MicroStrategy purchased nearly 12,000 BTC for $786 million, according to a June 20 filing with the US Securities and Exchange Commission (SEC).

Following the news, the company shares rose by 3% at pre-market trading to $1,507, according to Google Finance data.

Bitcoin purchase

The filing stated:

“MicroStrategy acquired approximately 11,931 bitcoins for approximately $786.0 million in cash, using proceeds from the Offering and Excess Cash (defined in our quarterly report on Form 10-Q for the three months ended March 31, 2024), at an average price of approximately $65,883 per bitcoin, inclusive of fees and expenses.”

With this latest acquisition, the company’s Bitcoin holdings have risen to 226,631 BTC. These were acquired at a total purchase cost of around $8.3 billion, averaging about $36,798 per BTC. Based on current prices of $65,990, the current market value of these holdings is more than $15 billion.

Notably, the company recently completed an $800 million debt offering with a 2.25% coupon and a 35% conversion premium. Since the start of the year, this strategy has helped the company raise over $2 billion for Bitcoin purchases.

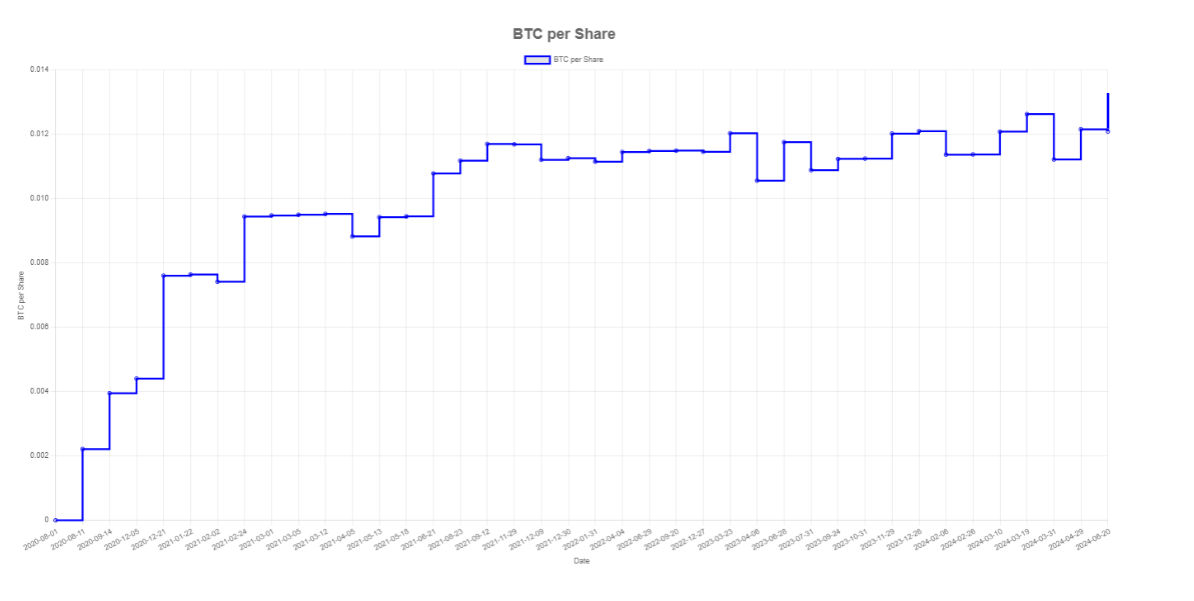

However, despite issuing more shares, which typically dilutes share value, CryptoSlate Insight reported that the company’s Bitcoin per share value has increased. This rise means each share now represents more Bitcoin value, benefiting shareholders.

MicroStrategy’s Bitcoin holdings per share have increased to 0.013163 BTC, with 17,194,000 shares outstanding and a total of 226,331 BTC held.

BTC to $1 million

Meanwhile, analysts at Bernstein have significantly increased their Bitcoin price projections, forecasting the flagship digital asset to reach $1 million by 2033 and $200,000 by the end of 2025.

This optimistic outlook is based on the top crypto’s surging demand and limited supply. The analysts pointed out that the newly launched spot Bitcoin ETFs and several institutions have begun incorporating BTC into their treasuries.

They also noted that the digital asset could receive approvals at major wirehouses and large private bank platforms before the end of the year, which would prompt institutional basis trading strategies that would further bolster its adoption.

The post MicroStrategy’s $786 million Bitcoin buy sees share value climb 3% appeared first on CryptoSlate.