On-chain data shows the early Bitcoin miners have participated in a large amount of profit-taking inside the recent price range of the asset.

Bitcoin Miners Have Harvested Large Profits Between $62,000 & $70,000

As pointed out by CryptoQuant founder and CEO Ki Young Ju in a new post on X, the ‘early’ BTC miners have realized a massive amount of profit this year. The early miners here refer to the Bitcoin validators who got in during the early phase of adoption of the cryptocurrency.

Miners generally sell what they mine in order to pay off their running costs, but some of them may choose to HODL instead. There are some early miners who haven’t moved their block rewards in ages.

These miners may also be HODLing, but a more probable explanation behind their dormancy could be that their wallets have simply become lost due to being forgotten or having their keys misplaced.

Nonetheless, it would appear that some of these old miners have awakened once more, as they have been making some moves recently.

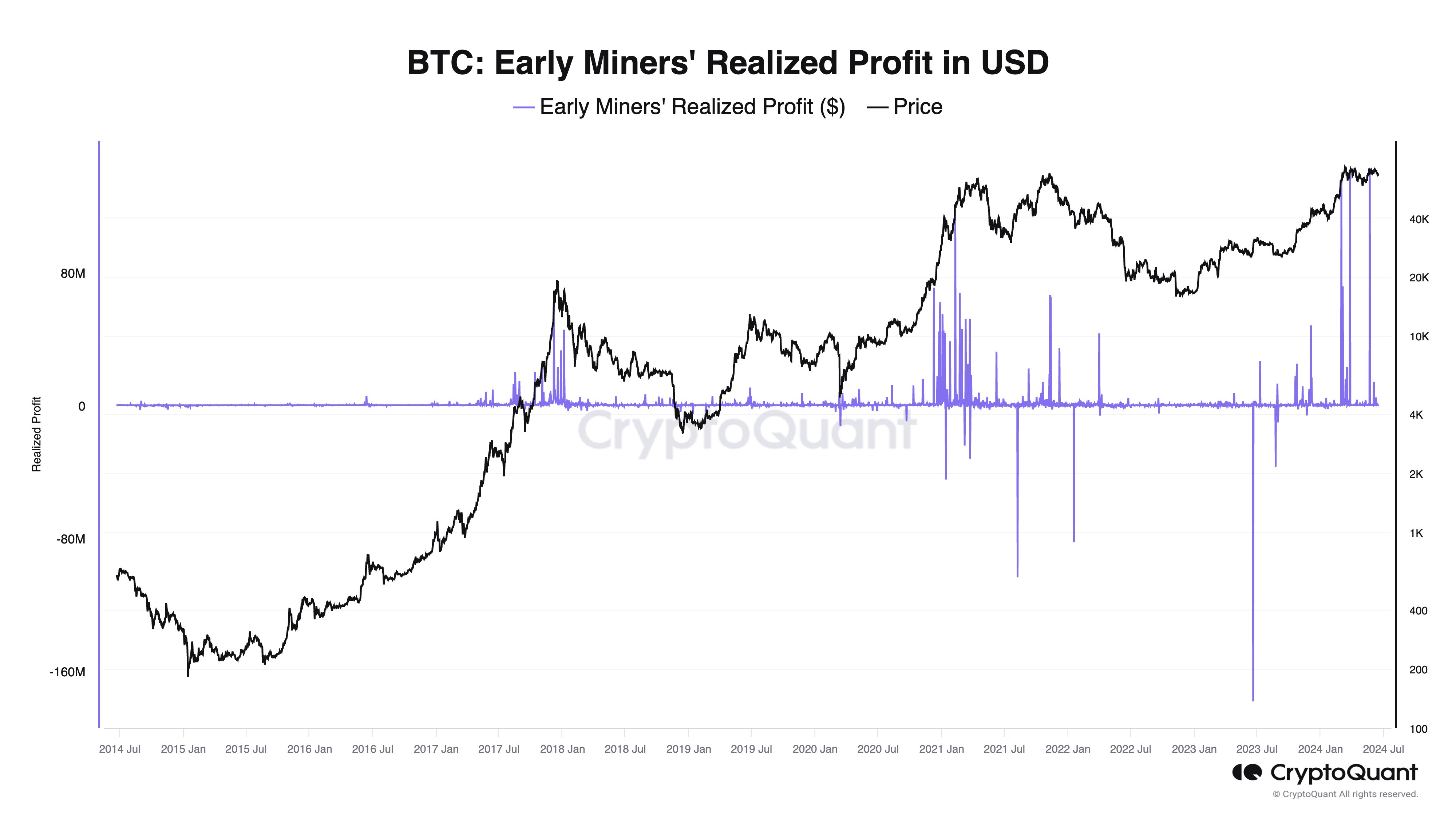

Below is a chart that shows the trend in the “realized profit” for these early miners over the past decade:

Here, the realized profit is an indicator that measures the total amount of profit (in USD) that the early miners of the cryptocurrency are harvesting through their transactions.

The metric calculates this by subtracting the price at which the coins were last moved by these ancient entities, from the current spot price at which these investors are moving them again.

As is visible in the chart, the indicator’s value has registered a few very large spikes this year, suggesting that the early miners have decided to book some of their gains.

These large values of the indicator have come as the price has traded inside the $62,000 to $70,000 range and have corresponded to a total profit-taking spree of a whopping $550 million.

From the graph, it’s apparent that this kind of trend isn’t unusual for a bull market, as previous such phases of the cryptocurrency had also witnessed the early miners breaking their silence to realize large profits.

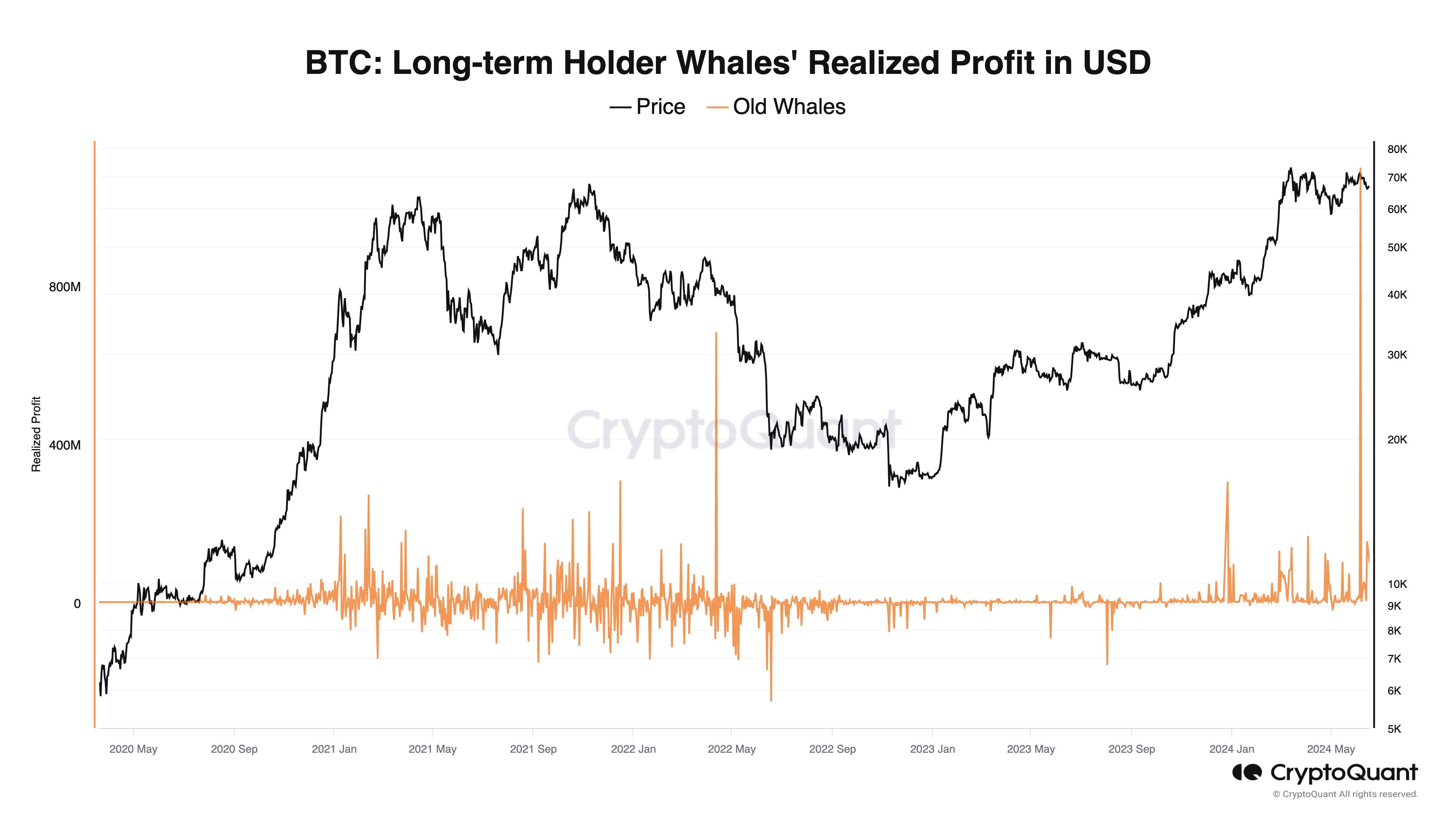

Another veteran cohort has also just participated in a large amount of profit-taking: the long-term holder whales. The long-term holders (LTHs) refer to the investors who have been holding onto their coins since more than 155 days ago, while the whales are typically defined as holders with at least 1,000 BTC.

Thus, the LTH whales would be the largest HODLers in the market. As the below chart shared by the CryptoQuant founder in another X post shows, the realized profit for these investors has seen a large spike recently.

BTC Price

At the time of writing, Bitcoin is trading at around $65,000, down around 4% over the past week.