Onchain Highlights

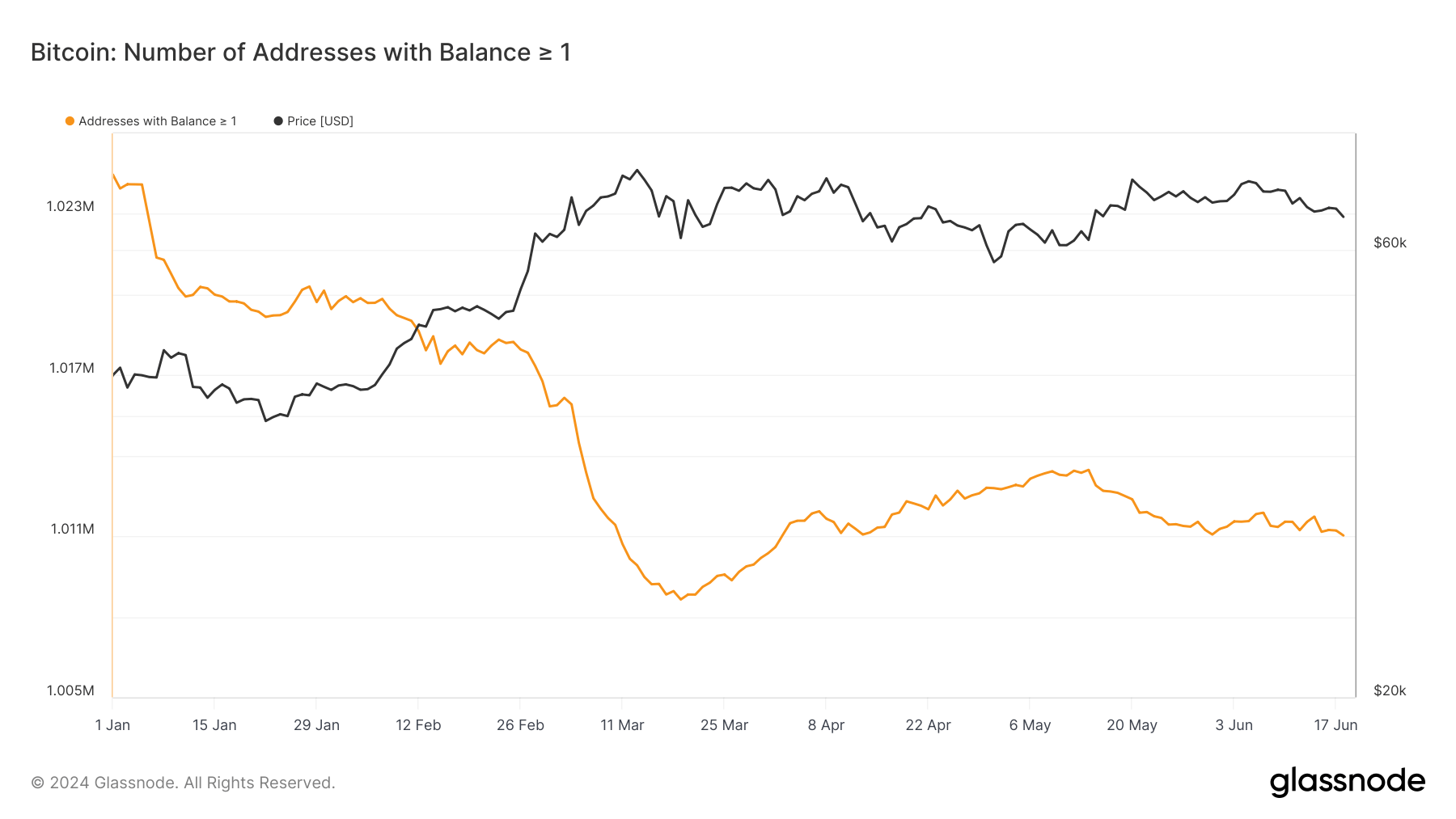

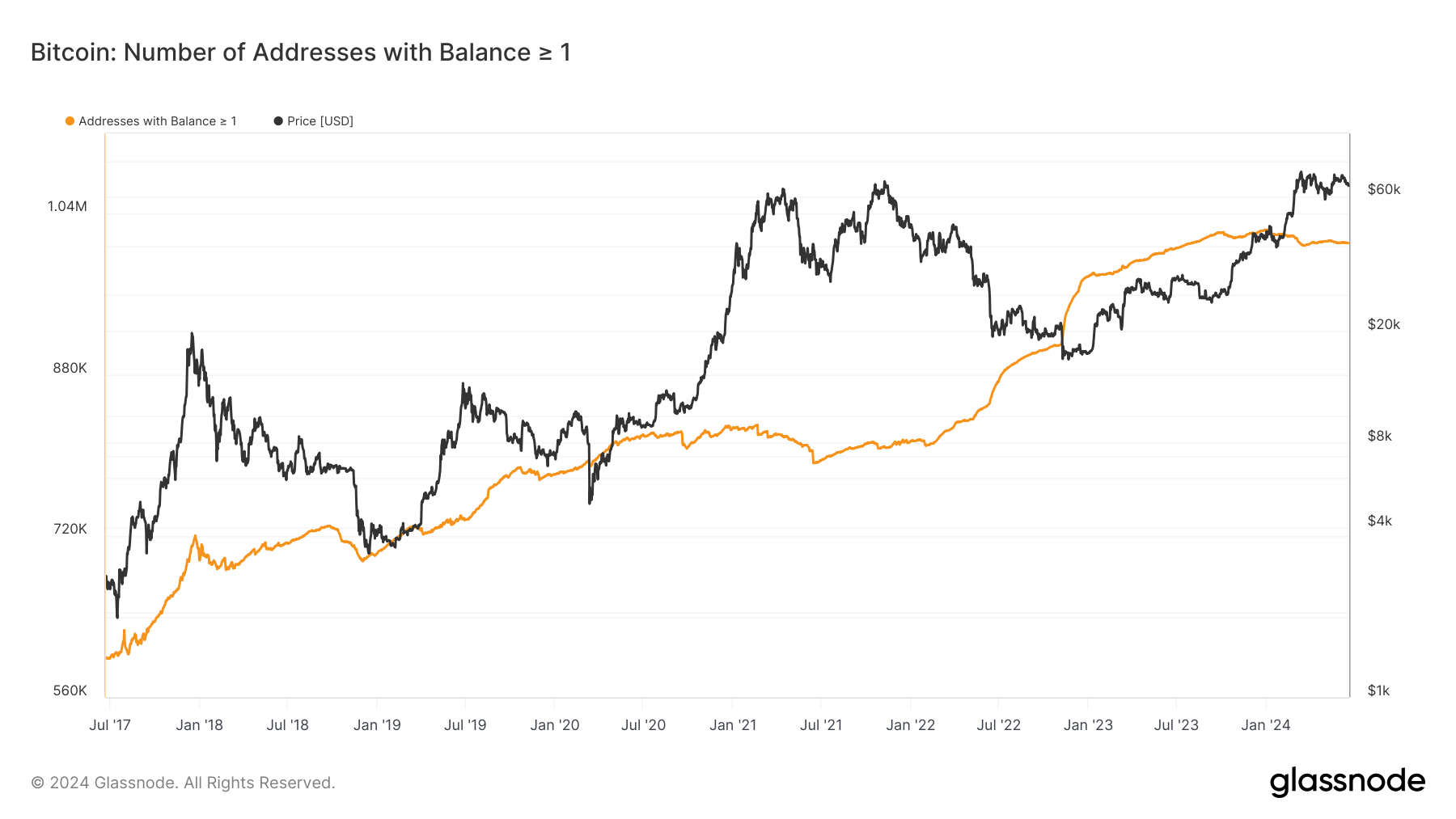

DEFINITION: The number of unique addresses holding at least 1 coin.

Bitcoin addresses holding at least one coin have exhibited a dynamic trend against its price in 2024. As the year began, the number of such addresses hovered around 1.023 million. However, a decline followed, hitting approximately 1.011 million by mid-June. This reduction paralleled a period of relative stability in Bitcoin’s price, which fluctuated around $60,000.

Analyzing longer-term data from mid-2017 to mid-2024, a steady increase in these addresses is apparent, rising from about 600,000 to over 1 million. This upward trend indicates growing accumulation among holders, even as Bitcoin’s price experienced significant volatility, including notable peaks and troughs.

This persistent growth in the number of addresses with at least one Bitcoin reflects sustained interest and confidence in Bitcoin despite market fluctuations. This pattern highlights the increasing decentralization and distribution of Bitcoin holdings among individual investors, which could contribute to the digital assets’s resilience and long-term stability.

The post Bitcoin addresses holding over 1 BTC drop to just above 1 million appeared first on CryptoSlate.