Quick Take

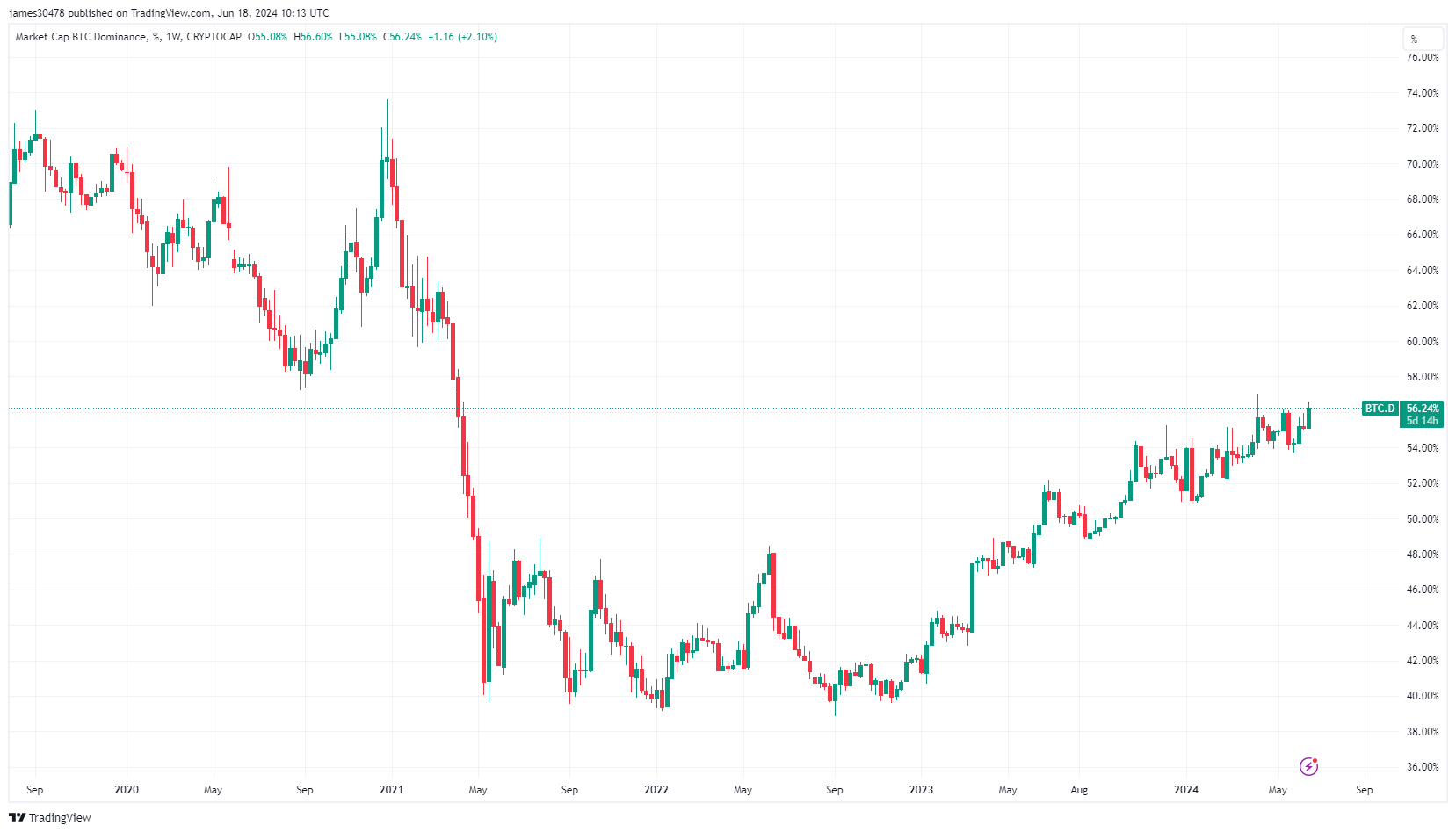

Bitcoin continues to trend down, falling over 11% from its all-time high. Despite this, Bitcoin dominance is on the rise, currently surpassing 56%. This level was briefly seen in April this year but was last consistently observed in April 2021.

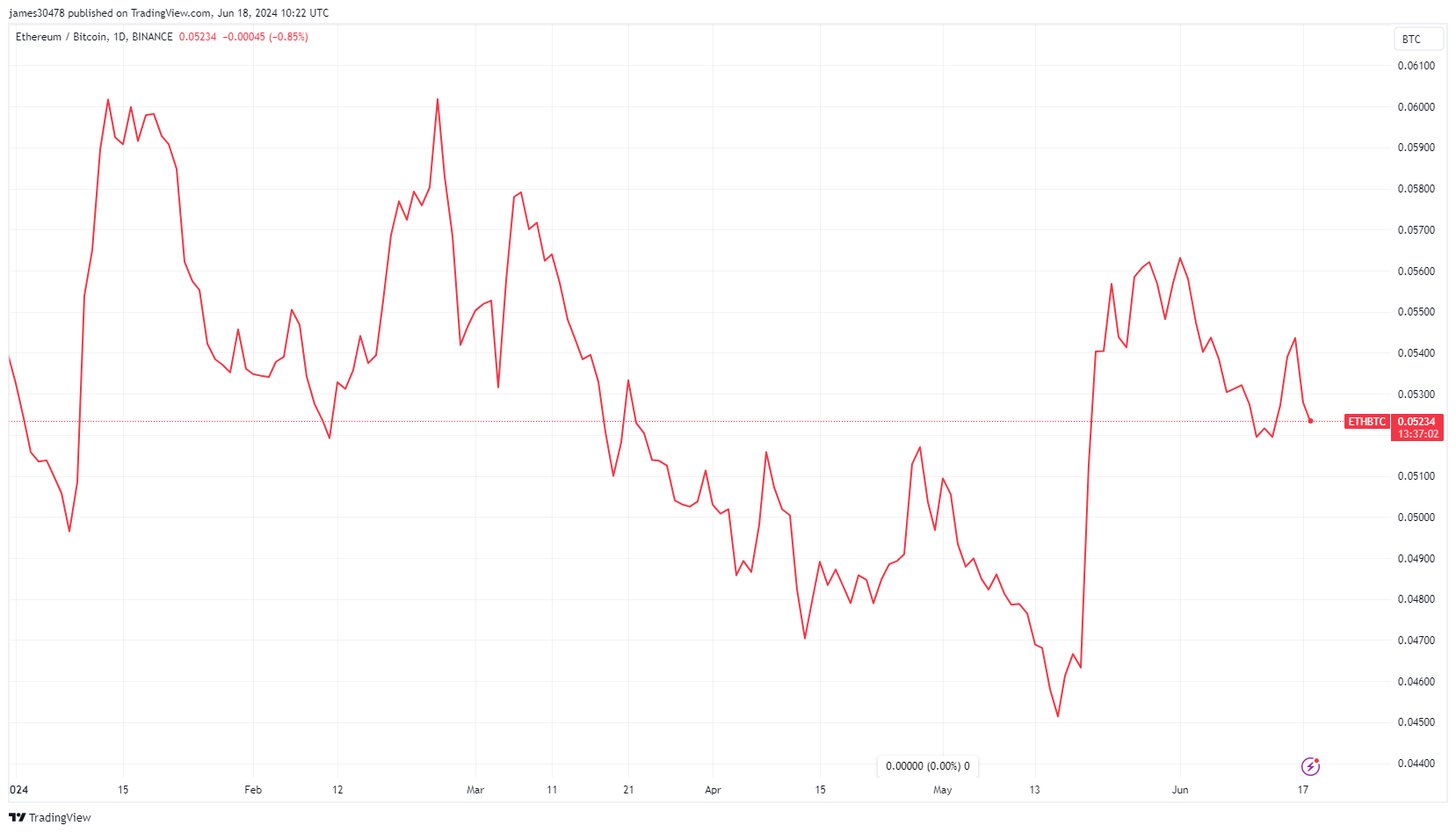

Consequently, the Ethereum to Bitcoin (ETH/BTC) ratio has been decreasing, currently trading at 0.052. Even after an initial spike due to the approval of the ETF, the ratio is currently down 2% year to date.

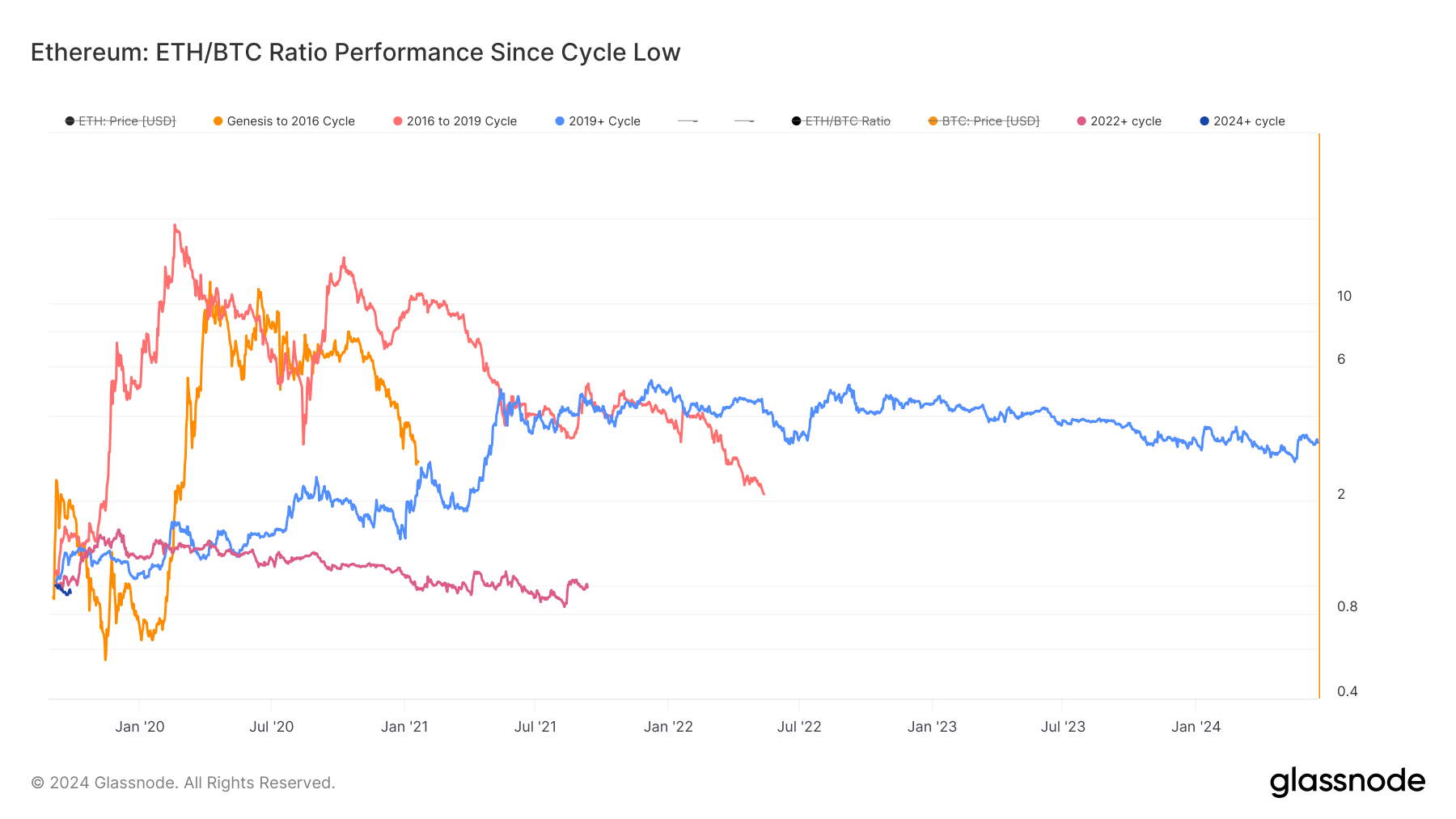

Examining the cyclical movements of the ETH/BTC ratio since the last cycle low reveals intriguing patterns. A cycle low occurred in June 2022, with the ratio dropping to 0.054 at the close and briefly dipping below 0.05. The previous cycle saw the ETH/BTC ratio plummet to 0.016 in September 2019.

Currently, the ETH/BTC ratio is just above 0.052 after recovering from 0.045 in May, indicating that Ethereum has slightly underperformed Bitcoin since 2022. However, compared to previous cycles, this is Ethereum’s worst-performing period. In prior cycles, Ethereum significantly outperformed Bitcoin, often by over 200%. This cycle’s performance is negative, making it the least favorable cycle for Ethereum returns in Bitcoin. This trend highlights a consistent decline in Ethereum’s relative performance across cycles.

The post Bitcoin dominance exceeds 56% as ETH/BTC ratio heads lower appeared first on CryptoSlate.