Onchain Highlights

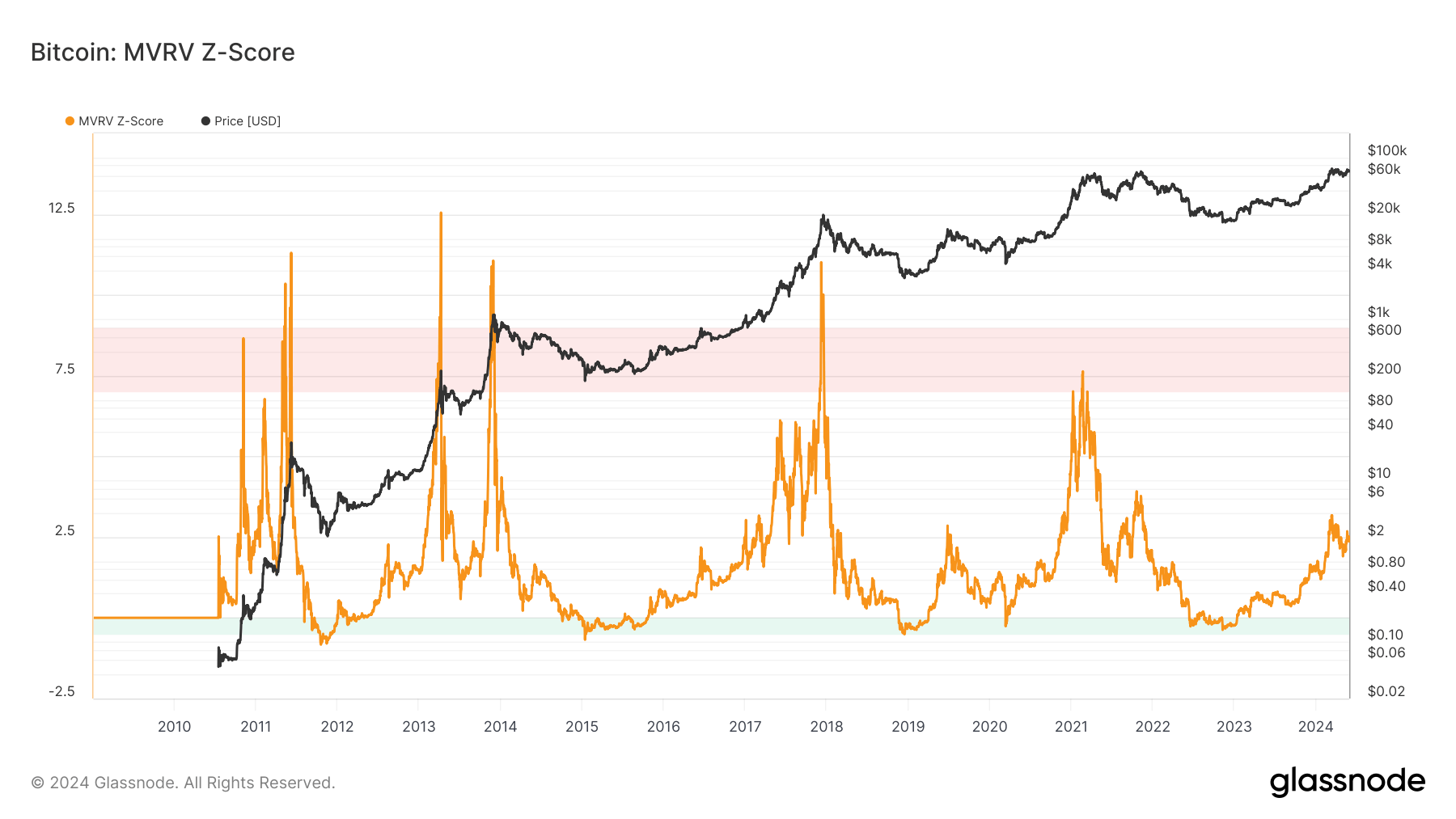

DEFINITION: The MVRV Z-Score evaluates whether Bitcoin is overvalued or undervalued relative to its “fair value.” Instead of using a traditional z-score method, the MVRV Z-Score uniquely compares the market value to the realized value. When the market value, measured as network valuation by spot price multiplied by supply, is significantly higher than the realized value, represented by the cumulative capital inflow into the asset, it has typically signaled a market top (red zone). Conversely, a significantly lower market value than the realized value often indicates market bottoms (green zone).

Recent data from Glassnode indicates key insights into Bitcoin’s market trends through its MVRV Z-Score. This metric helps understand the valuation extremes and potential price movements by analyzing the market value to realized value ratio.

The MVRV Z-Score has shown that Bitcoin’s price trends are significantly influenced by the activities of long-term holders (LTHs) and short-term holders (STHs). LTHs tend to dictate market movements, often leading to significant price shifts, while STHs generally react to these movements.

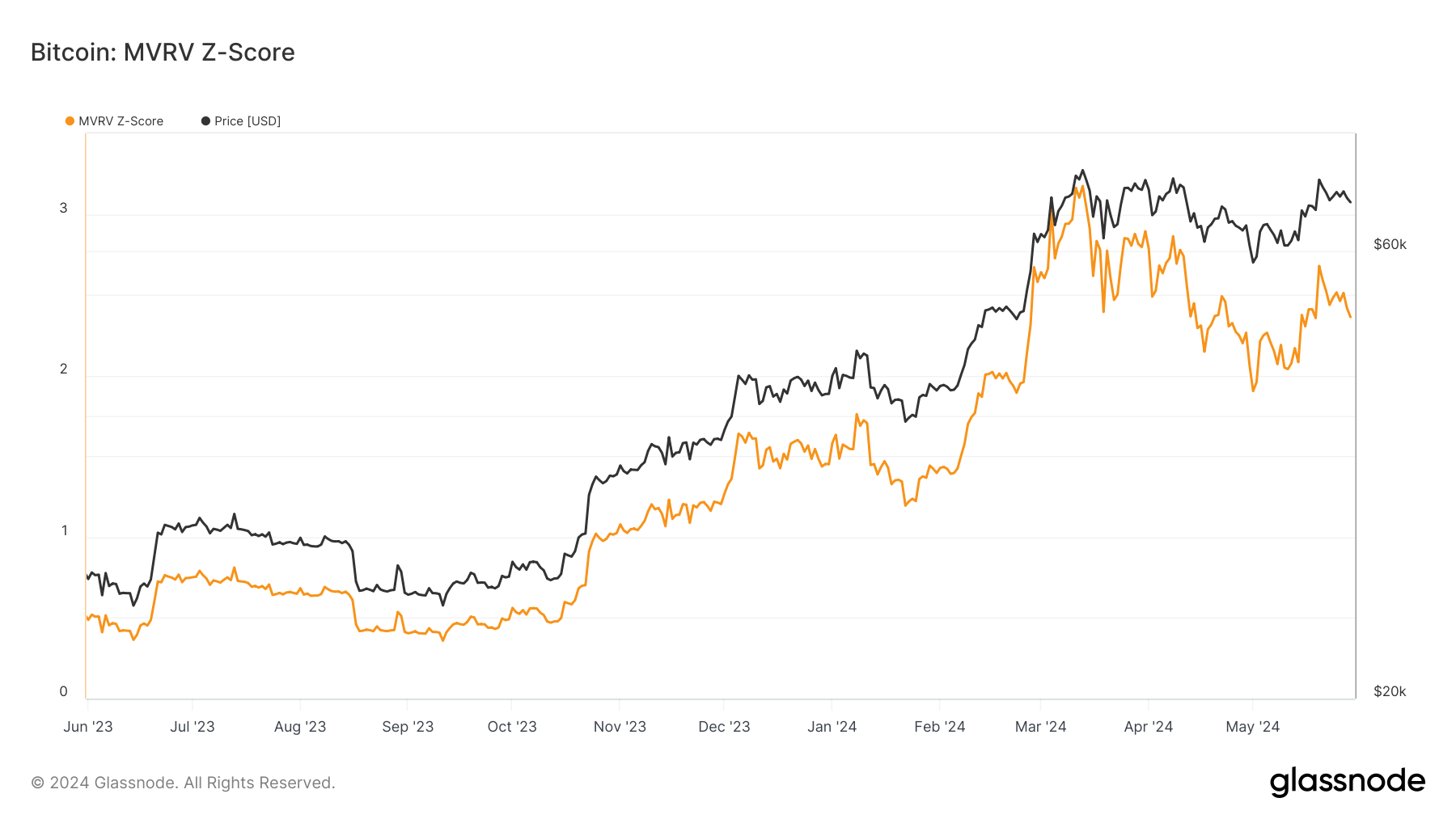

For instance, during the recent market fluctuations, LTHs have maintained a high MVRV ratio, suggesting periods where they could potentially realize significant gains. This was particularly evident as Bitcoin’s price peaked at around $73,700 and then stabilized at $71,600, reflecting strategic exits by long-term investors.

Additionally, previous analysis shows that such on-chain metrics continue to signal a potential bottoming of Bitcoin prices. The convergence and subsequent divergence of MVRV ratios between LTHs and STHs have historically indicated market reversals. This pattern has been observed in recent months, aligning with previous cycles where similar metrics have marked the end of bearish trends and the start of new bullish phases.

These factors collectively indicate a cautiously optimistic outlook for Bitcoin, although the MVRV Z-Score suggests that investors should remain vigilant about potential corrections. Understanding these metrics can provide insights into market cycles and inform strategic investment decisions.

The post Rising MVRV Z-Score signals possible Bitcoin bull run appeared first on CryptoSlate.