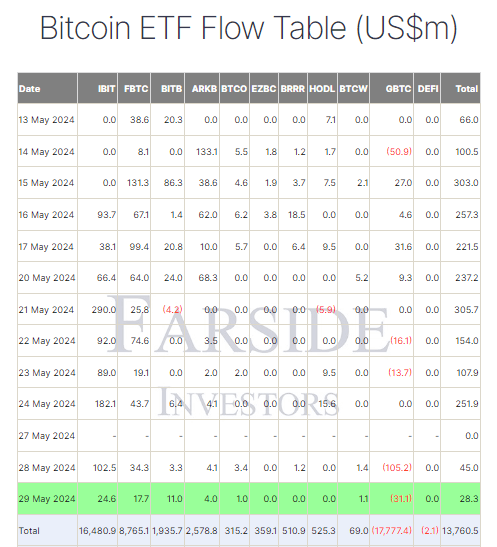

The latest data from Farside reveals slowing inflows into Bitcoin (BTC) exchange-traded funds (ETFs), totaling $28.3 million on May 29. Of the 11 ETF issuers, six experienced positive inflows, with BlackRock’s IBIT leading the pack. BlackRock IBIT saw a $24.6 million inflow, bringing its total net inflow to $16.5 billion. Fidelity’s FBTC followed with a $17.7 million inflow, raising its total net inflow to $8.8 billion. In contrast, Grayscale’s GBTC experienced an outflow of $31.1 million, resulting in a total net outflow of $17.8 billion. The overall ETF market has now accumulated a total of $13.8 billion.

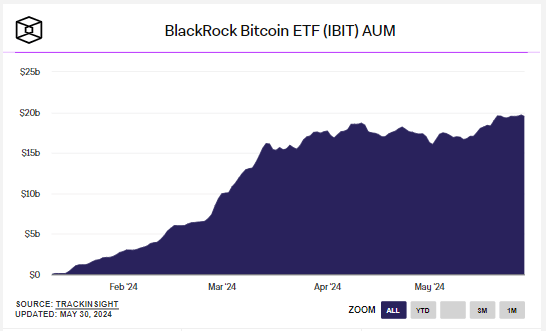

According to The Block, BlackRock IBIT’s assets under management (AUM) have surged to $19.5 billion.

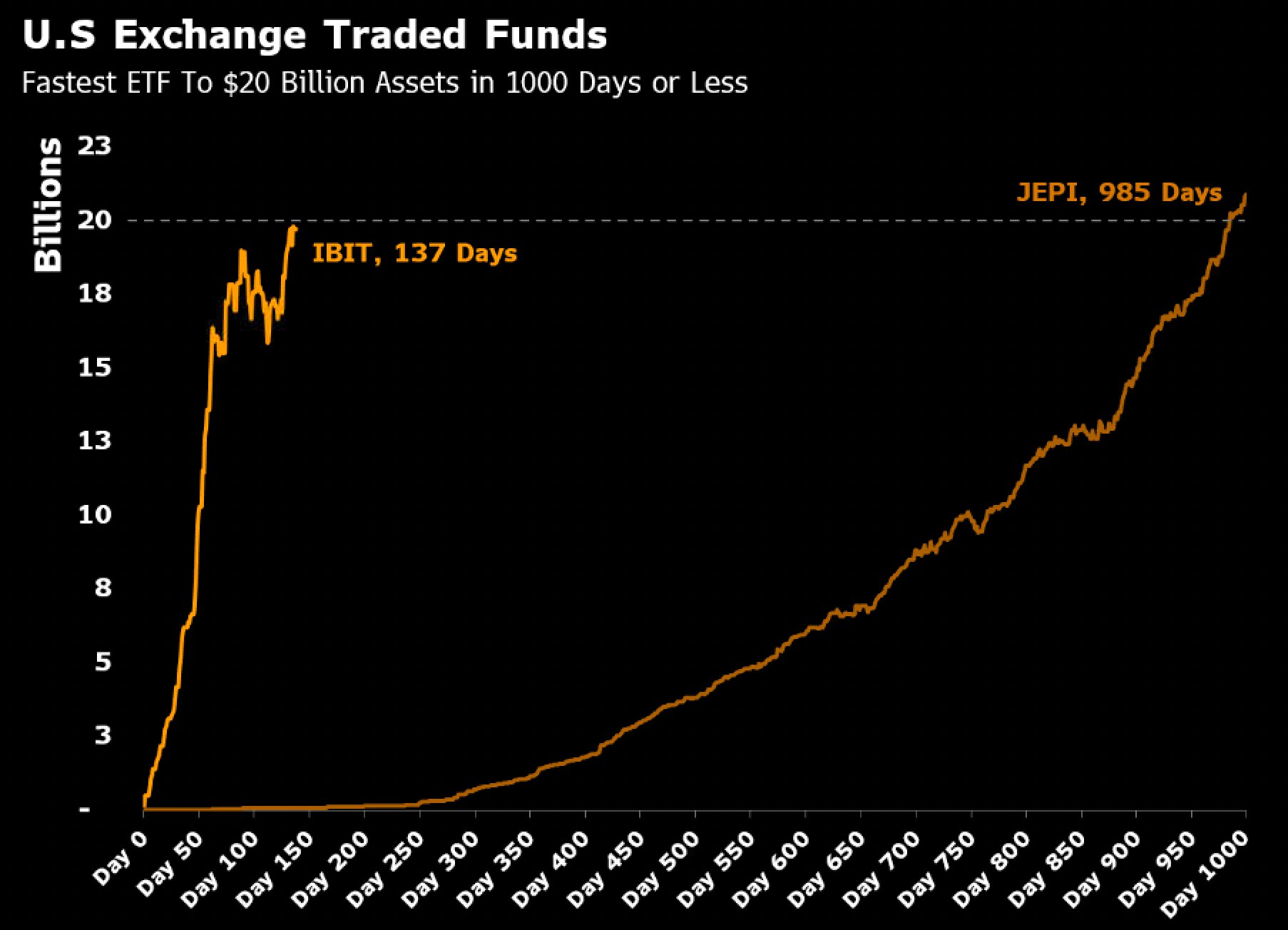

Senior Bloomberg ETF analyst Eric Balchunas highlighted the rapid growth of IBIT, noting its impressive performance. He stated:

“More context on just how absurd $IBIT is, there’s only been one ETF in history to reach $20b in assets in under 1000 days. $JEPI, which did it in 985 days. $IBIT is a hair away at 137 days.”

The next milestone for BlackRock’s IBIT could be surpassing the iShares Gold ETF (IAU), which currently holds roughly $29 billion in assets under management (AUM). Nate Geraci, president of the ETF Store, believes this milestone could be achievable by the end of the year. He stated:

“After passing GBTC, the next milestone to watch for the iShares Bitcoin ETF is tracking down the iShares Gold ETF. IAU, launched in 2005, has nearly $29 billion. It would be something if IBIT caught it before year-end, as it is currently nearing $20 billion.”

The post BlackRock IBIT on track to surpass iShares Gold ETF $29 billion AUM by year-end appeared first on CryptoSlate.