Altcoins are generating significant buzz among cryptocurrency watchers, as rumors of a potential Bitcoin breakout circulate. After weeks of sluggish trading, a recent surge of capital has revitalized the king of coins. This raises a pressing question: will altcoins ride the wave, or are they doomed to be left behind?

Whispers Of A Bitcoin Bonanza

Data from Farside Investors reveals a significant shift in investor sentiment. Nearly $890 million flowed into Bitcoin exchange-traded funds (ETFs) on June 4th, a clear sign of renewed interest. This surge in buying could act as a catalyst, sparking a wave of speculation and propelling Bitcoin prices upwards.

However, the question remains: how will this newfound focus on Bitcoin impact the broader cryptocurrency market? Historically, strong Bitcoin rallies have often been followed by altcoin seasons, periods where alternative cryptocurrencies experience explosive growth. But is this time different?

Altcoin Season: Just Over The Horizon?

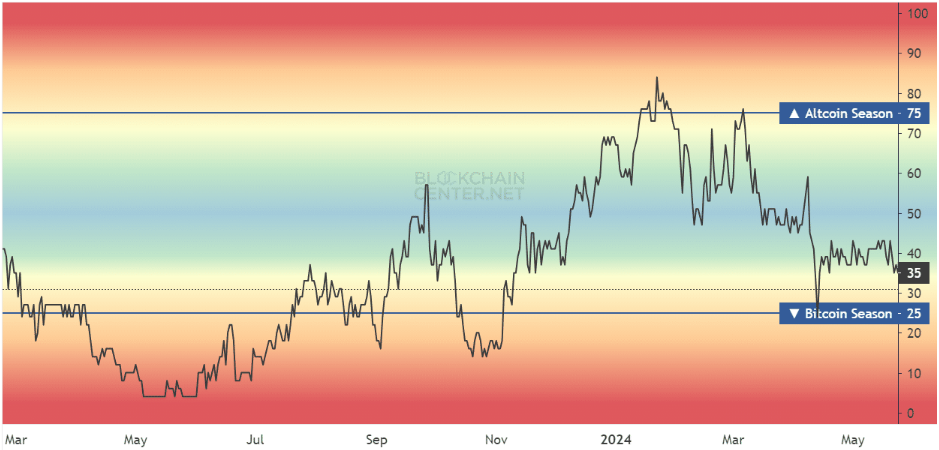

The Altcoin Season Index, a metric that gauges market sentiment towards altcoins, currently sits at a lowly 35. This stands in stark contrast to the readings of 80 observed just six months ago. This suggests that altcoins are not yet basking in the reflected glory of Bitcoin’s potential rise.

Experts believe that even with a Bitcoin surge, only a select few altcoins are likely to outperform the market leader. To truly unleash an altcoin season, the Altcoin Season Index would need to climb above 75, a sign of widespread bullishness across the entire altcoin ecosystem.

Why Altcoins Might Struggle To Shine

The sheer number of altcoins compared to previous cycles also throws a wrench into the altcoin season equation. In 2017 and 2021, for instance, the altcoin market was a much smaller pond. When Bitcoin surged, investor money flowed more readily into a smaller pool of altcoins, leading to significant price increases across the board.

Today, the landscape is vastly different. With thousands of altcoins vying for investor attention, any gains during an altcoin season might be concentrated in just a handful of high-performing projects, leaving the vast majority behind.

Bitcoin Dominance: A Key Indicator To Watch

Another crucial factor to consider is Bitcoin Dominance (BTC.D). This metric reflects Bitcoin’s market capitalization as a percentage of the total crypto market cap. Historically, a significant decline in BTC.D has coincided with altcoin seasons. In early 2021, for example, the coin’s dominance level plummeted from 70% to 40%, paving the way for a period of explosive altcoin growth.

Currently, however, BTC.D is on the rise, suggesting that altcoins are not yet the center of attention. Investors looking for altcoin opportunities should keep a close eye on this metric, as a sustained downtrend in the crypto’s dominance could be a harbinger of an approaching altcoin season.

Featured image from Indiana Daily Student, chart from TradingView