A crypto analyst has forecasted an “ultra bull scenario” for Bitcoin, highlighting key support levels and technical patterns that suggest a price rally above $80,000 in this market cycle.

Bitcoin Could See Upside Above $80,000

In a recent X (formerly Twitter) post, a crypto analyst identified as ‘CrediBullCrypto’ has doubled down on his previous prediction of an ultra-bull scenario for Bitcoin in the future. The analyst’s insights on Bitcoin’s recent activities suggest that the downside risk may be less significant than previously anticipated, paving a bullish path for a massive upside for Bitcoin.

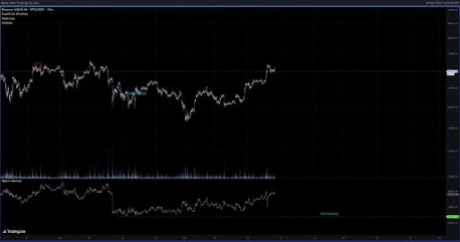

Sharing a graphical chart of Bitcoin’s price actions from April to May 2024 in a YouTube video, Credibull Crypto predicted that Bitcoin could see its price rising above $100,000 in this projected ultra-bull scenario. The focal point of his analysis was based on the Open Interest (OI) in Bitcoin’s perpetual futures on Binance, the world’s largest crypto exchange.

According to the crypto analyst, Open Interest has reached 78,000 BTC, significantly higher than its baseline of 64,000 BTC. CrediBull Crypto revealed that this current Open Interest was in a danger zone. This is because the 14,000 BTC difference typically indicates elevated market activities, which often precede volatile price movements.

Additionally, the CrediBull Crypto revealed that a single unidentified Bitcoin whale was responsible for approximately 10,000 BTC of the increased 14,000 BTC Open Interest. This means that the anonymous whale controls 70% of all the added Open Interest on Binance perpetual futures since the baseline.

He also disclosed that in the scenario where the anonymous whale can withstand 10% to 15% downward pressure without liquidating their assets, the actual available Open Interest that would be vulnerable to a decline would be only 4,000 BTC, instead of the initial 14,000 BTC addition. The analyst revealed that out of the 4,000 BTC, some would be directional shorts, noting that the net long positions at risk would be even lower.

Given this theory, CrediBull Crypto argued that the potential for a downside is more limited. As a result, the ultra bull scenario where Bitcoin’s price surges to new all-time highs was worth considering.

Potential Retracement Towards $60,000

In his YouTube video, CrediBull Crypto also highlighted a potential retracement slightly above the $60,000 price mark. The analyst predicted a bearish scenario, where Bitcoin could see its price falling significantly towards $62,000 to $63,000.

At the time of writing, Bitcoin’s price is trading at $69,774, reflecting a 0.08% decrease in the last 24 hours, according to CoinMarketCap. CrediBull Crypto disclosed that Bitcoin had failed to break through key resistance levels above $70,000.

He predicts that consistent declines and liquidations could potentially trigger a bottom below $60,000. However, he also revealed that such a bearish turnaround was highly unlikely at this time, as Bitcoin’s price movements currently indicates an ultra bullish scenario.