Coinbase-backed Ethereum layer-2 network, Base, is experiencing rapid growth, reflecting the significant adoption and attention it enjoys from the crypto community.

Base’s growth comes amid the exchange launch of its Smart Wallet, a self-custodial solution aimed at bringing more than 1 billion users on-chain.

Increased network activity

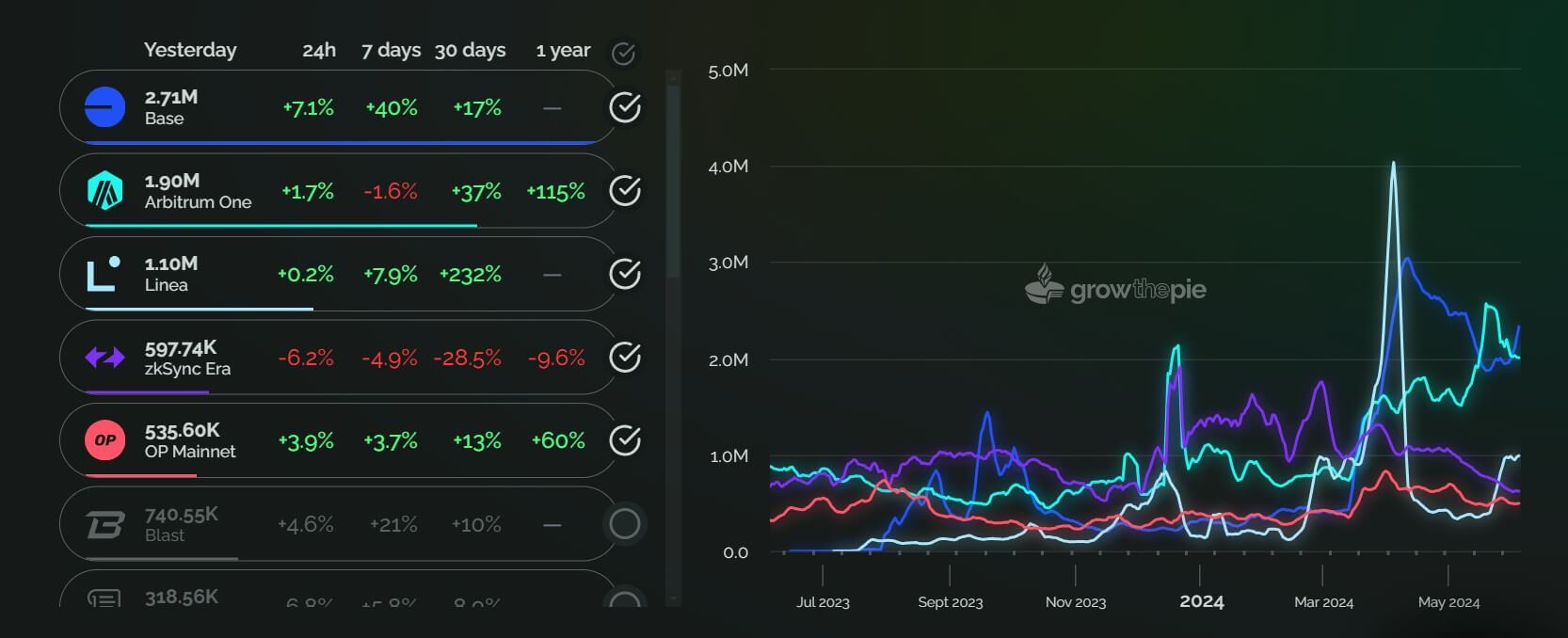

Base recorded the highest daily transactions among Ethereum layer-2 networks in the past day, surpassing notable rivals like Arbitrum and Optimism.

According to data from blockchain analytics platform GrowThePie, Base’s transaction count increased 7.1% to 2.7 million on June 4, compared to Arbitrum’s 1.89 million.

L2Beat data further confirms this significant activity. The platform shows that Base processes an average of 31.37 transactions per second (TPS), while Arbitrum handles about 22 TPS.

This surge in network activity has led to substantial growth in the total value of assets locked (TVL) on the layer-2 network. L2BEAT reports that Base’s TVL has increased by 8.68% to $7.64 billion, closely approaching Optimism’s TVL of $7.76 billion. Currently, Optimism and Base control 16.42% and 16.17% of the L2 market, respectively, while Arbitrum holds a 40% share.

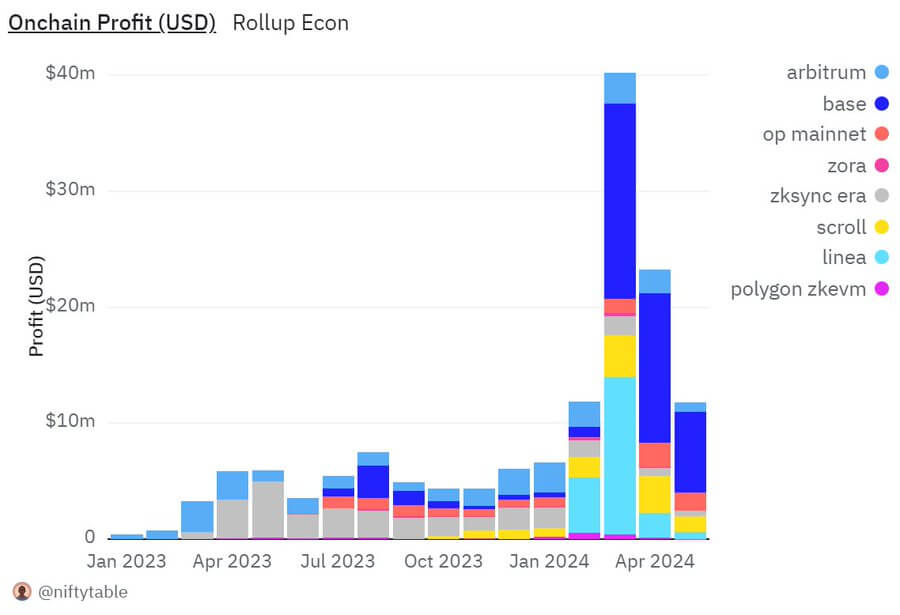

Additionally, a Dune Analytics dashboard curated by on-chain analyst Kofi indicates that Base is the highest-earning layer-2 network over the past three months. According to the dashboard, Base earned $16.88 million in March, $12.90 million in April, and $6.98 million in May.

Market experts said network activity on Base surged following the implementation of the Dencun Upgrade in March. This update introduced proto-danksharding, significantly reducing gas fees for layer-2 solutions like Base. At the time, CryptoSlate reported that Base saw heightened bot trading activities that pushed its transaction fees to high levels compared to rivals.

Smart wallet

Coinbase has introduced its highly anticipated Smart Wallet product to the market, saying it would address the significant challenges that have made going on-chain “slow, expensive, and hard.”

According to the firm:

“Smart Wallets allows users to create a free, secure, self-custody wallet in just a few seconds. They simplify onboarding, reduce the number of transactions to be signed, and seamlessly let you use your Coinbase balances onchain.”

The self-custodial wallet would initially support eight networks, including Base, Ethereum, Optimism, Arbitrum, Polygon, Avalanche, BNB, and Zora.

The post Base outpaces Optimism and Arbitrum amid Coinbase’s Smart Wallet debut appeared first on CryptoSlate.