Onchain Highlight

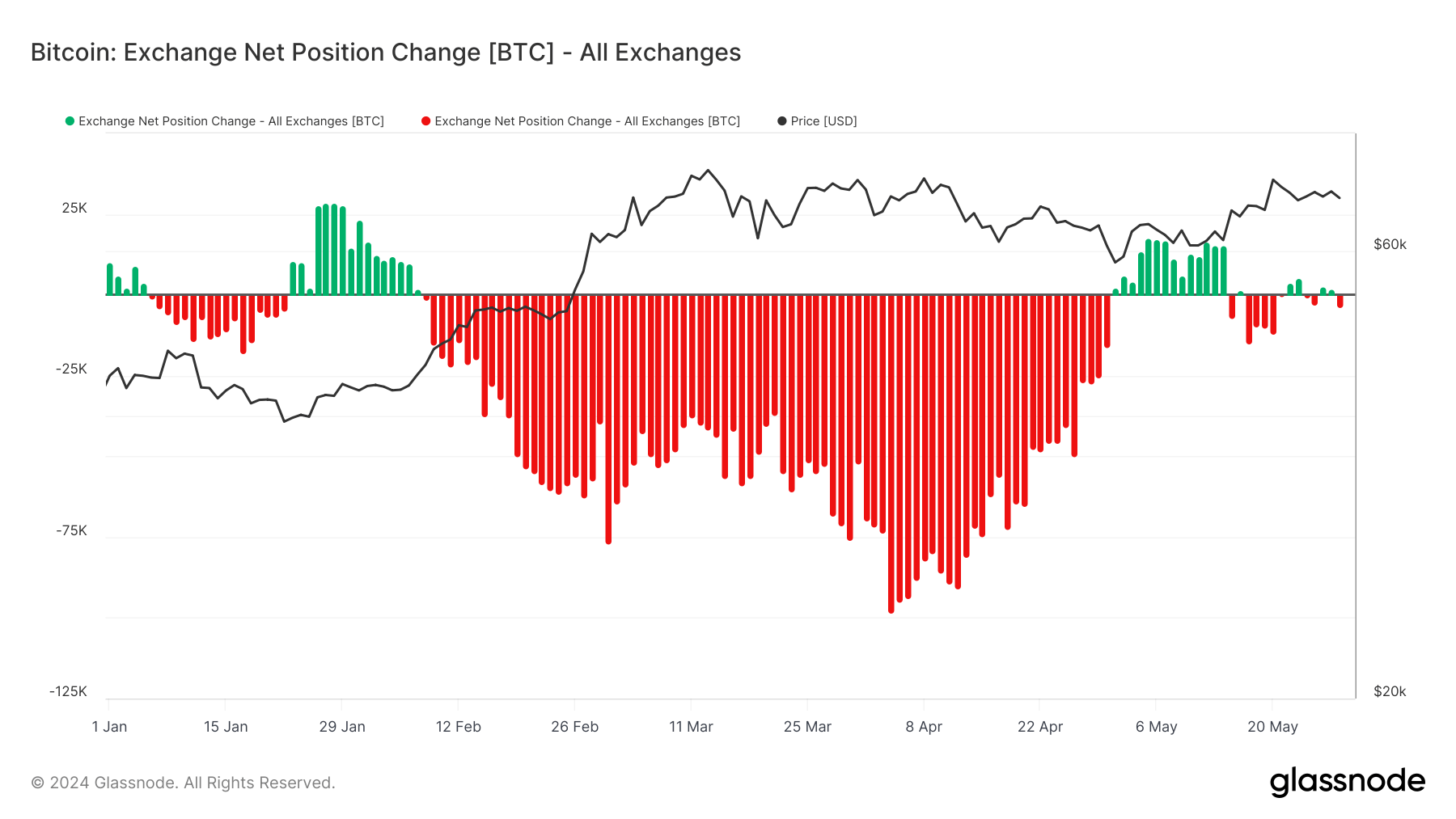

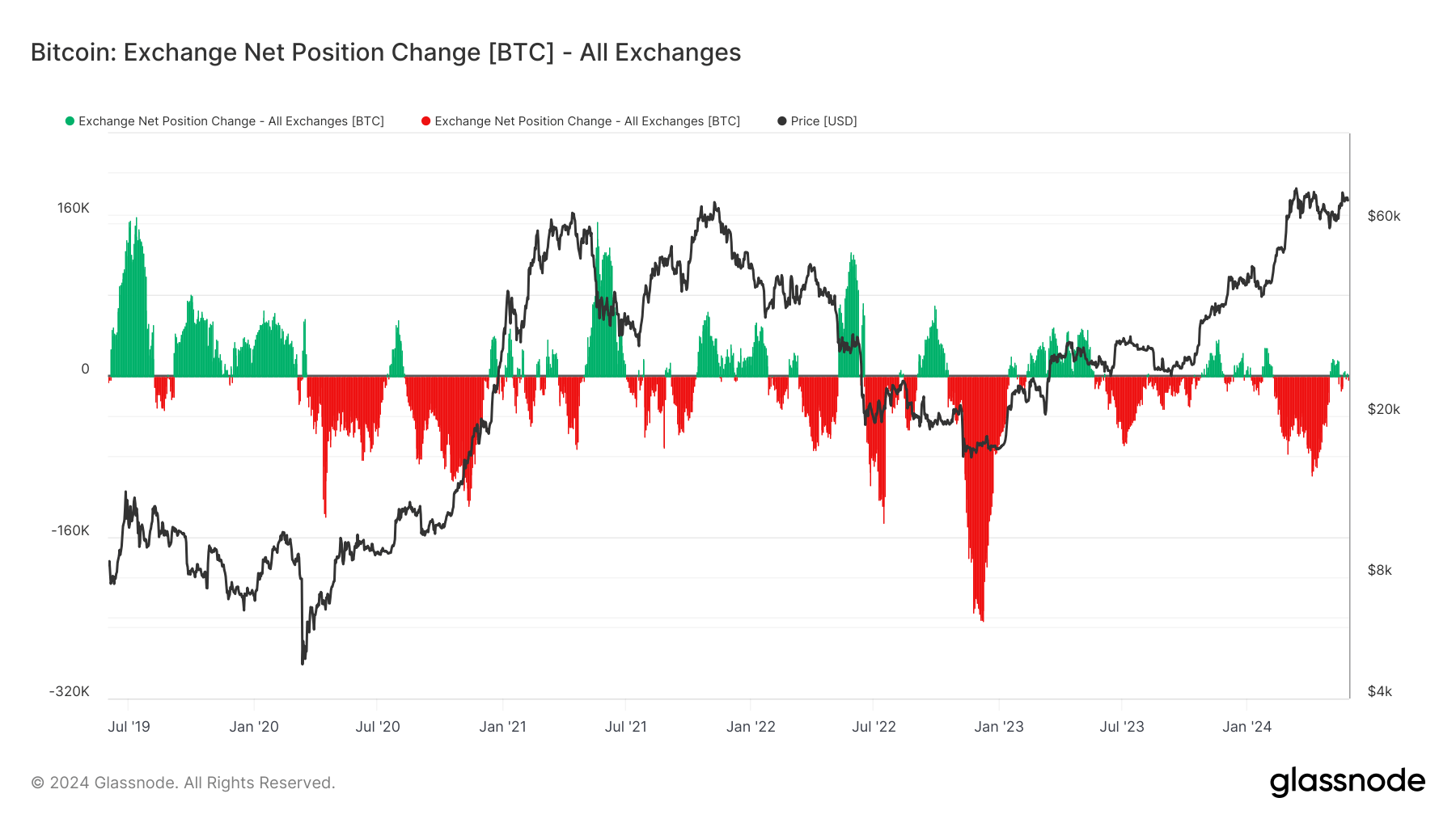

DEFINITION: Exchange Net Positon Change by Glassnode is the 30-day change in the supply held in exchange wallets.

Bitcoin’s exchange net position change has been experiencing notable fluctuations, influenced by various market factors. According to Glassnode data, the significant outflows from Bitcoin exchanges in 2023 have reversed in recent months. The trend of net withdrawals that dominated the market has shifted towards net inflows, indicating a change in investor behavior as more Bitcoin is being moved back onto exchanges.

This shift in exchange net position is mirrored by activities surrounding Bitcoin ETFs. BlackRock’s IBIT ETF notably attracted substantial inflows, contributing significantly to the overall increase in Bitcoin held on exchanges. On May 21, BlackRock’s ETF saw an inflow of $290 million, highlighting the growing institutional interest in Bitcoin.

Simultaneously, Grayscale’s Bitcoin Trust (GBTC) has continued to see outflows, though at a decreasing rate compared to earlier in the year. This outflow is partially offset by the inflows into other ETFs, demonstrating a redistribution of Bitcoin holdings among different types of investment vehicles.

The increasing exchange deposits and ETF inflows suggest that investors are positioning themselves for potential market movements, possibly anticipating future price changes or regulatory developments. This dynamic interplay between exchange net positions and ETF activities provides a comprehensive view of the current state of Bitcoin investment strategies.

The post Consistent Bitcoin exodus from exchanges highlights investor confidence appeared first on CryptoSlate.