The CEO of the on-chain analytics firm CryptoQuant explained that Bitcoin’s price isn’t currently overvalued based on its network fundamentals.

Bitcoin Price May Not Be Overvalued Yet Based On Thermo Cap Ratio

In a new post on X, CryptoQuant CEO and founder Ki Young Ju has discussed about how the recent trend in the Bitcoin Thermo Cap Ratio has been like. The “Thermo Cap” is a capitalization model for BTC that calculates the total value of the asset by taking each token’s value as the same as the spot price when it was mined on the network.

Put another way, this model calculates the cumulative value of the coins mined by the miners since the inception of the blockchain. This is quite different from what, for example, the usual market cap does. In the market cap’s case, the current spot price is taken as the value of all coins in circulation.

As the coins that miners mine are the only way to increase the cryptocurrency’s supply, the Thermo Cap may be considered a measure of the “true” capital inflows coming into the network.

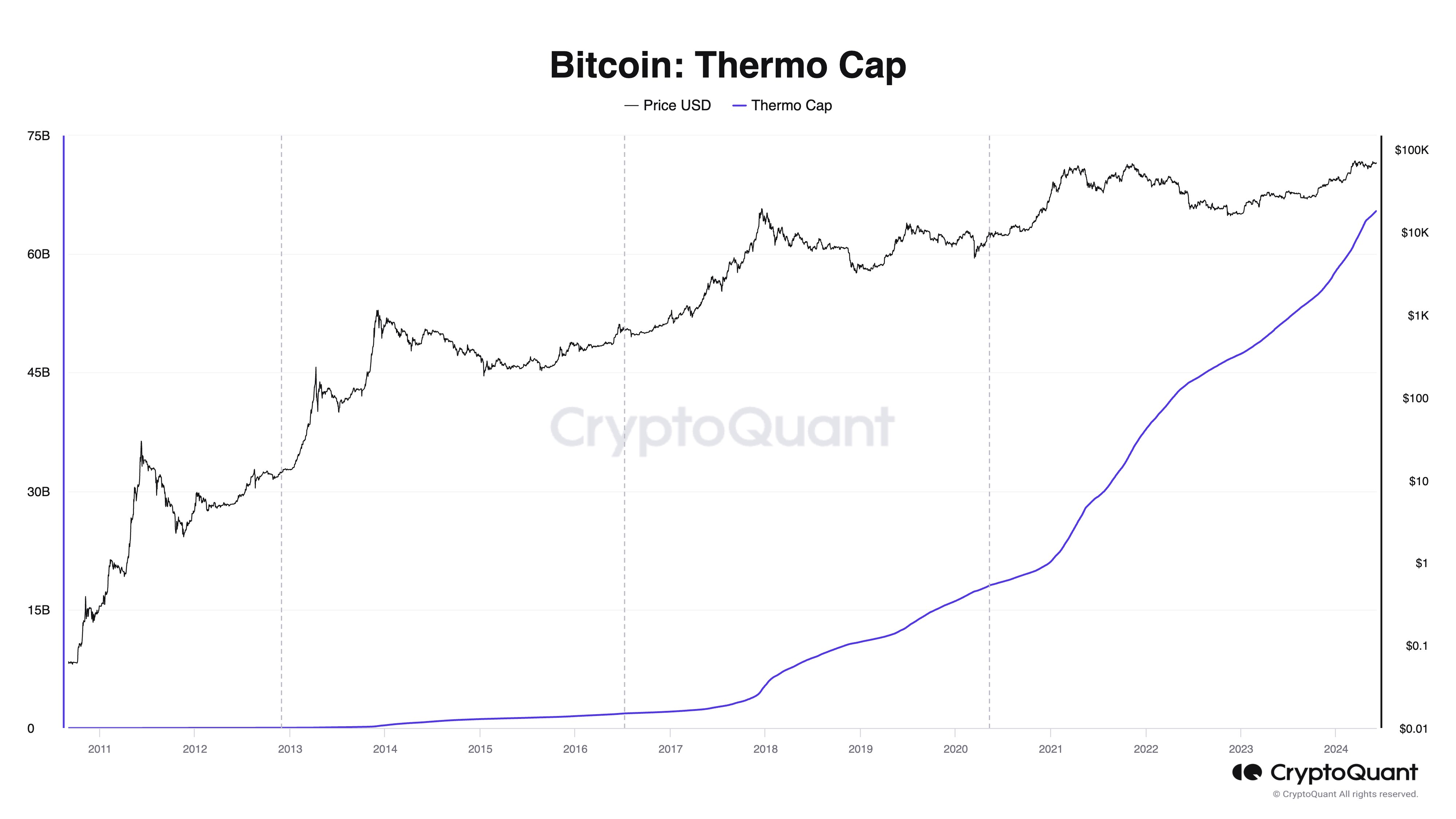

Here is a chart that displays how the Bitcoin Thermo Cap has changed over its history:

As the above graph shows, the Thermo Cap has seen an accelerating growth curve. This naturally reflects the increasing amount of capital flowing into the asset over the years.

In the context of the current topic, though, the indicator of interest isn’t the Thermo Cap itself but rather the Thermo Cap Ratio. This metric tracks the ratio between the Bitcoin market cap and the Thermo Cap.

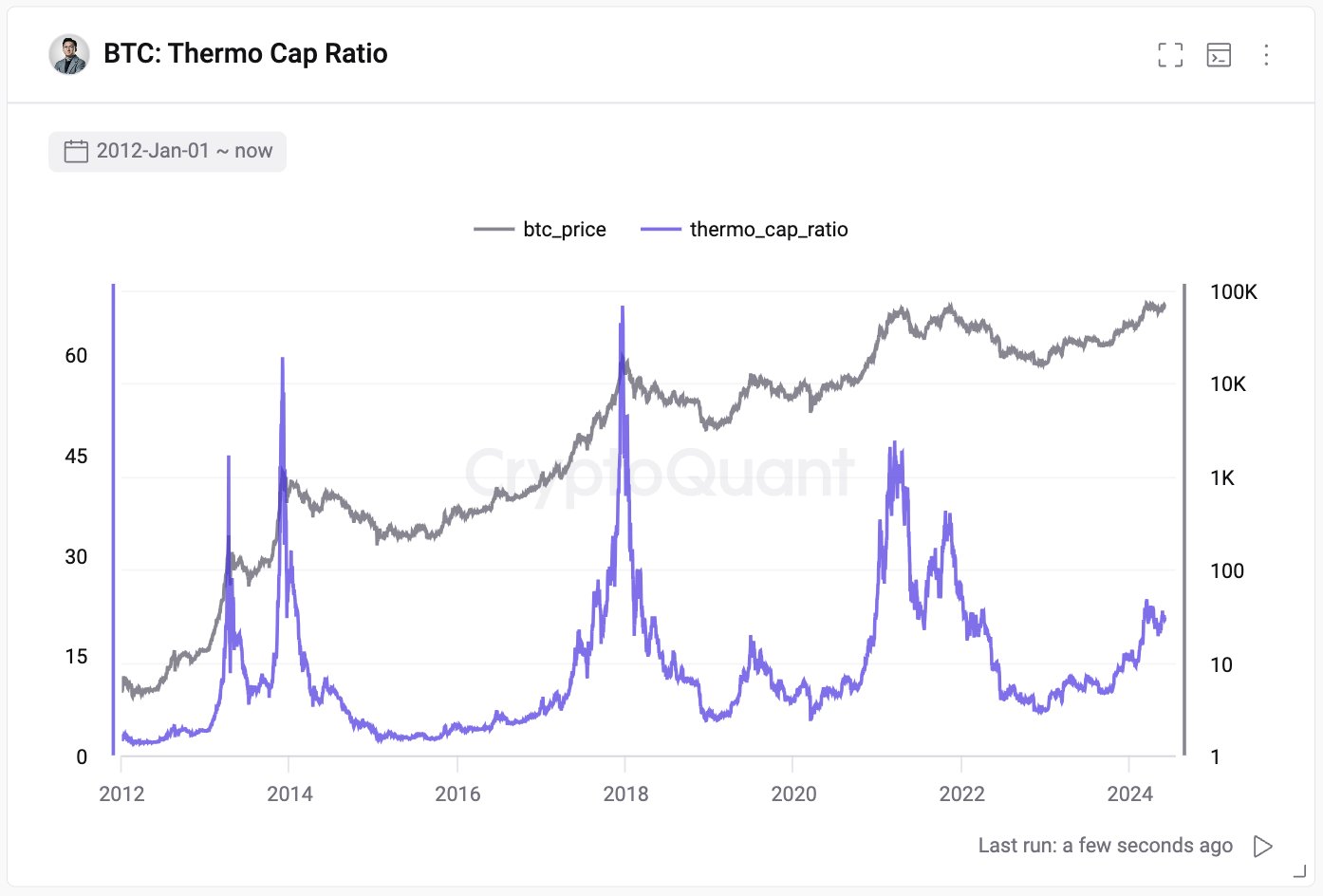

The chart below shows the trend in the Thermo Cap Ratio over the asset’s history.

An interesting pattern is visible in the graph. It appears that very high values of the Thermo Cap Ratio have coincided with highs in the cryptocurrency’s price.

At high values, the Bitcoin market cap is quite large compared to the Thermo Cap, meaning that coins are trading at a much higher rate than they were mined at.

It’s also apparent that bottoms in BTC occur when the ratio assumes low values. The recent trend in the indicator has been that of a rise, but its value has not touched the levels where bull run tops would have happened in the past. “Bitcoin is not currently overvalued based on network fundamentals,” notes the CryptoQuant founder.

BTC Price

Bitcoin has been unable to break out of its range recently as its price has kept up the trend of sideways movement. At present, BTC is trading at around $68,900.