2.36B | 7.5% | -29.39% | 672,196 | 16,495 |

With $9.01 billion in volume, Ethereum trails closely behind Solana and holds 28.5% of the market. The volume decreased by 27.05% over the past week, which might not be a notable oscillation for a smaller blockchain but is especially significant given Etehreum’s foundational role in DeFi. However, with 470,704 active traders and 15,568 active pairs, the blockchain remains a key hub for DEX activity despite the decrease.

Binance’s BNB ranks third in volume with $4.56 billion, making up 14.5% of the total market. This represents a slight increase of 0.71%, showcasing resilience amidst market downturns. With 1 million active traders and 45,249 active pairs, the BNB chain continues to be a preferred choice for a large number of traders. However, the relatively small volume relative to the number of users shows that those traders might be dealing in lower volume trades than on Ethereum.

With a volume of $2.67 billion, Arbitrum captures 8.5% of the market. The volume drop of 28.04% could reflect shifting user preferences or broader market trends. Nonetheless, the 336,072 active traders it saw in the past week show that quite a bit of value is still being generated. Base is a notable up-and-comer in DeFi, with $2.36 billion in volume and 7.5% of the market share. Despite a decrease of 29.39% in volume, Base supports a relatively high number of active traders at 672,196, indicating strong user engagement.

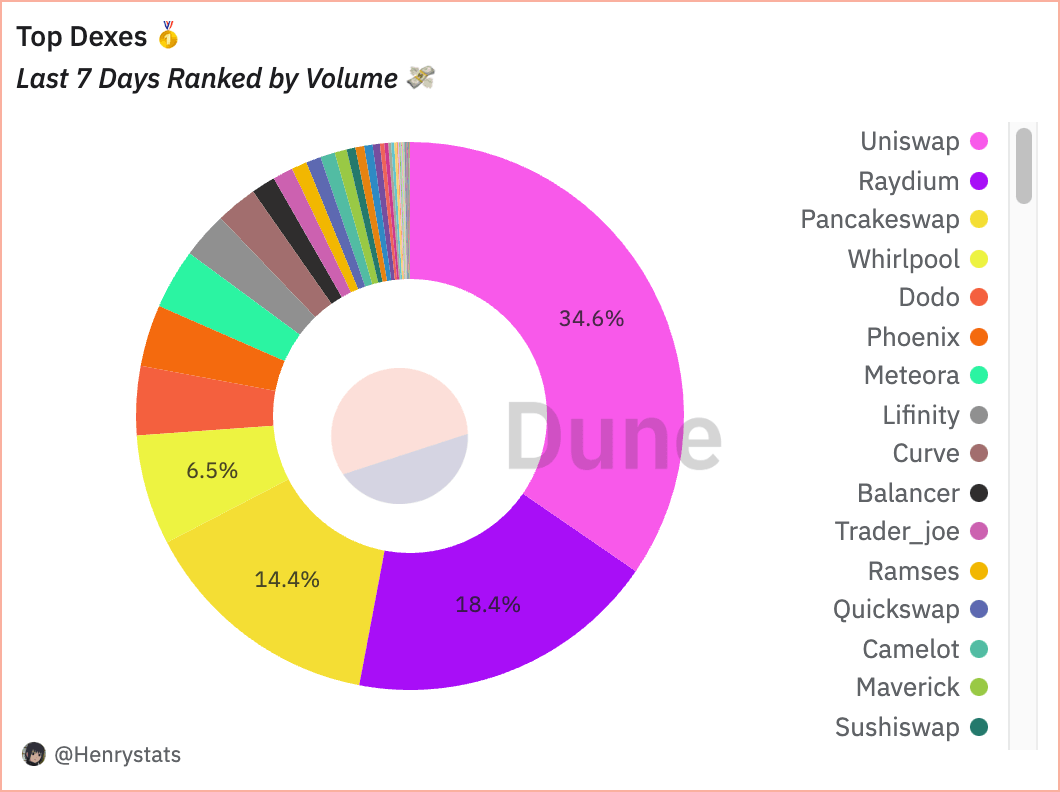

Regarding DEXs, Uniswap leads the market with a 7-day volume of $10.91 billion, constituting 34.6% of the total market volume. It maintains a high number of active traders at 1.456 million and supports 30,683 active pairs despite a 28.93% drop in volume over the past week. The decrease in volume could be attributed to broader market conditions, but its substantial trader base suggests enduring loyalty and trust in the platform.

| DEX | Volume (USD) | % of Total Volume | Change Over Period | Active Traders | Active Pairs |

|---|---|---|---|---|---|

| Uniswap | $10.91B | 34.6% | -28.93% | 1.456M | 30,683 |

| Raydium | $5.80B | 18.4% | +11.76% | 2.309M | 46,905 |

| PancakeSwap | $4.54B | 14.4% | -0.63% | 1.172M | 43,239 |

| Whirlpool | $2.05B | 6.5% | -4.68% | 514,709 | 1,963 |

Operating on the Solana blockchain, Raydium has shown impressive growth with a volume of $5.80 billion, marking an 11.76% increase. With 2.309 million active traders and 46,905 active pairs, Raydium is a critical player in Solana’s dominance, providing users with a wide array of trading options and contributing significantly to the volume on the blockchain.

The leading DEX on BNB, Pancakeswap, saw a trading volume of $4.54 billion, with a marginal decrease of 0.63% in the past seven days. With 1.172 million active traders and 43,239 active pairs, Pancakeswap remains a significant force in the DeFi space. Its volume stability suggests a resilient platform that continues to attract a steady stream of users.

The large number of traders and active pairs shows that the DeFi market is highly liquid, and traders have a wide range of options. Solana’s dominance over the market shows users prefer platforms that offer speed and low transaction costs despite occasional outages and hiccups.

The significant drops in volume we’ve seen across blockchains and even individual DEXs are contrasted by resilience in platforms such as Pancakeswap and BNB, showing that pockets of stability form in the market even during high volatility.

The post DeFi landscape shifts as Solana dethrones Ethereum in trading volume appeared first on CryptoSlate.