Solana (SOL), the high-speed blockchain network, is facing a balancing act. While experiencing a short-term price bump, analysts warn of a potential plunge if a key technical level crumbles.

Bullish Flicker Amidst Bearish Gloom

SOL’s price has seen a recent uptick of 3.60%, currently hovering around $162. However, this seemingly positive movement comes against the backdrop of a broader downward trend. Analysts attribute this shift to a change in market sentiment.

Meanwhile, the altcoin’s RSI is 48, which denotes a neutral position. As a result, SOL has room to move in either direction because it is neither overbought nor oversold.

A drop in trading activity has been observed, which is typical of periods of consolidation. A spike in trade volume following a breakout should confirm the trajectory of the trade.

Lifeline Or Looming Abyss?

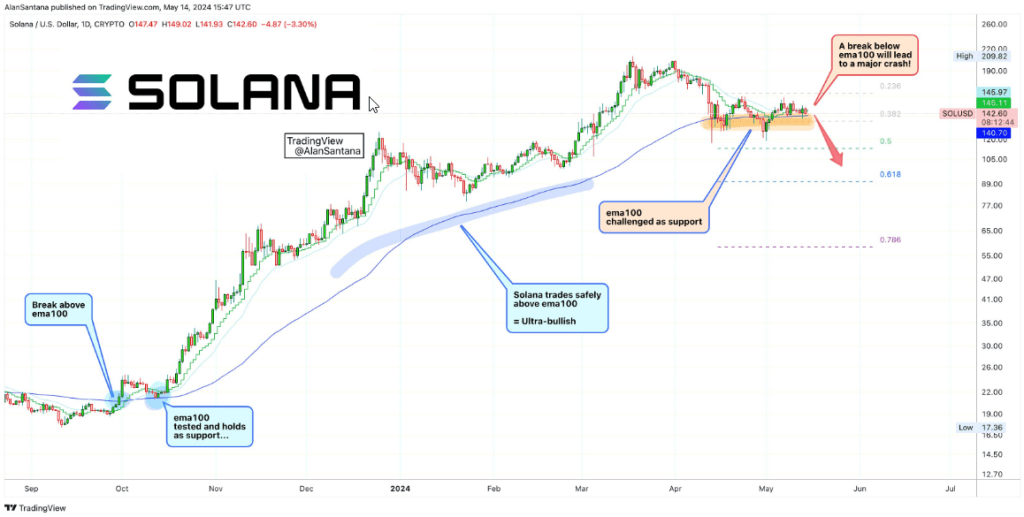

Crypto analyst Alan Santana emphasizes the significance of the Exponential Moving Average 100 (EMA 100) as a critical support level for SOL. The EMA 100 acts as a technical indicator, reflecting the average price over the past 100 days.

Support Weakens | Solana To Crash Below 100#SOL | #Solana

A trend following system uses a moving average as the main tool to generate trading signals for a system trader; the moving average is like the holy grail of technical analysis, together with the RSI.

The moving… pic.twitter.com/9d5NrjuWWR

— Alan Santana (@lamatrades1111) May 14, 2024

Historically, SOL has found support at this level during bullish periods. In September and October 2023, price breakouts above the EMA 100 signaled positive market sentiment. However, the recent trend reversal has cast a shadow over this once reliable indicator.

A Potential Price Plunge

Santana warns that a drop below the current EMA 100, sitting at roughly $140, could trigger a significant downturn for SOL.

This breach could instill fear among investors, potentially leading to a sell-off and pushing the price even lower. The analyst cautions of a possible plunge below $100 if such a scenario unfolds.

Solana: Beyond The Technical

While the technical analysis paints a concerning picture, it’s crucial to remember the inherent volatility of the cryptocurrency market.

Short-term predictions based on technical indicators may not always hold true. Other factors, such as industry news, regulations, and broader market trends, can also play a significant role in price movements.

For instance, a positive regulatory stance towards cryptocurrencies could boost investor confidence and lead to a price increase, even if technical indicators suggest a downtrend.

Conversely, negative news surrounding a blockchain hack or security vulnerabilities could trigger a sell-off, defying bullish technical signals.

The Road Ahead

Solana’s future trajectory remains uncertain. Will the $140 price point become a launchpad for a recovery, or will it crumble, sending SOL tumbling down deeper?

Featured image from Pngtree, chart from TradingView