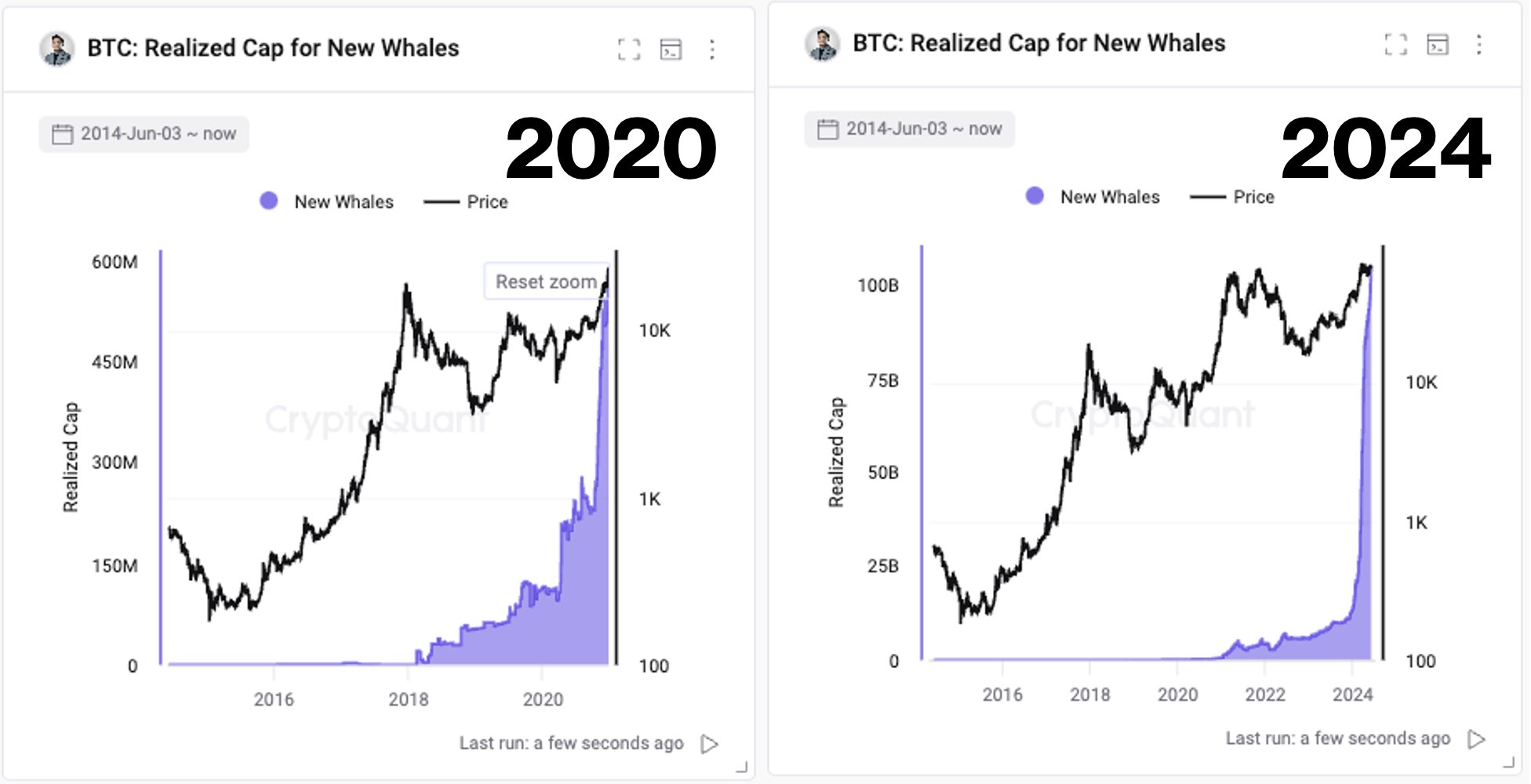

CryptoQuant CEO Ki Young-Ju today pointed out significant similarities in Bitcoin’s market behavior between the current state and mid-2020, a period marked by stagnant prices but high on-chain activity. Young-Ju’s insights were illustrated with two key charts and shared via a post on X, drawing parallels that suggest a robust undercurrent of large volume transactions, potentially outside the public exchange networks.

The first chart, representing data up until 2020, shows Bitcoin’s price alongside the realized cap for new whales – a metric that tracks the aggregate value at which the newly acquired Bitcoin by large investors was last moved. It’s a different form of market capitalization that assesses each UTXO at the price it last changed hands, rather than its present market price. This metric reflects the actual realized value of all the coins in the network, rather than their current market value.

This value experienced a sharp increase around mid-2020, precisely when Bitcoin’s price was caught in boredom just like in recent months, consistently trading around the $10,000 mark. According to Young-Ju, this period was characterized by high on-chain activity which later analysis suggested involved over-the-counter (OTC) transactions among institutional players.

In the second chart, extending to 2024, a similar pattern emerges with even more pronounced growth in the realized cap for new whales, despite Bitcoin’s price showing a sideways movement for almost 100 days now. The chart indicates a significant addition of about $1 billion daily into new whale wallets, a term typically referring to addresses holding large amounts of Bitcoin, often linked with institutional or highly capitalized individual investors.

What This Means For Bitcoin Price

Ki Young-Ju elaborated on these observations: “Same vibe on Bitcoin as mid-2020. Back then, BTC hovered around $10k for 6 months with high on-chain activity, later revealed as OTC deals. Now, despite low price volatility, on-chain activity remains high, with $1B added daily to new whale wallets, likely custody.”

He further referenced a tweet from September 2020 that corroborated his analysis, noting that the “number of BTC transferred hits the year-high, and those TXs are not from exchanges. Fund Flow Ratio of all exchanges hits the year-low. Something’s happening. Possibly OTC deals.”

This comparison and the sustained high level of the realized cap for new whales suggest an ongoing accumulation phase among large-scale investors, reminiscent of the activity observed in mid-2020. Such movements are generally not visible on traditional crypto exchanges and indicate a strong institutional interest that could be a precursor to significant market moves. Following Young-Ju’s tweet, BTC price rallied by 480% from September 2020 till November 2021.

If a similar move is brewing for Bitcoin price remains to be seen, but the continuous growth in Bitcoin holdings among new whales, along with sustained price levels, points to a potential buildup of pressure beneath the apparent calm of the market surface. As observed in the past, such conditions may lead to substantial price movements once the accumulated Bitcoin begins to impact the broader market through either increased liquidity or renewed trading interest.

At press time, BTC traded at $68,271.