The winds of change are blowing through the crypto mining industry. The highly anticipated halving event in April 2024, which sliced block rewards in half, has sent shockwaves through the ecosystem. Daily revenue for miners has plummeted by over 70% since the halving, forcing them to scramble for new avenues to secure their bottom line.

Enter Artificial Intelligence (AI). Buoyed by the success of projects like OpenAI’s ChatGPT, AI computing is experiencing a surge in demand. This, coupled with potentially higher profit margins compared to Bitcoin mining, is making AI an increasingly attractive option for miners.

AI: A Beacon Of Hope In A Volatile Sea

Companies like Bit Digital are leading the charge, with AI already contributing nearly 30% of their revenue. Other industry players like Hut 8 and Hive are also dipping their toes into the AI pool.

Adam Sullivan, CEO of Core Scientific, said:

“The shift to AI allows us to create a diversified business model with more predictable cash flows.”

This diversification is crucial in the face of the volatile nature of Bitcoin prices. By incorporating AI, miners are aiming to reduce their dependence on a single, often unpredictable, income stream.

Mass Exodus Or Miner Metamorphosis?

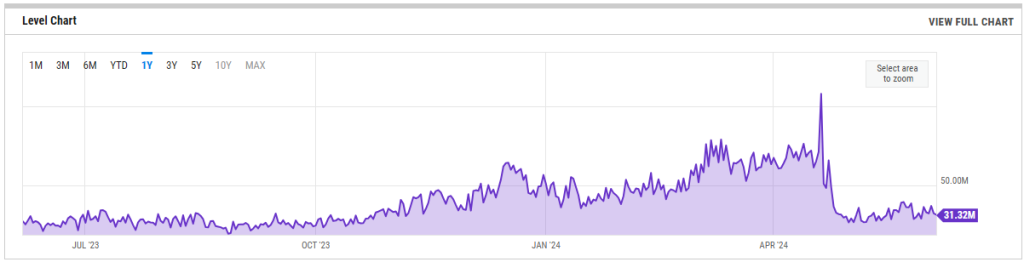

The impact of the halving isn’t limited to dwindling profits. Data suggests a potential shakeout within the mining community. A recent report indicates a significant drop in the Bitcoin network hashrate, a metric reflecting total mining power. This could signal a mass exodus of miners, particularly those with less efficient rigs struggling to stay afloat after the reward reduction.

Further corroborating this theory is the recent flash in the Hash Ribbons metric. This indicator tracks the difference between short-term and long-term moving averages of hashrate, with spikes suggesting low mining activity or miner capitulation.

Crypto hedge fund Capriole Investments interprets this as a potential “tempting Bitcoin buy signal,” suggesting the market might be reacting to a decrease in mining pressure.

Mining pressure refers to the pressure on crypto miners to sell their Bitcoin. Miners earn Bitcoin as a reward for securing the network and typically sell it to cover operational costs like electricity and equipment. When pressure decreases, it often indicates that miners are less compelled to sell their Bitcoin.

A Silver Lining For Long-Term Bulls?

Meanwhile, some analysts claim that institutional investors are showing renewed interest in Bitcoin, turning “risk-on” in their approach. This could be a sign of growing confidence in the long-term prospects of the cryptocurrency.

Featured image from The Motley Fool, chart from TradingView