The cryptocurrency market continues to navigate a sea of uncertainty, and Avalanche (AVAX) is no exception. While AVAX has displayed some resilience compared to its altcoin peers, a closer look reveals a market grappling with conflicting signals – a mix of cautious optimism and underlying unease.

Bullish Whispers Or A Mirage?

The future of AVAX remains shrouded in uncertainty. While some positive signs exist, like relative outperformance and pockets of bullish sentiment, they are countered by concerning metrics like dwindling market control and a significant drop in trading activity.

Avalanche: Resistance Levels Loom Large

A look at AVAX’s six-month chart reveals a rollercoaster ride, characterized by sharp peaks and troughs. This volatility highlights AVAX’s susceptibility to broader market trends and its dependence on specific developments within its ecosystem.

Over the past few months, AVAX has exhibited a pattern of price spikes followed by equally sharp corrections. Currently, the altcoin seems to be consolidating around the $38 mark after a recent dip from April’s highs.

If AVAX can maintain support around the crucial $35 level, there’s a possibility for a northward trajectory, especially if a broader bull run materializes in the cryptocurrency market.

However, significant resistance awaits at $48 and $53 – price points that AVAX has repeatedly tested and failed to surpass in recent months. A sustained breakout above these levels would signal a significant shift in momentum, potentially propelling AVAX towards the $80 or even $100 mark by the third quarter.

A Tale Of Two Markets: Where Do Traders Stand?

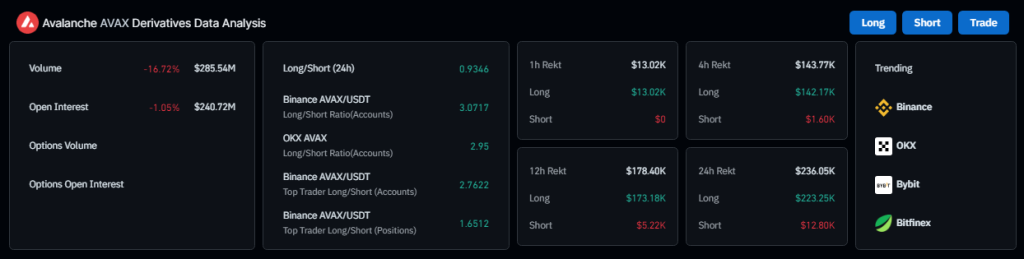

The trading scene surrounding AVAX presents a curious dichotomy. Coinglass data reveals a staggering 60% drop in trading volume, signifying a significant decline in market activity. This is further corroborated by a relatively balanced long/short ratio across various platforms, suggesting overall indecision among traders regarding AVAX’s future.

However, a glimmer of bullish sentiment emerges from Binance, a prominent cryptocurrency exchange. Here, the long/short ratio skews considerably higher, indicating a potentially more optimistic outlook among individual traders on this specific platform.

Meanwhile, with a 40% rating on the Fear and Greed Index, the current status of the AVAX market is characterized by neutral mood, indicating that investors have balanced opinions.

Losing Dominance, Waning Interest?

AVAX’s struggles extend beyond trading. The altcoin seems to be loosening its grip on market share, with search interest also declining. This translates to a lack of market control and potentially waning general interest – not exactly the recipe for success for a token aiming for significant gains.

Featured image from Summitpost, chart from TradingView