Data suggests the market sentiment around Solana (SOL) and Bitcoin (BTC) is negative currently, something that could benefit their prices.

Crowd Bearish About Solana & Bitcoin While Ethereum Gets All The Hype

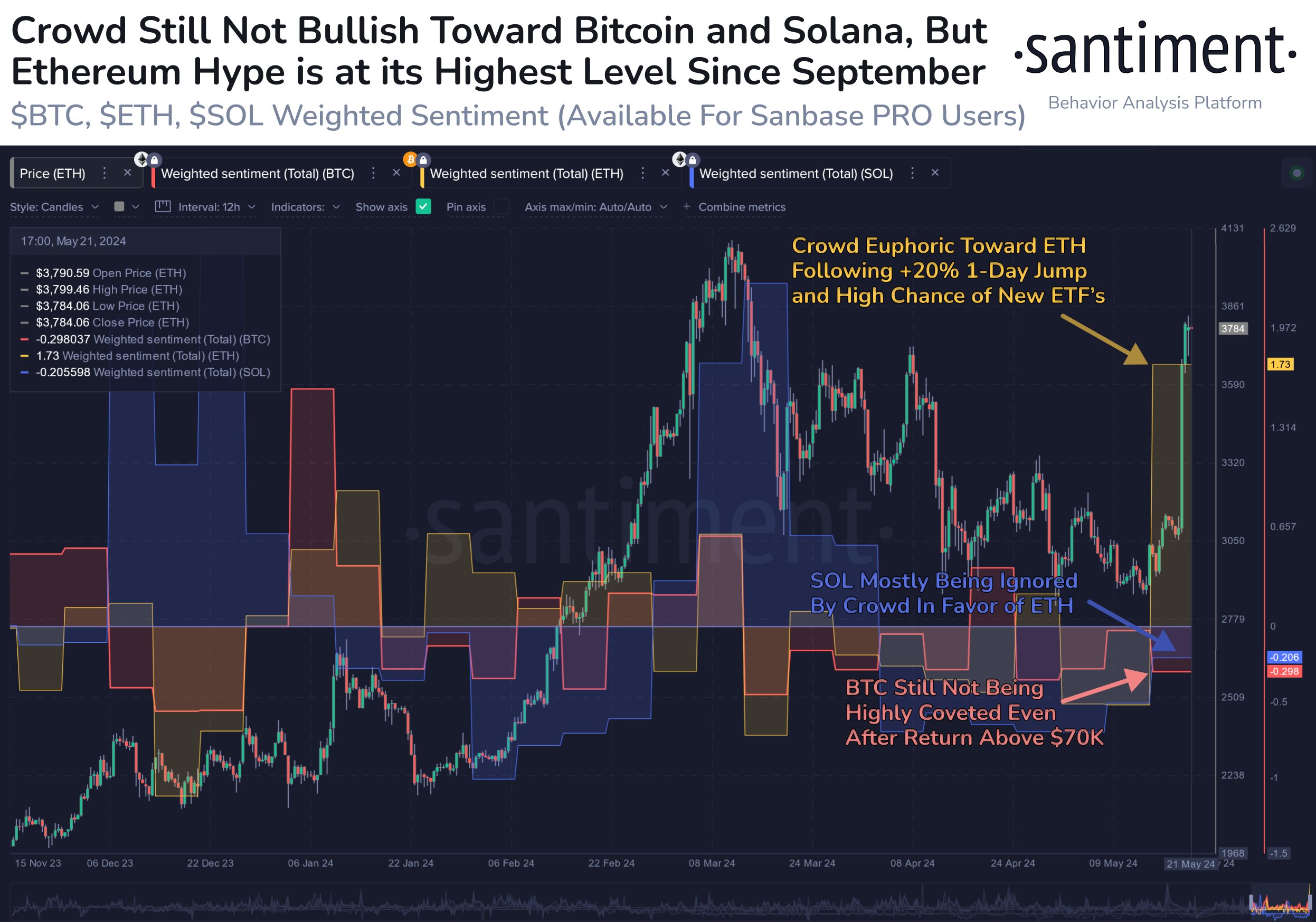

As explained by the on-chain analytics firm Santiment in a post on X, investors have still not become bullish about Bitcoin and Solana despite their recent surge.

The relevant indicator here is the “Weighted Sentiment,” which is based on two other metrics: Sentiment Balance and Social Volume. The former measures the net sentiment among cryptocurrency traders right now.

This indicator works by analyzing social media data and applying a machine learning model to differentiate between negative and positive posts about the asset. Then, it uses the difference between the two to determine which side is currently dominant.

The second metric of interest here, Social Volume, tracks the unique number of posts/messages/threads on social media platforms discussing a given asset. Essentially, its value represents the degree of discussion the coin receives from social media users.

While the Sentiment Balance does provide information about the net sentiment in the market, it’s not always useful, as it doesn’t say anything about how many users actually share this opinion.

The Weighted Sentiment fixes this problem by weighing the Sentiment Balance against the Social Volume. This means that this indicator’s value only spikes in either direction when many posts discuss the asset, and most of them are positive or negative about the coin.

Here is a chart showing the trend in the Weighted Sentiment for three of the top cryptocurrencies in the sector: Bitcoin, Ethereum, and Solana.

As displayed in the above graph, the Weighted Sentiment for Bitcoin and Solana has been negative recently. Interestingly, these red levels have persisted despite their prices observed bullish winds.

Ethereum, on the other hand, has seen a large positive spike in the indicator, implying that many bullish posts related to the coin are spreading on social media.

This optimism behind the cryptocurrency is due to positive news about the odds of the ETH spot exchange-traded funds (ETFs) being approved.

Historically, market euphoria has been a bearish sign, as the price generally tends to move opposite to the majority’s expectations. Similarly, investors’ fear has been a positive sign that fresh surges will start.

As such, at least going by the sentiment, Bitcoin and Solana may be more likely to see a rise than Ethereum, which may be getting too hot.

SOL Price

With gains of more than 19% over the past week, Solana is among the best performers out of the top coins by market cap. At present, SOL’s price is trading around $177.