Onchain Highlights

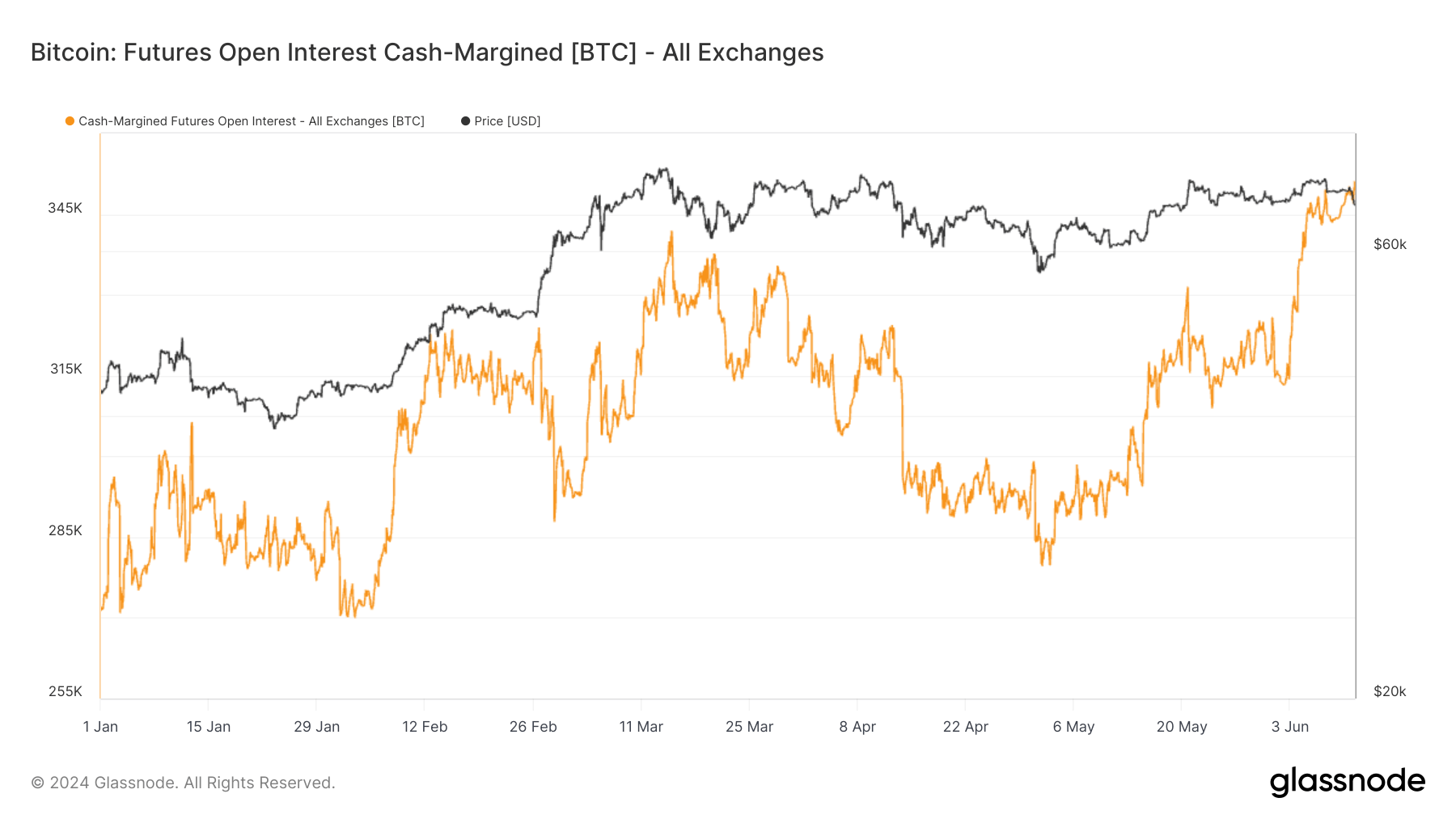

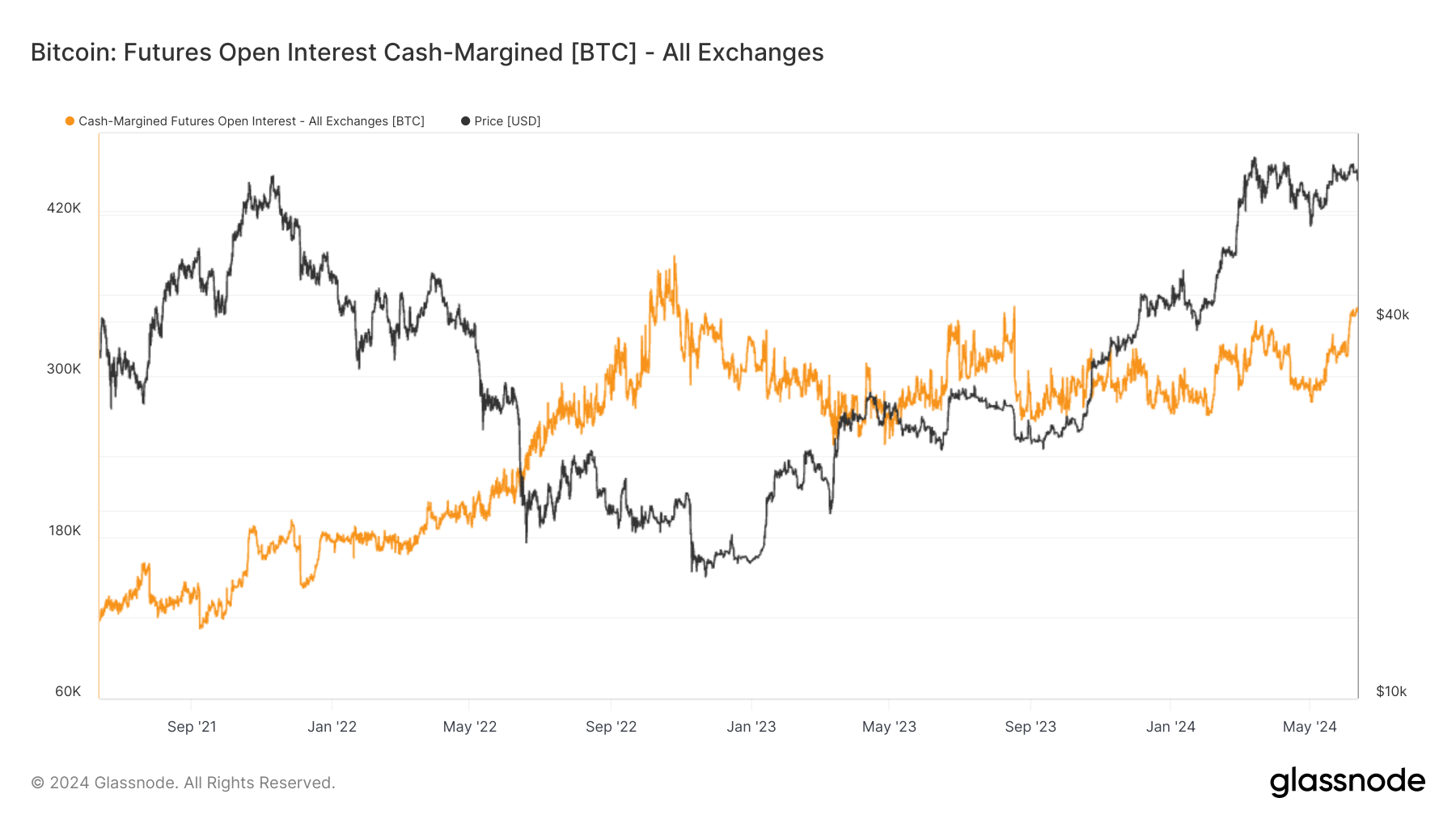

There has been a significant increase in the use of cash-margined contracts in Bitcoin futures. Data from Glassnode showed that there has been a substantial increase in cash-margined futures open interest across exchanges, rising to over 345,000 BTC as of June 11. This represents a significant increase from the 260,000 BTC cash-margined futures open interest seen at the beginning of the year. This increase reflects a broader market trend towards risk mitigation and a preference for collateral stability.

CryptoSlate’s earlier analysis found a discernible shift from Bitcoin-margined to cash-margined futures contracts. This change is attributed to traders’ growing preference for using USD and stablecoins as collateral to avoid the inherent volatility of cryptocurrencies. This trend is seen as a sign of market maturity, with a higher emphasis on stability and risk management in the highly volatile futures market.

The increase in cash-margined futures is also likely influenced by the recent Bitcoin halving event in April 2024, which has historically had a significant impact on market trends and trading strategies. As traders and investors continue to adapt to these changes, the overall market structure is set to move towards less volatile investment mechanisms. As CryptoSlate previously noted, this development is crucial for attracting more institutional investors who prioritize stability and risk management in their portfolios.

The post Bitcoin futures show notable growth in cash-margined contracts appeared first on CryptoSlate.