Bitcoin sharks and whales are relentless in accumulating the flagship crypto despite its unimpressive price action. These categories of investors are seen to have increased their Bitcoin positions in the last five months. This is undoubtedly bullish for the Bitcoin ecosystem and could soon have an effect on Bitcoin’s price.

Bitcoin Investors Have Bought 154,560 BTC In The Last Five Months

On-chain analytics platform Santiment revealed in an X (formerly Twitter) post that Bitcoin wallets holding at least 10 BTC have added 154,560 more BTC in the last five months. The platform noted that this purchase is significant as it is one of “crypto’s top leading indicators” when it comes to bullish signals for the flagship crypto.

Santiment further mentioned that cryptocurrencies rise whenever these Bitcoin wallets accumulate and that an extended bear market occurs whenever they offload their holdings. This means that Bitcoin and other crypto tokens could rise soon enough, with these Bitcoin investors currently adding to their positions.

These whales are usually known to have a significant impact on the market as their purchases could trigger a significant price surge in Bitcoin’s price. Meanwhile, a continuation of this accumulation trend is crucial, as the on-chain analytics platform Glassnode suggested that Bitcoin has failed to hold above $70,000 due to a lack of demand for the flagship crypto.

As such, these Bitcoin investors could help drive up the demand for Bitcoin if they manage to sustain this accumulation trend. Bitcoin is expected to finally achieve a successful breakout above $70,000 as this happens.

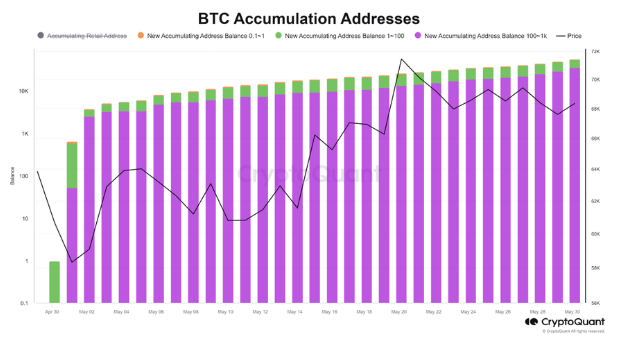

The on-chain analytics platform CryptoQuant has also recently provided a bullish outlook for Bitcoin. A market analysis on the platform noted a notable increase in the number of new participating Bitcoin accumulation addresses even though the flagship crypto hasn’t recorded any significant surge in its price over the past month.

Bitcoin Still Far From Its Peak

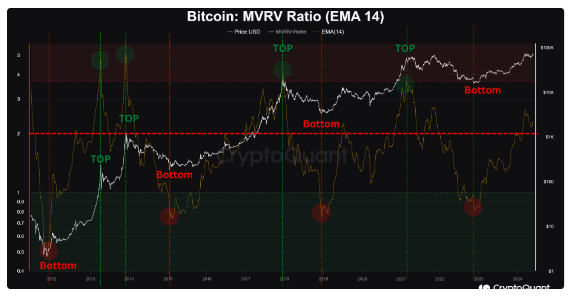

In another blog post on the CryptoQuant platform, crypto analyst Tarekonchain mentioned that Bitcoin is still far from its peak. He made this assertion based on the MVRV (Market Value to Realized Value) indicator, which the analyst claimed gives a “highly accurate alert for Bitcoin price tops and bottoms.”

According to Tarekonchain, the MVRV value being below 2 indicates a continued accumulation zone, meaning that Bitcoin is still undervalued. He added that Bitcoin only begins its path to a new peak when the MVRV value exceeds 2. He revealed that the MVRV value is currently at 2.3, indicating there is still room for Bitcoin’s price to rise significantly before it reaches its fair value.

Bitcoin’s price is said to have peaked in previous cycles when the MVRV indicator reached a value of 3.5 or above, proving that the flagship crypto is still far from its peak in this bull run. Tarekonchain predicted that Bitcoin could still achieve a new high in this cycle and possibly rise above $100,000.

Featured image from Pexels, chart from TradingView