The cryptocurrency XRP is making waves as open interest (OI) for the token experiences a dramatic rise. This surge in investor positioning coincides with the ongoing legal battle between Ripple Labs, the company behind XRP, and the US Securities and Exchange Commission (SEC).

Bullish Bets On The Horizon

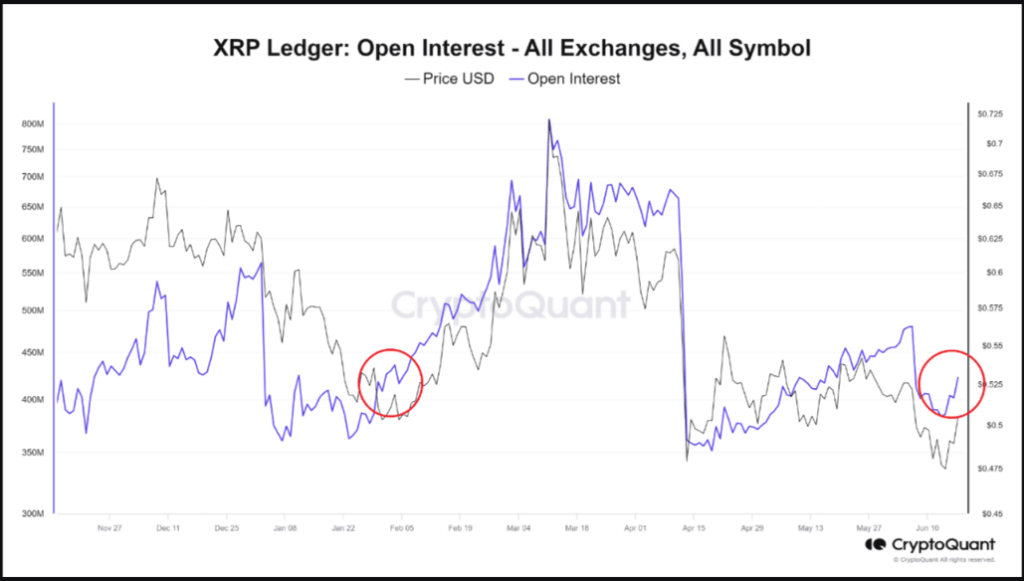

Cryptocurrency analysis platform CryptoQuant detected a significant increase in XRP’s open interest, indicating a growing number of investors entering positions. This trend suggests a bullish sentiment, with investors betting on a potential price appreciation for XRP in the near future. The logic is simple: more investors entering the market with buy orders typically drives the price upwards.

Recent developments in the SEC lawsuit, which accuses Ripple of selling unregistered securities in the form of XRP, seem to be buoying investor confidence. A recent court decision, for instance, may have provided some clarity on the legal classification of XRP, potentially paving the way for a more favorable outcome for Ripple.

Volatility Ahead: Potential Market Swirls

While the surge in open interest is a positive sign for XRP bulls, CryptoQuant warns of potential market volatility on the horizon. Rising open interest can be a double-edged sword. It indicates increased market activity, but it can also lead to higher volatility.

A market with high open interest can resemble a busy intersection. Increased activity can lead to more opportunities, but it also raises the risk of sudden changes. Just as drivers need to be extra cautious at a crowded intersection, investors in a market with high open interest need to be prepared for potential volatility as new information or shifting market sentiment prompts investors to adjust their positions quickly.

This potential volatility underscores the importance of caution for XRP investors. While the current trend suggests optimism, it’s crucial to remember that the outcome of the SEC lawsuit remains uncertain and the broader cryptocurrency market is inherently volatile.

XRP Price Prediction

Meanwhile, XRP is predicted to rise by 21% to reach $0.602 by July 19, 2024. Despite this optimistic forecast, the current market sentiment remains bearish, indicating caution among traders. However, the Fear & Greed Index at 64 shows a state of greed, suggesting positive market activity and buying interest despite the prevailing caution.

In the past 30 days, XRP has seen 14 green days, or 47% of the period, indicating moderate positivity. The price volatility over this period has been 3.67%, which is relatively moderate for a cryptocurrency.

Featured image from Search Engine Land, chart from TradingView