Bitcoin’s price has risen roughly 2% in the past 24 hours, trending above $70,000, a psychological level. As bulls prepare for more gains, Willy Woo, an on-chain analyst, believes the coin could soar even higher after breaking above the all-important resistance level at $72,000.

Will Bitcoin Soar To $75,000 Due To A Short Squeeze?

Even after the spike on May 20 lifted the coin above $66,000 after days of lower lows, taking Bitcoin to $56,500, bulls didn’t follow through. As things stand now, Bitcoin is within a broader range, capped at $72,000, the first local support, and $73,800, the all-time high.

However, a breach would be significant considering the significance of $72,000, a level that has only been retested but not broken in several weeks. One explanation for potential price expansion is that a breakout, ideally with rising volume, might signal the start of another leg up, drawing demand.

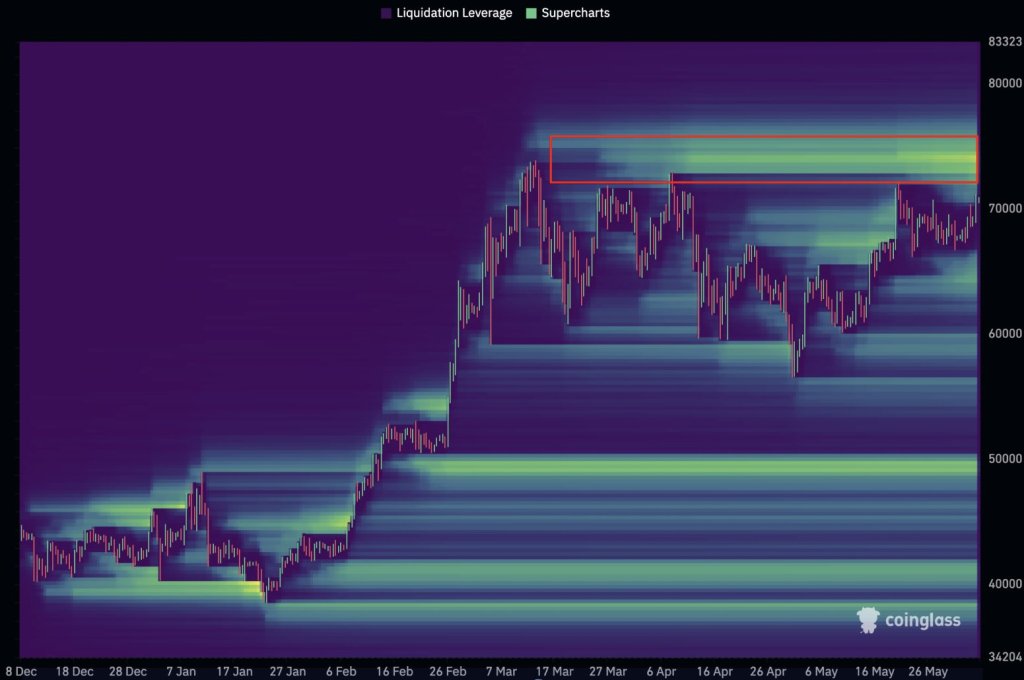

For Woo, closing $72,000 could see prices fast expand, even breaking $75,000 because of a short squeeze. Once bulls pierce and close above this level of interest, there would be a wave of liquidations, where many short positions are forced to close, driving prices higher.

Based on Woo’s analysis, roughly $1.5 billion worth of short positions will be liquidated “all the way up to $75,000.” If this happens, then it is highly likely that Bitcoin will register new all-time highs roughly seven weeks after Halving.

Inflow To Spot BTC ETFs Rising, Demand Will Only Continue Rising

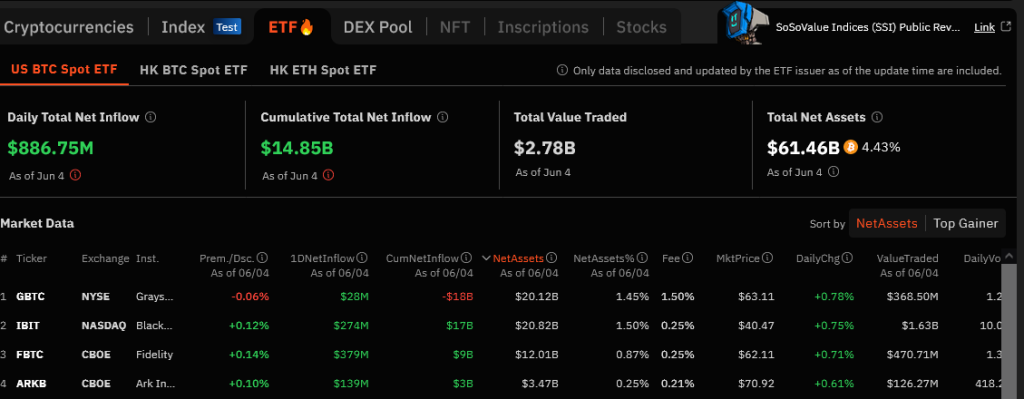

Underpinning this bullish sentiment is the impressive surge in institutional inflows into spot Bitcoin exchange-traded funds (ETFs) on June 4. According to sosovalue data, spot Bitcoin ETF issuers bought $886.6 million worth of BTC yesterday.

Fidelity bought $378.7 million of BTC, while BlackRock, behind the largest spot BTC ETF, bought $274.4 million of the coin. Bitwise also made a substantial demand, adding $61 million of BTC.

Interestingly, Grayscale also saw inflows, adding $28.2 million of BTC on behalf of its clients. This influx was the second-highest daily inflow volume since the launch of spot Bitcoin ETFs in January 2024.

With this wave of institutional demand, Bitcoin is above $71,500. Most importantly, prices remain above $70,000, confirming the bull spike from the middle BB on June 3.

The demand for these complex derivatives will only increase. Yesterday, the Thailand Securities and Exchange Commission (SEC) approved the country’s first spot Bitcoin ETF. The product will only be accessible to wealthy and institutional investors. The green lighting comes after a similar product went live in Australia.