Crypto analyst CryptoCon has revealed a key level to watch out for as Bitcoin attempts to break critical resistance levels. The analyst suggested that a drop to this price level may not be bad for Bitcoin and could instead be necessary for it to finally make that price rally.

$57,938 Is The Price Level To Keep An Eye On

CryptoCon mentioned in an X (formerly Twitter) post that $57,938 is the “new price to watch for the 20-week EMA (Exponential Moving Average).” He noted that such a price drop might be necessary, stating that “boredom and sideways price action allow room for growth.” Based on his analysis, any potential price decline that Bitcoin experiences is a healthy correction and shouldn’t be considered a bearish reversal.

Meanwhile, Bitcoin is showing impressive strength on the charts, with CryptoCon stating that the flagship crypto “continues to hold the 20-week EMA as support while visiting the almost absolute bottom of the cycle 4 DMI support zone.” CryptoCon’s positive outlook for Bitcoin provides assurance that a parabolic move is still on the horizon.

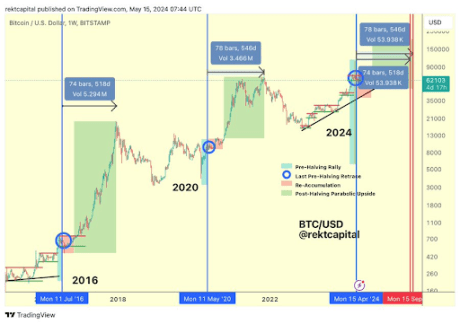

Crypto analyst Rekt Capital also recently shared a positive outlook for Bitcoin. He revealed that Bitcoin was out of the “Danger Zone,” suggesting that the flagship crypto was primed for a move to the upside. The analyst also remarked that Bitcoin was running out of unremarkable months before it began its parabolic phase.

Crypto analyst Mikybull Crypto hinted that Bitcoin was already showing signs of this imminent parabolic phase. In an X post, he mentioned that Bitcoin was displaying a cup and handle reversal pattern on the weekly chart and that the “breakout will be explosive and will send it to a cycle top.”

While agreeing with Mikybull Crypto’s analysis, Crypto analyst BitQuant mentioned that $95,000 will be “achieved in one move, and that is quite obvious.” He, however, noted that it remains uncertain when this move will happen and called for patience as everyone waits for Bitcoin “to perform as expected.”

BitQuant further advised that it might be better to leave the market for those who can’t “avoid the torture,” claiming that there “will be a lot of pain for those with weak nerves” in the coming months. Based on Arthur Hayes’s prediction, investors might have to wait until August for that big move from the flagship crypto.

Bitcoin Is Still Far From Its Market Top

In a recent X post, Rekt Capital suggested that Bitcoin was still far from its market top. He highlighted past cycles, which show that the bull market peak usually occurs between 518 and 546 days after the halving. Based on this, the analyst predicts that the flagship crypto will likely peak in September or October 2025.

The crypto analyst also acknowledged that Bitcoin has been accelerating in this cycle by over 200 days. However, he remarked that Bitcoin could resynchronize with past halving cycles if it continues to consolidate for longer.