Bitcoin is rising, recently breaking above $67,000, and heading towards the all-important $70,000, a psychological round number. One analyst took to X amid this uptick, noting that whales holding over 1,000 BTC are not moving their coins to exchanges. Instead, they likely expect prices to spike higher in the coming days and weeks.

Though movements over the weekend were muted, the extension earlier today is overly bullish for optimistic traders. As BTC prices edge, coin holders (and sometimes whales) usually take profits, especially if gains are shaky and not as strong.

Whales Are Not Selling, More Gains Expected?

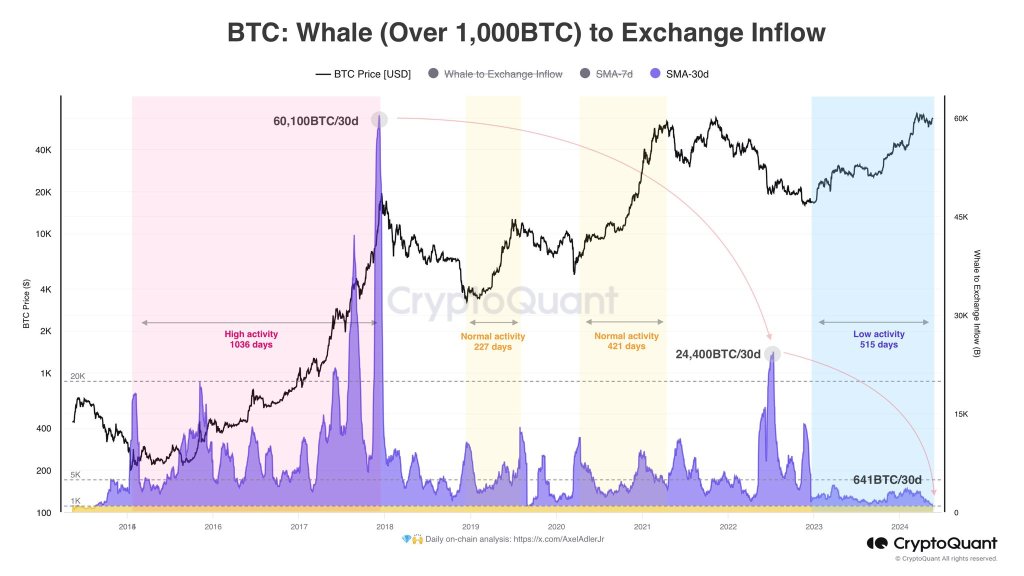

However, the current cycle looks like whales are holding on, expecting prices to recover strongly. The analyst notes that the 30-day average is 641 BTC, with the reading decreasing sharply from mid-2023.

This means that whales are bullish and unmoved by short-term price movements. Though this observation doesn’t necessarily mean bulls expect a moonshot, they are holding cement the outlook that prices might move higher in the coming sessions.

Accompanying the breakout above $66,0000, on-chain data shows that the Market Value to Realize Value (MVRV) ratio is also rising. According to the analyst, the MVRV ratio for those who have held BTC for between 1 and 3 months has climbed above 66,500.

This expansion means they have exited the “unrealized loss” zone, signaling a shift in sentiment among short-term holders. At spot rates and prices trading above $66,700, above the $66,500 level, HODLers are in the green and can exit for a profit or HODL.

Bitcoin Finds Strong Support Above $60,000

It remains to be seen how prices will react in the short to medium term. However, another analyst notes that over 530,000 BTC was traded at $66,250. Accordingly, this line is turning out to be a strong, reliable support. If bulls soak in the selling pressure, the line at $66,250 can act as a reliable anchor for the next leg up toward an all-time high.

Analysts agree that the zone above $60,000 is a reliable support level. Taking to X, another analyst said that the Bitcoin Short-Term Holder Cost Basis (STHCB) is rising and stands at $60,700. Historically, the STHCB has acted as a dynamic support during bull runs and resistance in bear markets.

In on-chain analysis, the STHCB is a metric that tracks the average price at which short-term holders (those holding BTC for less than 180 days, bought their coins.

Historically, the STHCB has acted as a support level during bull runs and a resistance level during bear markets. Currently, the STHCB sits at $60.7K and is steadily increasing, suggesting a potential floor for the price.