Chainlink (LINK), the oracle network powering decentralized finance (DeFi), is experiencing a solid rise, breaching a six-week high of $17.40. This surge comes amidst a wave of optimism fueled by the recent approval of an Ethereum exchange-traded fund (ETF) and speculation surrounding a potential Chainlink ETF.

Transactions And DeFi Dominance Fuel Rally

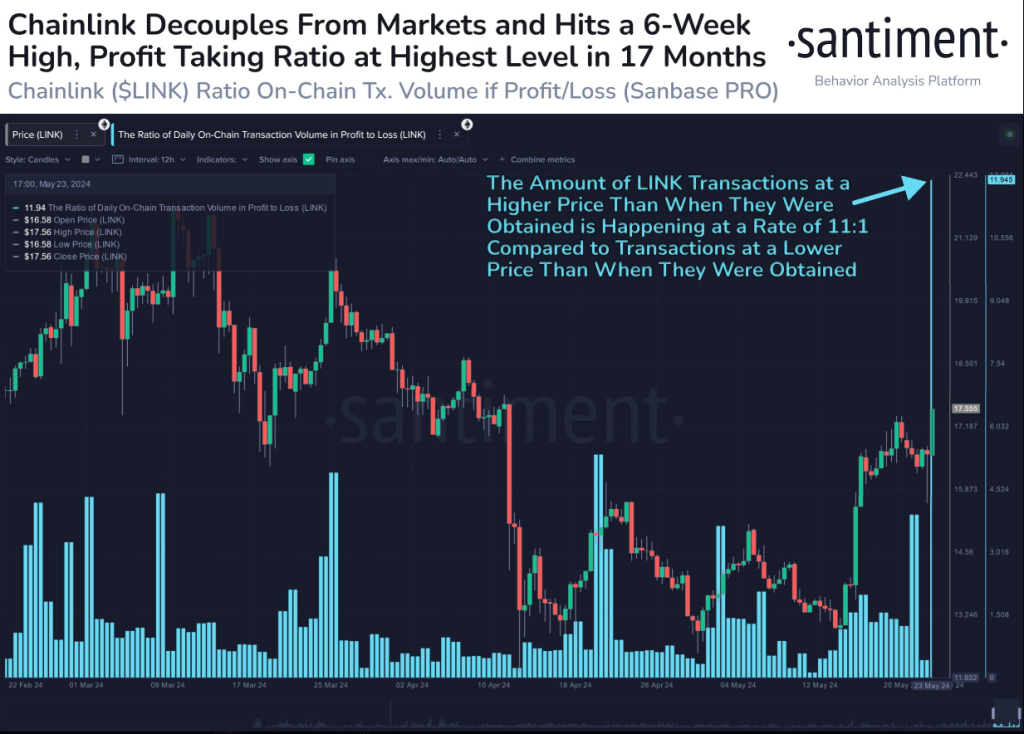

On-chain data reveals a strong buying sentiment for LINK, with a record 11 profitable transactions for every one at a loss. This surge in profitability coincides with the broader market’s positive reaction to the Ethereum ETF. Analysts believe this approval signals a growing institutional interest in cryptocurrencies, potentially paving the way for similar vehicles focused on specific projects like Chainlink.

#Chainlink has climbed well ahead of the #crypto pack, quickly surpassing $17.50 for the first time in 6 weeks. #Onchain today, there are 11 transactions in profit for every 1 $LINK transaction at a loss. This is the highest ratio since Dec. 8, 2022. https://t.co/nILlWsXWNh pic.twitter.com/joMV55V5x7

— Santiment (@santimentfeed) May 24, 2024

Tomi Point, a renowned crypto analyst, took to social media to express his belief that Chainlink could be the next beneficiary of the ETF boom.

Chainlink’s role in bridging the gap between DeFi and traditional finance makes it a prime candidate for an ETF. Point highlighted Chainlink’s robust DeFi ecosystem, boasting reliable data connections to over 20 blockchains, as a key factor driving its institutional appeal.

Technicals Flash Green

The current market sentiment surrounding Chainlink is overwhelmingly bullish. Despite the Fear & Greed Index hovering in “extreme fear” territory, most technical indicators point towards a sustained uptrend. As of May 24th, 2024, a majority of technical analysis tools confirmed a positive outlook for LINK.

Several analysts have weighed in with bullish price predictions. Digitcoinprice predicts LINK to reach $37.35 by the end of May, representing a staggering 117% increase. The overall optimistic outlook is bolstered by LINK’s impressive performance in the past month, with a price appreciation of over 16%.

Chainlink Whales Pour In $16 Million More

Meanwhile, this week’s bullish fluctuations in whale activity on Chainlink are another important sign that shows how popular LINK and other Ethereum-hosted cryptocurrency projects are among investors.

The Santiment graphic above displays changes in the balances of LINK tokens held by the top 100 largest wallets in real time.

As of May 19, the top 100 Chainlink investors held 701 million LINK tokens. By May 25, they had increased their holdings by over 1.2 million LINK, totaling 702 million.

Featured image from Texture X, chart from TradingView