Quick Take

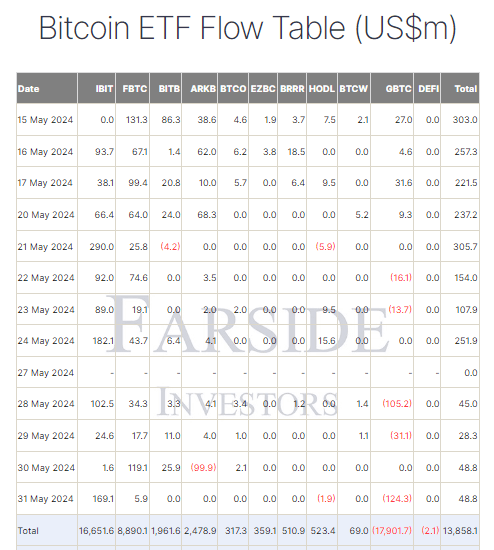

Farside data shows that on May 31, Bitcoin (BTC) exchange-traded funds (ETFs) experienced another inflow, matching the previous trading day’s amount of $48.8 million. Despite the inflows, only two issuers reported positive net inflows. BlackRock’s IBIT ETF saw the largest inflow, with $169.1 million, raising its total net inflow to $16.7 billion. Fidelity’s FBTC ETF followed with a $5.9 million inflow, bringing their total to $8.9 billion. In contrast, Grayscale’s GBTC ETF experienced a significant outflow of $124.3 million, marking the largest since May 1. The total net inflows for Bitcoin ETFs now stand at $13.9 billion.

Farside data shows that these developments have led to 14 consecutive trading days of inflows totaling $2.2 billion, which has seen the Bitcoin price go from roughly $63,000 to $69,000. We are nearing the record of 17 consecutive trading day inflows, which totaled $4.4 billion in inflows, which saw the price go from roughly $40,000 to $50,000.

This influx of interest coincides with Ark Investment’s decision to abandon its Spot-Ether ETF ambitions. It is also accompanied by ArkB’s outflow of $99.9 million from its BTC ETF on May 30, the largest since its launch.

The post 14 straight days of inflows for Bitcoin ETFs as Ark abandons ETH ETF amid $100m BTC outflow appeared first on CryptoSlate.