Quick Take

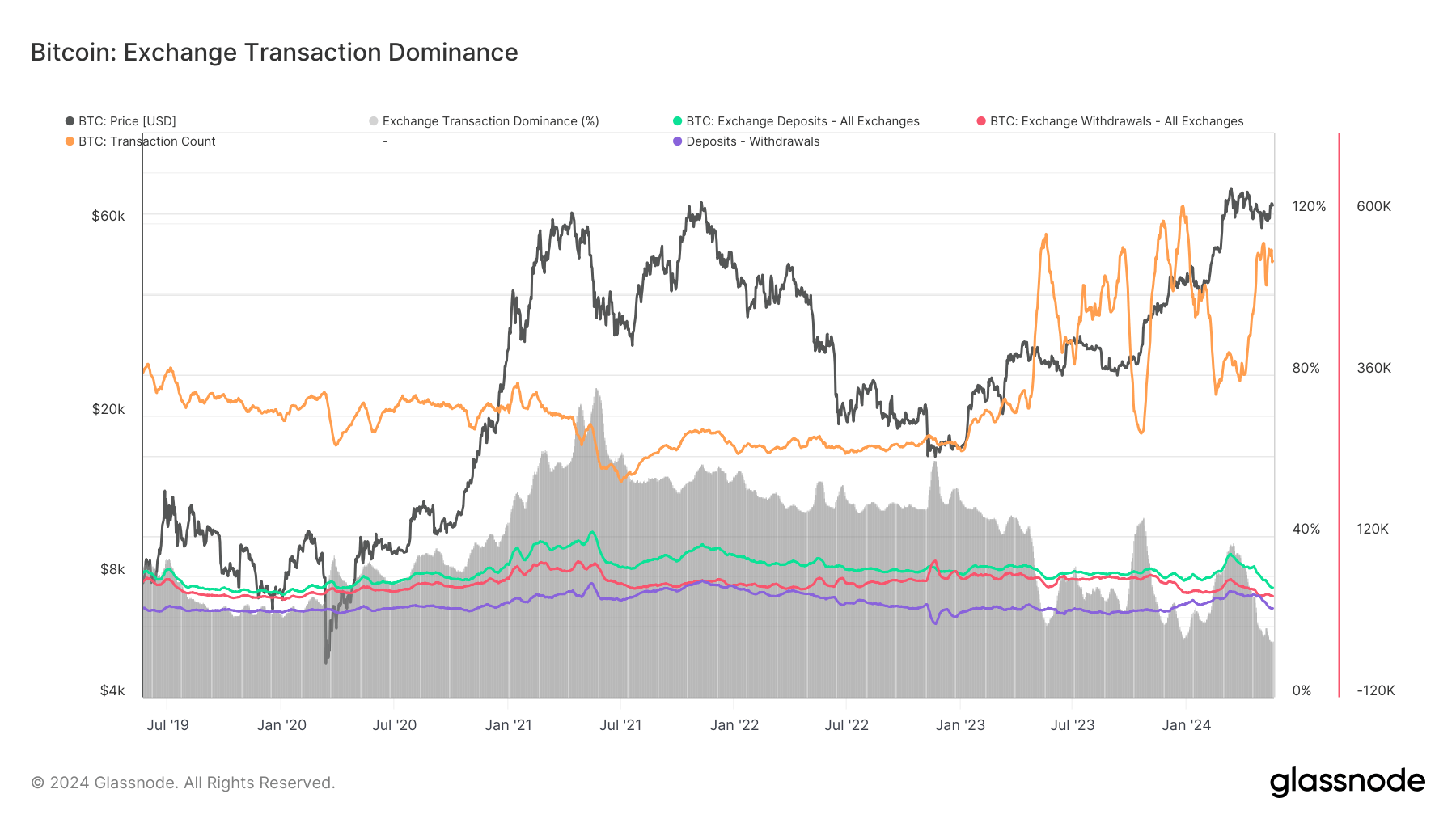

Historically, deposits onto exchanges tend to outpace withdrawals, with one notable exception in the past five years occurring during the FTX collapse in November 2022 when withdrawals spiked.

Typically, Bitcoin deposit surges correlate with price run-ups, as investors look to sell their holdings. This was evidenced by the over 90,000 BTC deposited onto exchanges in a single day during Bitcoin’s all-time high price peak in March 2024. Since then, deposits have declined to around 43,000 BTC as of May 19.

While withdrawals have trailed deposits, the gap between the two metrics continues to narrow. As of May 19, withdrawals sat at approximately 30,000 BTC, with the difference between deposits and withdrawals dropping to around 13,000 BTC – the lowest level since Q4 2023.

This dynamic suggests that while substantial deposits are still occurring, indicating sell pressure, the reduced difference points to lessening net deposits rather than a spike in withdrawals. The reduction of deposits daily has helped Bitcoin reclaim its almost 20% climb from the local bottom on May 1.

The post Bitcoin’s deposit-to-withdrawal gap reaches smallest margin since Q4 2023 appeared first on CryptoSlate.