Quick Take

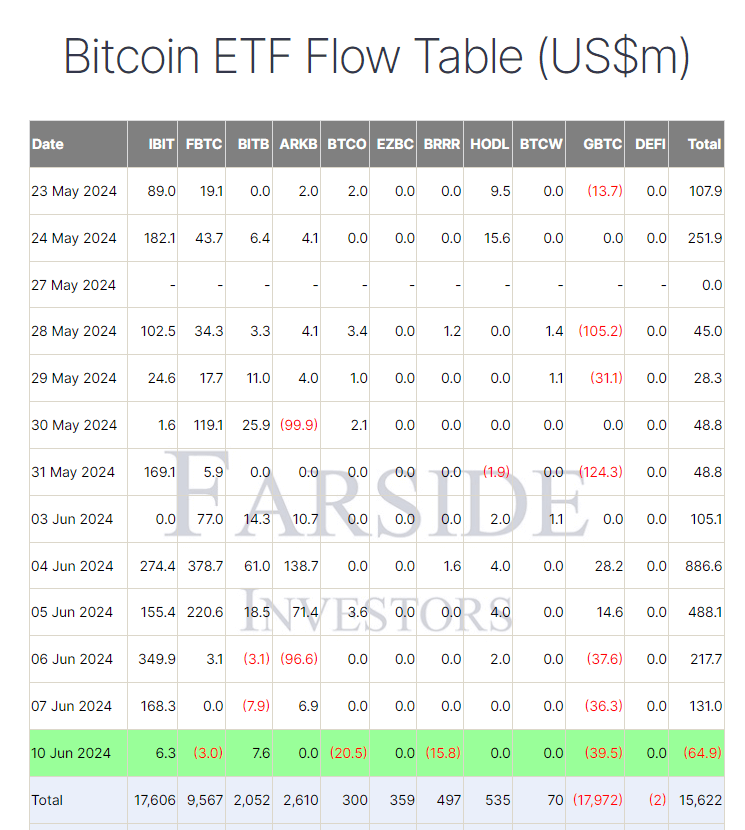

Farside data shows that on June 10, Bitcoin (BTC) exchange-traded funds (ETFs) saw a $64.9 million outflow, marking the first outflow since May 10 and halting a streak of 19 consecutive trading-day inflows. Four ETF issuers drove the outflows.

Grayscale’s GBTC led the outflows with $39.5 million, bringing their total outflows to $18 billion. The BTCO Invesco Galaxy ETF also saw substantial outflows of $20.5 million, though their total net inflow remains positive at $300 million. Valkyrie’s BRRR ETF experienced a $15.8 million outflow, but its total net inflow still stands at a healthy $497 million. Fidelity’s FBTC had a smaller outflow of $3 million, yet it maintains a robust total inflow of $9.6 billion, according to Farside data.

In contrast, two issuers saw positive inflows. BlackRock’s IBIT recorded an inflow of $6.3 million, while Bitwise’s BITB ETF saw an inflow of $7.6 million. Despite the recent outflows, total inflows into Bitcoin ETFs remain substantial at $15.6 billion.

The post 19-trading day Bitcoin ETF inflow streak ends with $64.9 million outflow appeared first on CryptoSlate.