Onchain Highlights

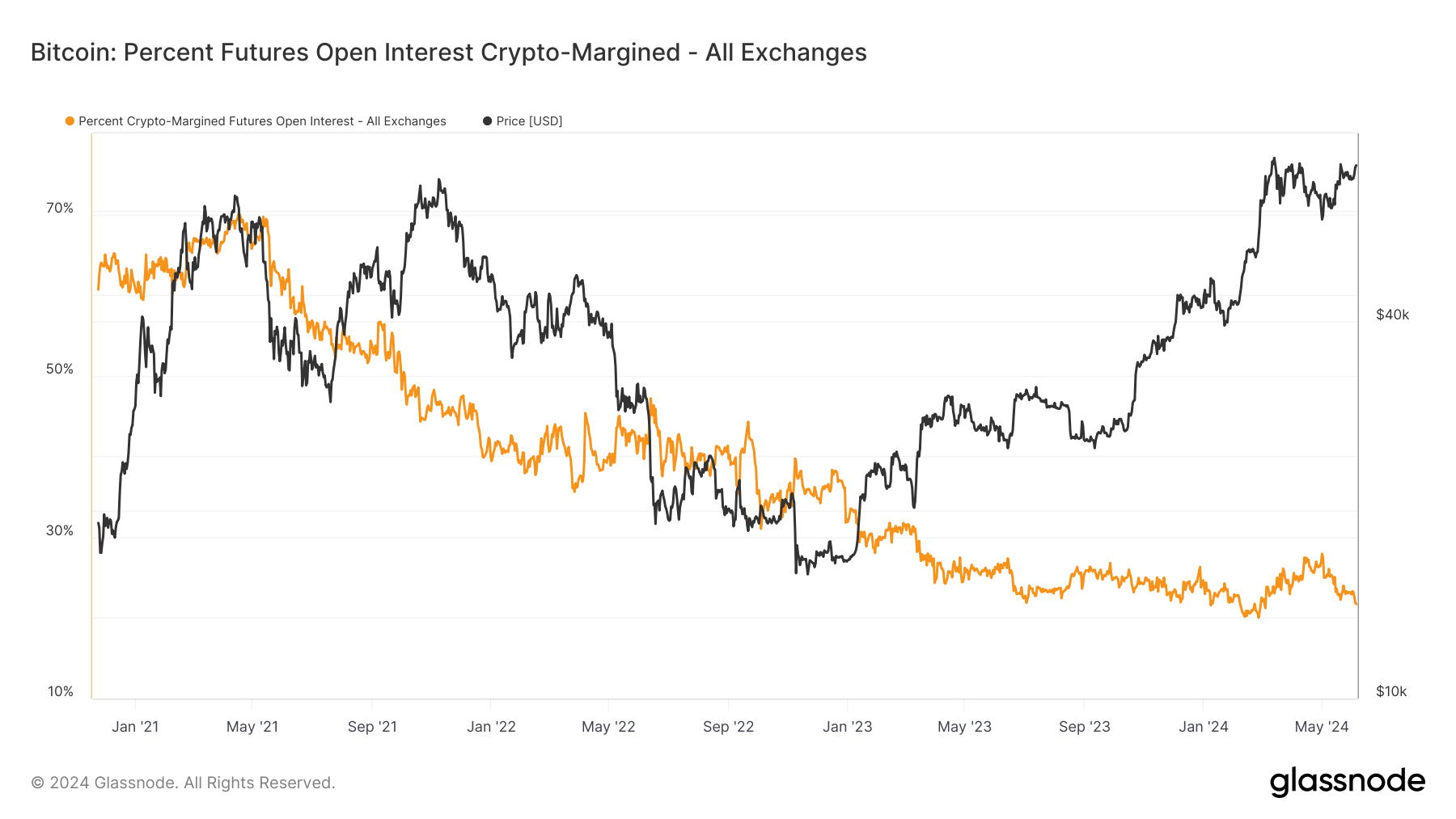

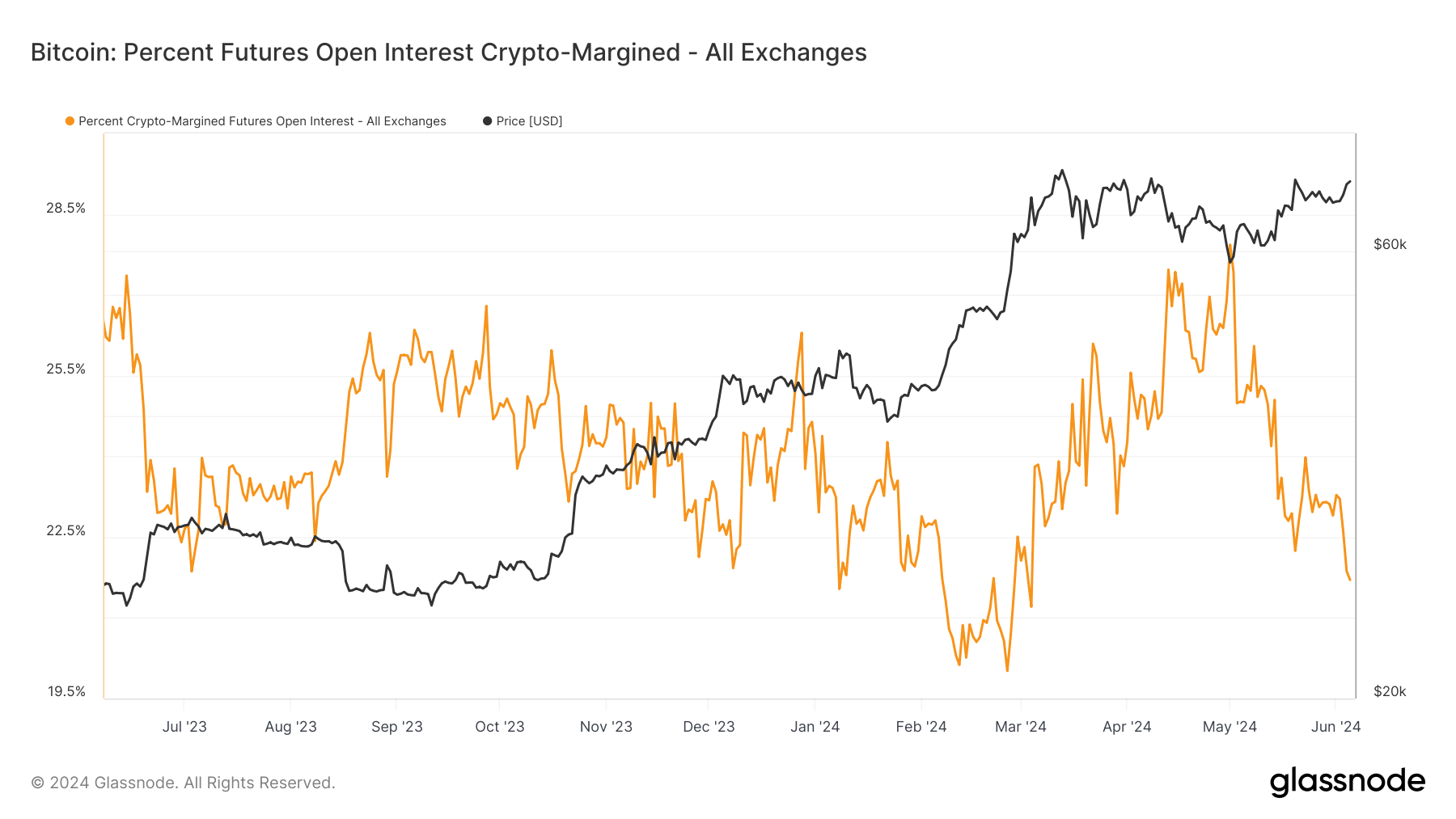

DEFINITION: The percentage of futures contracts open interest that is margined in the native coin (e.g., BTC) and not in USD or a USD-pegged stablecoin.

Bitcoin’s futures market is undergoing a notable shift, as reflected in the declining percentage of crypto-margined futures open interest across all exchanges. Data from Glassnode highlights a significant drop in the use of Bitcoin as collateral for futures contracts, falling from 70% in early 2021 to less than 20% by mid-2024.

This trend suggests a growing preference for more stable forms of collateral, such as USD or stablecoins, over Bitcoin itself. The rationale behind this shift is to mitigate the compounded risks associated with the volatility of Bitcoin prices, which can lead to increased liquidations during market swings. This move towards stability and risk mitigation signals a maturation of the market, where traders are adopting strategies to manage volatility more effectively.

Furthermore, the futures market’s response to Bitcoin’s price stabilization around $70,000 indicates an evolving landscape where open interest is beginning to recover. This recovery in open interest, coupled with the ongoing shift towards stable collateral, highlights changing trader behaviors and market forces.

The post Decline in crypto-margined futures signals shift towards stable collateral appeared first on CryptoSlate.