Quick Take

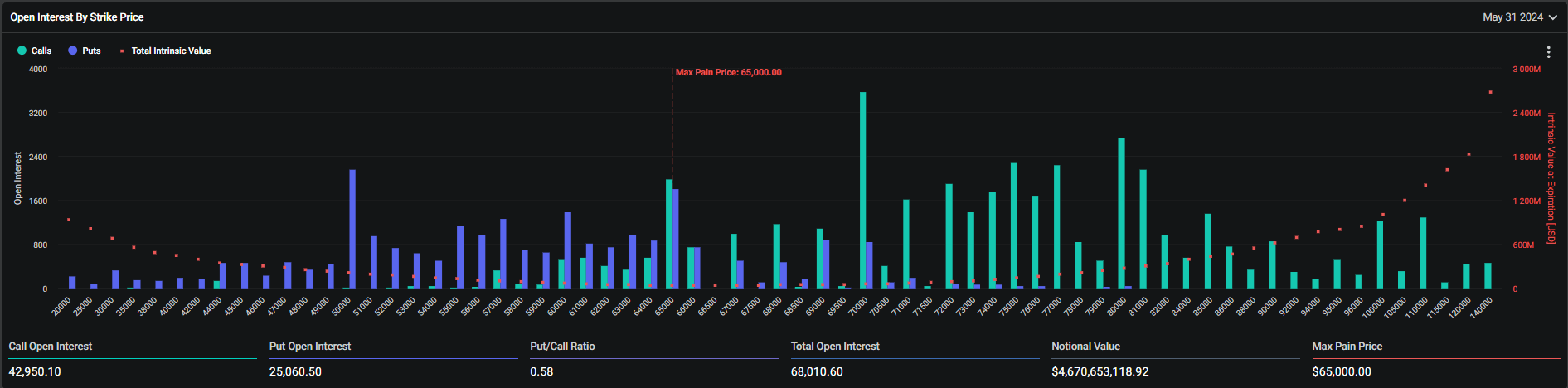

As the end of the month approaches, significant options expiries for both Bitcoin and Ethereum are set for May 31. Bitcoin trades around $68,500 with a put/call ratio of 0.58, indicating a bullish sentiment among traders. The total open interest is roughly 68,000 BTC, translating to a substantial notional value of $4.7 billion. The max pain price is $65,000, suggesting that this level could act as a gravitational pull for Bitcoin’s price as expiration nears due to hedging activities.

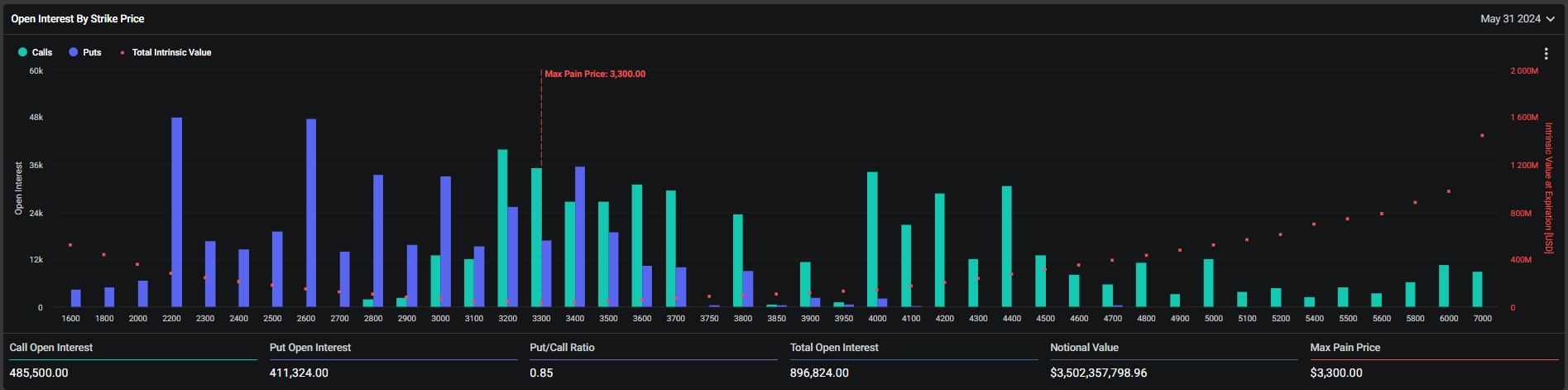

Ethereum, in contrast, is trading below $4,000 with a put/call ratio of 0.85, reflecting a more balanced sentiment between bullish and bearish positions. The notional value is lower compared to Bitcoin at $3.5 billion, but the total open interest for Ethereum options is at 897,238 ETH. The max pain price for Ethereum is set at $3,300, potentially influencing price movements as the expiration date approaches.

While Ethereum’s open interest is significant around the $2,200 and $2,600 strike prices, there is also notable activity at higher strike prices. Many Ethereum call options are positioned at these elevated levels, reflecting mixed sentiment.

In contrast, Bitcoin demonstrates a more pronounced bullish sentiment, evidenced by its lower put/call ratio and concentrated open interest at higher strike prices. This suggests traders are more optimistic about Bitcoin’s price prospects compared to Ethereum.

The post Bitcoin options expiry indicates bullish sentiment, Ethereum shows mixed outlook appeared first on CryptoSlate.