In his latest essay titled “The Easy Button,” Arthur Hayes, founder of the crypto exchange BitMEX, delves into the dynamics of global monetary policies and their consequential ties to what he describes as the impending ‘Crypto Valhalla.’ Hayes analyzes the policy maneuvers of the world’s major economies, notably Japan, the United States, and China, and their effects on the crypto landscape.

The Dawn Of Crypto Valhalla

Hayes outlines the Federal Reserve’s potential strategy in coordination with the US Treasury to engage in unlimited dollar-for-yen swaps with the Bank of Japan (BOJ). This measure aims to manipulate exchange rates to stabilize the yen without causing disruptive economic shifts.

Hayes states, “The Fed, acting on orders from the Treasury, can legally swap dollars for yen in unlimited amounts for as long as they wish with the BOJ.” This tactic, according to Hayes, is designed to avert immediate financial crises by deferring hard economic decisions.

The implications for Japan’s economy are stark, with Hayes predicting severe consequences should the BOJ decide to raise interest rates: “If the BOJ raises interest rates, it commits seppuku,” Hayes notes, using the Japanese term for ritual suicide to underscore the potential self-destructive economic impact, given that the BOJ is the largest holder of Japanese Government Bonds (JGBs) and would incur massive losses.

The devaluation of the yen has also significant ramifications for China’s global economic competitiveness, especially in exports. Hayes discusses how a weaker yen harms China’s export economy by making Japanese goods cheaper internationally, directly competing with Chinese products.

He suggests that the People’s Bank of China might respond by devaluing the yuan to maintain competitive balance. “If the yen keeps weakening, China will respond by devaluing the yuan,” Hayes predicts, outlining a potential economic tit-for-tat that could destabilize global markets.

Hayes further theorizes about a dramatic monetary policy shift in China involving its substantial gold reserves. He posits that China could use these reserves to peg the yuan to gold, thereby creating a new economic landscape.

“China is estimated to have stockpiled over 31,000 tonnes of gold […] I believe that for domestic and foreign political reasons, China wishes to keep the dollar-yuan rate stable.” By pegging the yuan to gold, China could potentially insulate itself from currency fluctuations and exert greater control over its economic destiny.

The essay also touches on the intersection of US politics and economic policy, particularly in light of the approaching presidential election. Hayes speculates that domestic economic pressures, such as job losses and the reshoring of manufacturing, could significantly influence the Biden administration’s policy decisions.

He argues that the administration may avoid aggressive moves against China to prevent a backlash in pivotal states: “Biden must win these battleground states to keep the Orange Man at bay. Biden cannot afford a yuan devaluation before the election.”

Hayes suggests that these global currency maneuvers could lead to a bullish scenario for cryptocurrencies. He advises crypto traders and institutional investors to monitor the USDJPY exchange rate closely, asserting that significant movements could indicate shifts favorable to crypto valuations.

“Watch the USDJPY rate closer than Solana devs monitor uptime,” he advises, highlighting the potential for substantial financial opportunities in the cryptocurrency space.On the timing of a potential “Crypto Valhalla,” Hayes speculates that the pace of yen depreciation will accelerate into the fall. “This will put pressure on the US, Japan, and China to do something. The US election is a crucial motivating factor for the Biden administration to come up with some solution.”

According to Hayes, a USDJPY surge towards 200 is “enough to put on the Chemical Brothers and ‘Push the Button.’ This analogy to the Chemical Brothers’ song underscores the urgency and drastic nature of the action required to counter such a currency imbalance.

“If my theory becomes reality, it is trivial for any institutional investor to buy one of the US-listed Bitcoin ETFs. Bitcoin is the best-performing asset in the face of global fiat debasement, and they know it. When something is done about the weak yen, I will mathematically guestimate how flows into the Bitcoin complex will ratchet the price to $1 million and possibly beyond. Stay imaginative, stay boolish, now is not the time to be a cuck,” Hayes concludes.

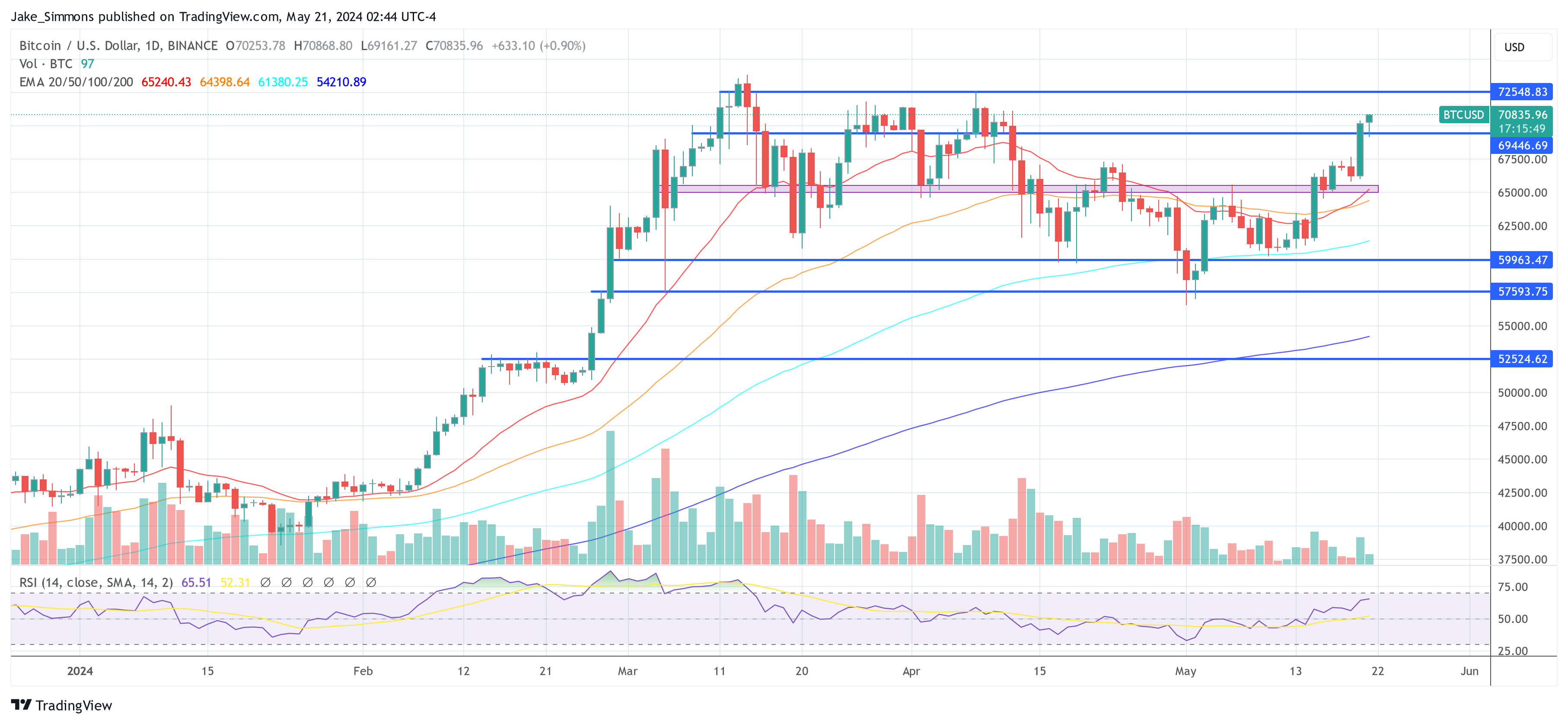

At press time, Bitcoin traded at $70,835.