Quick Take

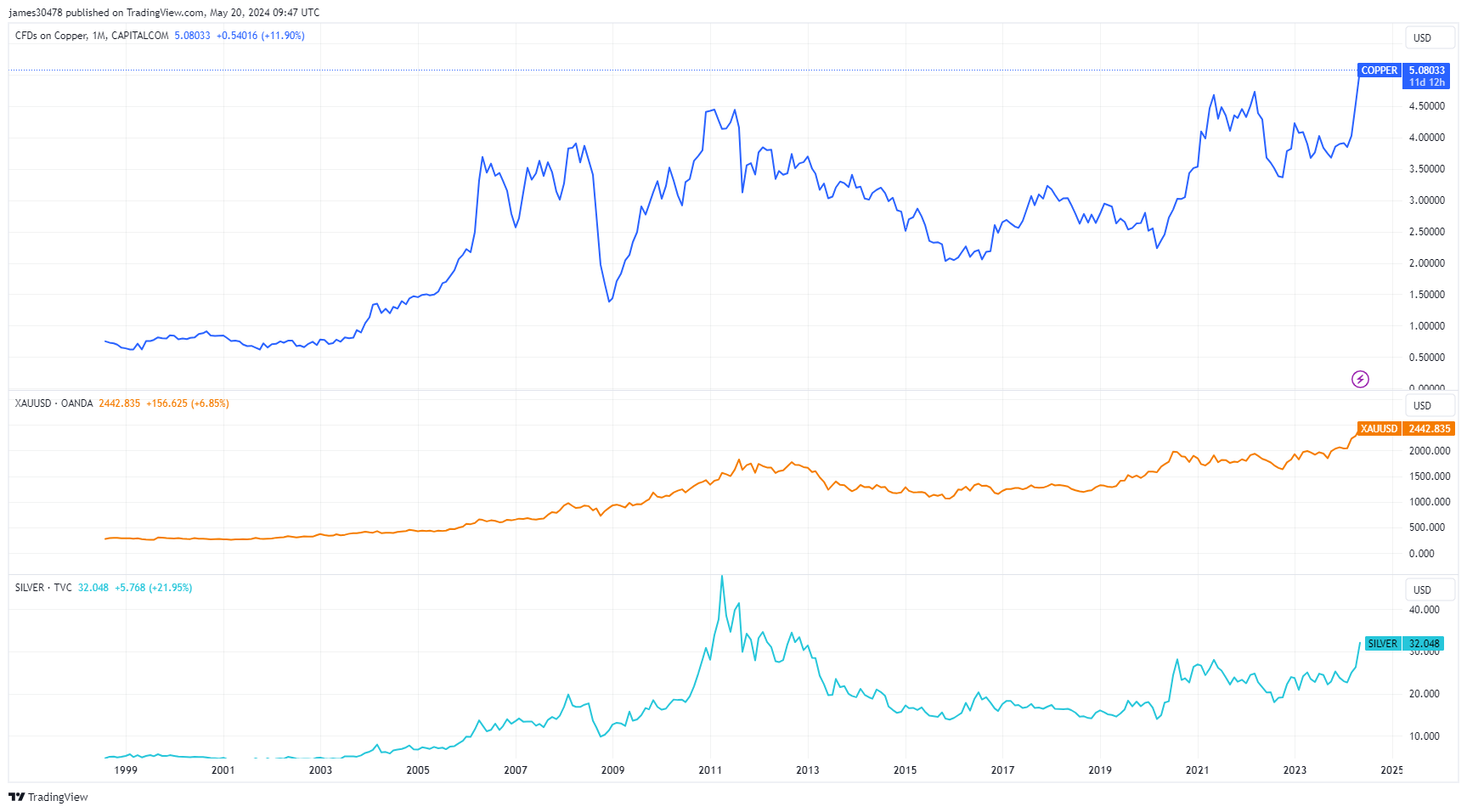

As economic uncertainty looms, traditional safe-haven assets like gold, silver, and copper are soaring to new heights. Gold recently hit a new all-time high of $2,443 an ounce, up nearly 20% year-to-date. Silver is approaching $32 an ounce, its highest level since October 2012, while copper is trading above $5, an all-time high.

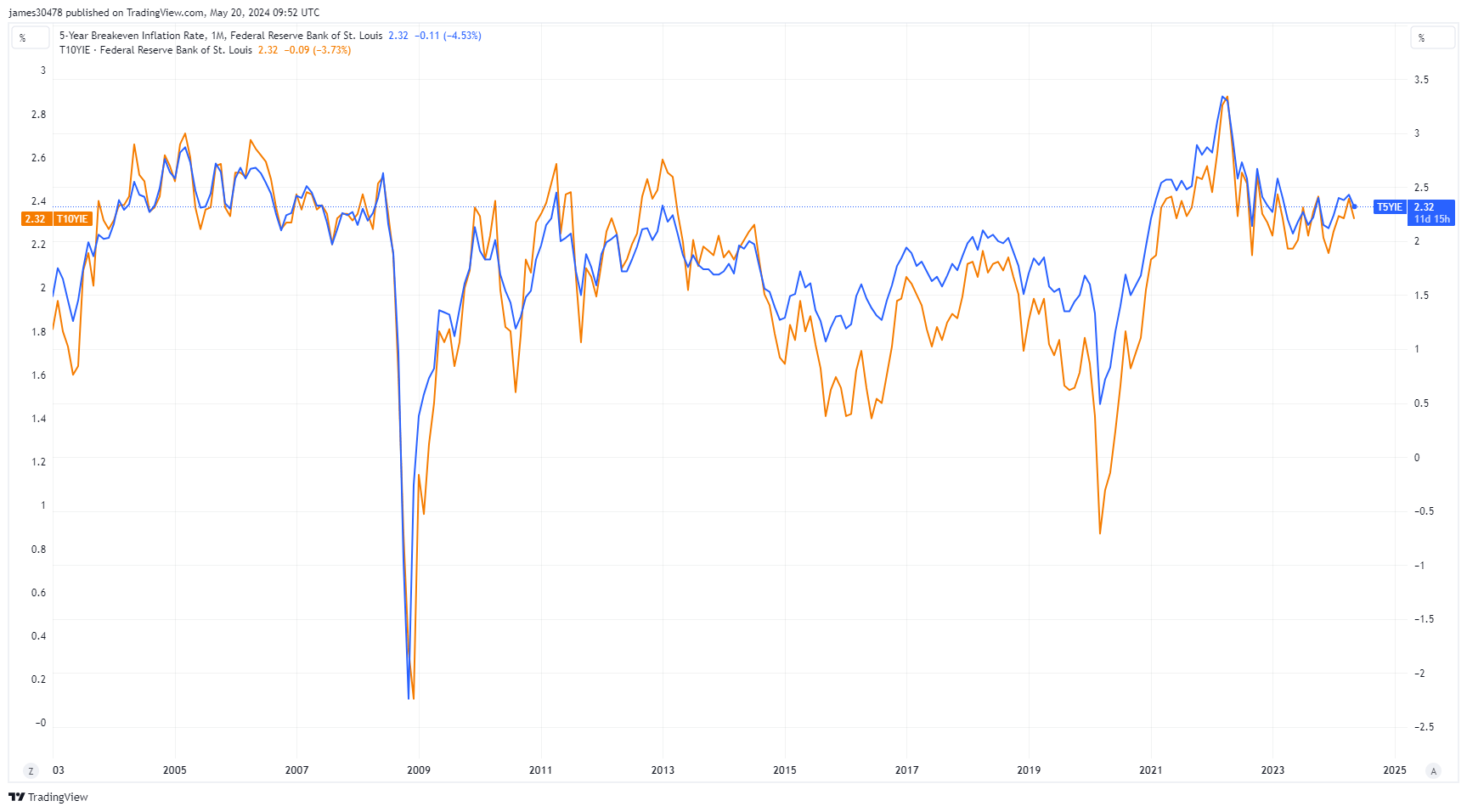

The surge in precious metals and industrial commodities can be attributed to several factors. Inflation concerns are mounting, with both 5-year and 10-year inflation expectations hovering around 2.3%, higher than central banks’ target of 2%. Inflation expectations have remained above 2% since January 2021.

Safe-haven demand is also driving investors towards these assets, as 11 out of the past 14 rate-hiking cycles have ended in a recession, while interest rates are at their highest level in over 20 years in the US.

Furthermore, investment shifts and geopolitical uncertainties, such as ongoing wars and upcoming elections, could be contributing to the rally. A rise in copper prices can signal higher costs of goods and manufacturing or even economic growth.

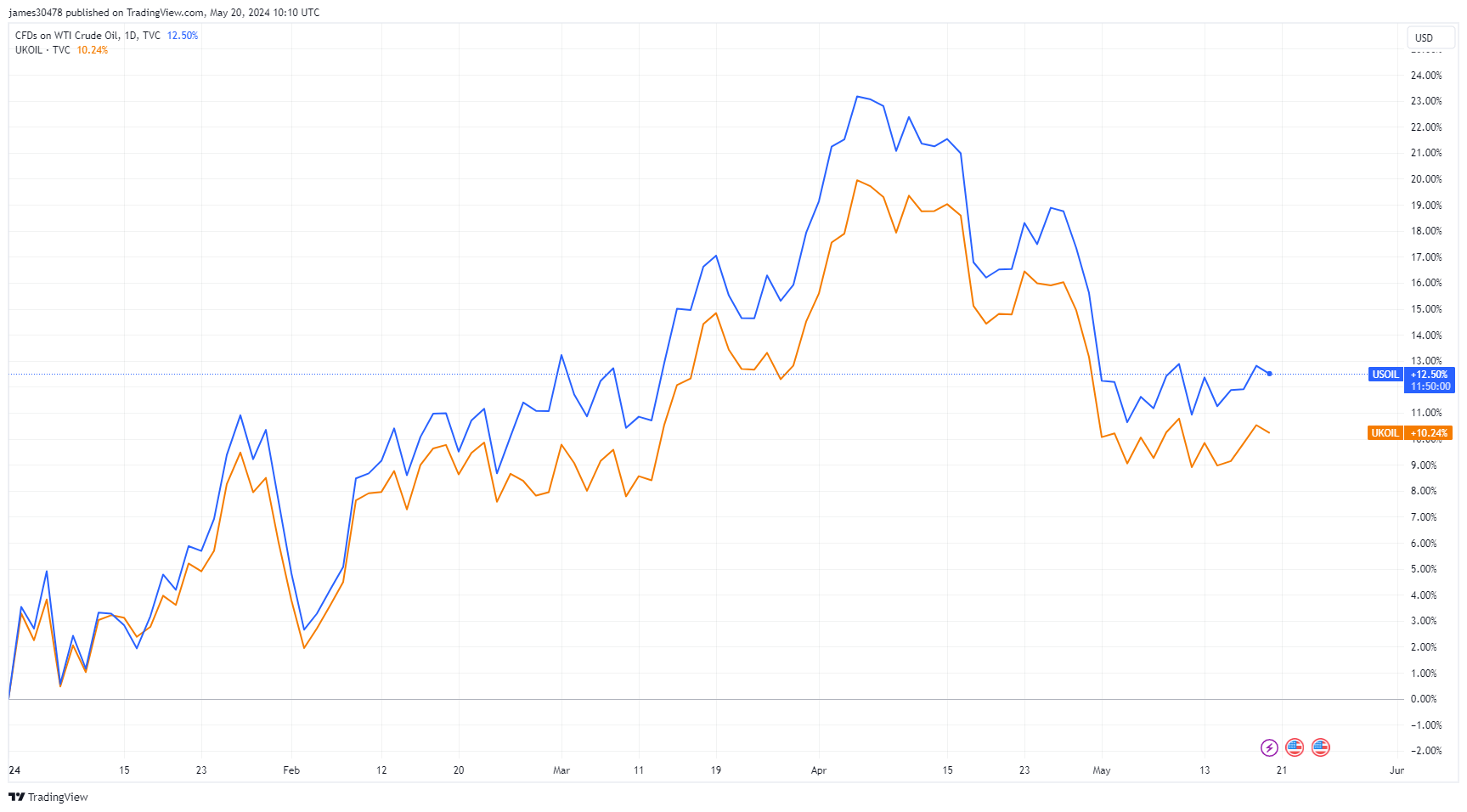

Despite WTI and Brent crude oil prices dropping by over 10% from their April highs, they have still registered a year-to-date increase of over 10%. This divergence may indicate the beginning of an economic slowdown as demand for oil weakens.

Interestingly, as traditional safe havens shine, Bitcoin, often touted as “digital gold” due to its limited supply, decentralization, and potential hedge against uncertainty, is trading at around $67,000. With the U.S. stock market also at all-time highs, the question arises: Is Bitcoin the next asset to catch up with the rally?

The post Is Bitcoin the next asset to catch up with the rally? appeared first on CryptoSlate.