Quick Take

US ETFs

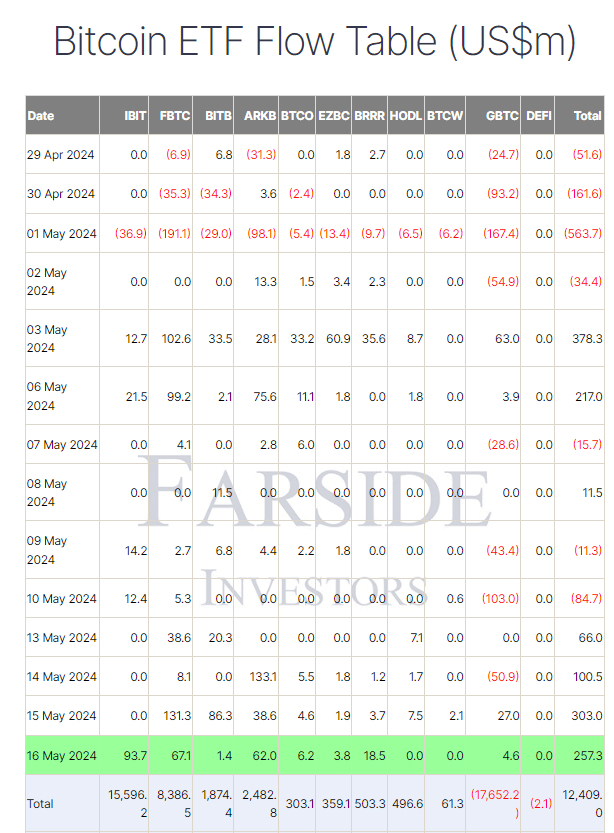

According to data from Farside, US Bitcoin (BTC) exchange-traded funds (ETFs) saw a $257.3 million inflow, marking the fourth consecutive day of inflows. The inflows were widespread, with 8 out of the 11 U.S. ETFs reporting positive flows. BlackRock’s IBIT ETF saw the largest single-day inflow of $93.7 million, the biggest since April 12. This brings IBIT’s total inflows to an impressive $15.6 billion.

Fidelity’s FBTC ETF also continued its strong performance, adding $67.1 million and taking its total net inflows to $8.4 billion. Meanwhile, the Grayscale GBTC Trust saw a $4.6 million inflow, taking its total cumulative outflows to $17.7 billion. Total inflows for the ETFs hit $12.4 billion, according to Farside data.

HK ETFs

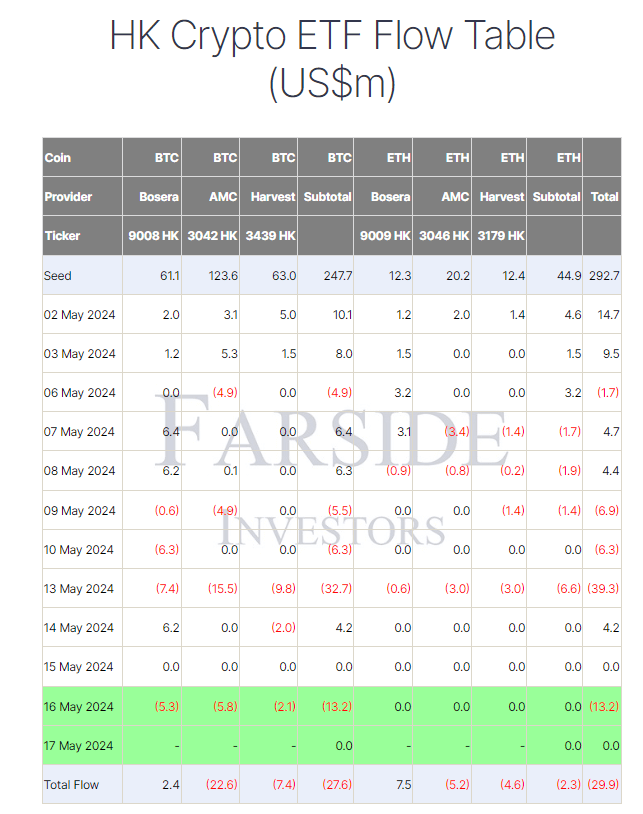

The story differs in Hong Kong (HK), where all three listed BTC ETFs experienced outflows totaling $13.2 million on May 16. This marks the second-largest single-day outflow for HK digital asset ETFs. No inflows or outflows occurred for the Ethereum ETFs. Overall, HK’s BTC ETFs have seen $27.6 million in outflows, while Ethereum ETFs have witnessed $2.3 million, bringing the combined outflows to $29.9 million, according to Farside data.

The post US Bitcoin ETFs see fourth consecutive day of inflows, adding $257.3 million appeared first on CryptoSlate.