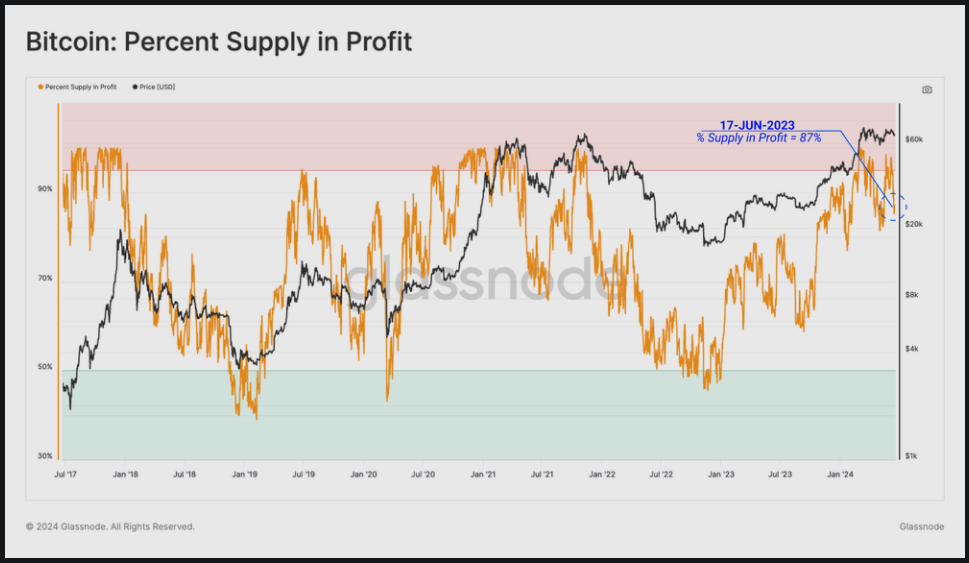

The current state of the Bitcoin market offers a mix of optimism and caution for investors. Over 87% of Bitcoin holders are in profit, with their investments valued higher than their initial purchase prices.

On average, these investors are seeing unrealized gains of 120%, a significant figure that reflects the substantial rally that pushed Bitcoin to its all-time high in March, according to Glassnode data. However, despite these gains, the market exhibits both encouraging long-term trends and some short-term uncertainties that merit closer examination.

Profitability And Market Metrics

The profitability among Bitcoin investors is notable. The MVRV (Market Value to Realized Value) metric, a key indicator of market sentiment, remains comfortably above its yearly baseline. This metric measures the ratio of Bitcoin’s market value to its realized value and serves as a gauge of average unrealized profit across the market.

A high MVRV ratio indicates that most investors are sitting on substantial unrealized gains, painting a positive picture of the market’s health. This upward trend contrasts with the recent price volatility, underscoring the resilience of long-term investors who bought the dip and are now seeing their foresight rewarded.

Reduced Trading Activity And Demand

Despite the overall profitability, the Bitcoin market is experiencing a notable reduction in trading activity. The vibrant speculative trading that once characterized the market has significantly diminished.

Day traders, who previously capitalized on price swings, have retreated, resulting in reduced trading volumes and tepid demand. This lack of speculative trading has led to a stagnation in Bitcoin prices, which are now confined to a well-defined range. The market’s current state can be likened to a calm period after a storm, where activity is subdued, and prices sway gently without significant movement.

Investor Caution And Market Sentiment

The reduced trading activity reflects a broader sentiment of caution among investors. The current period of consolidation suggests that many investors are taking a wait-and-see approach, carefully assessing the market landscape before making any decisive moves.

This cautious sentiment is further evidenced by on-chain data showing a significant decrease in the flow of Bitcoin into exchanges. Typically, an increase in Bitcoin transfers to exchanges is a precursor to selling activity, as holders look to liquidate their positions. The current decline in these transfers indicates that both short-term and long-term holders are refraining from selling, preferring to hold onto their assets.

Short-term holders, who once actively traded Bitcoin for quick profits, are now transferring significantly fewer coins compared to the peak levels seen in March. This behavior suggests a shift towards a more conservative strategy, possibly in anticipation of future price movements. Long-term investors, on the other hand, appear content to maintain their positions, exhibiting confidence in Bitcoin’s long-term potential despite the short-term market stagnation.

Featured image from Adobe Stock, chart from TradingView