Following the recent price spike that brought Ethereum (ETH) close to the $4,000 mark, the second-largest cryptocurrency has experienced inflows and renewed market enthusiasm. This comes in response to the US Securities and Exchange Commission’s (SEC) approval of Ethereum ETF applications by major asset managers.

Best Week For Ethereum Since March

According to a report by CoinShares, digital asset investment products have witnessed a total of $2 billion inflows, contributing to a five-week consecutive run of inflows amounting to $4.3 billion.

Additionally, trading volumes in exchange-traded products (ETPs) have risen to $12.8 billion for the week, a 55% increase from the previous week.

Notably, inflows have been observed across various providers, indicating a turnaround in sentiment. Incumbent providers have also experienced a slowdown in outflows, reinforcing the positive market sentiment.

As seen in the image above, Bitcoin (BTC) continues to dominate the market, with inflows totaling $1.97 billion for the week. On the other hand, short Bitcoin products saw outflows of $5.3 million for the third consecutive week.

Similarly, Ethereum has also seen a notable surge in inflows, recording its best week since March with a total of $69 million, which for CoinShares is likely a reaction to the unexpected SEC decision to allow spot-based ETFs on Ethereum.

Differing Perspectives On ETH’s Price

Despite the positive developments, Ethereum’s price has struggled to maintain bullish momentum, failing to retest its yearly high of $4,100 reached in March. On Friday, the price dropped as low as $3,577.

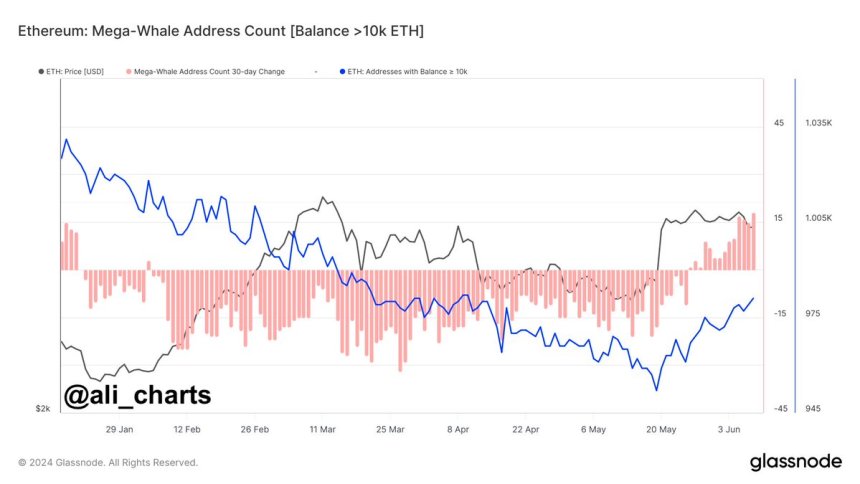

However, Ethereum addresses holding more than 10,000 ETH have increased by 3% in the past three weeks, indicating a significant spike in buying pressure.

Market analysts have provided differing perspectives on Ethereum’s future price action. “Trader Tank” predicts that ETH may drop to $3,500 while acknowledging the potential for a bullish reversal upon reclaiming the $3,700 level.

On the other hand, crypto analyst Lark Davis highlights that Ethereum’s supply on exchanges is at an eight-year low, suggesting that the upcoming ETFs could cause a “massive supply shock” and potentially lead to a substantial increase in ETH’s price.

Ultimately, as Ethereum’s price remains uncertain, market participants eagerly await the next movements in the cryptocurrency. As investors and analysts closely monitor the market dynamics, the question of whether a breakout above $4,000 or a retest of lower support levels at $3,500 awaits an answer.

The second-largest cryptocurrency on the market is currently trading at $3,690, down 6.5% in the past two weeks.

Featured image from DALL-E, chart from TradingView.com