Bitcoin keeps catching the attention of investors and analysts with its price changes and big moves. Recently trading at $65,715, Bitcoin’s small increase of nearly a percent in the last 24 hours has sparked some cautious optimism among crypto fans around the world. This newfound confidence is boosted by big whale activity and positive long-term predictions from top analysts.

Big Investor Buys $395M Worth of Bitcoin

A well-known crypto whale has made headlines by buying 6,070 BTC, worth about $395 million. This is the whale’s first big purchase in over 18 months. Known for smart trading moves, this investor previously bought 41,000 BTC during the 2022 market dip at an average price of $19,000 per BTC.

In a brilliant move, the whale sold 37,000 BTC during the market upswing in 2023 and 2024 at an average price of $46,800, making a huge $1.74 billion in proceeds and over $1 billion in profit. This latest purchase shows the whale’s renewed faith in Bitcoin’s future, hinting at big price movements ahead.

Analysts Predict Bitcoin Could Reach $100,000

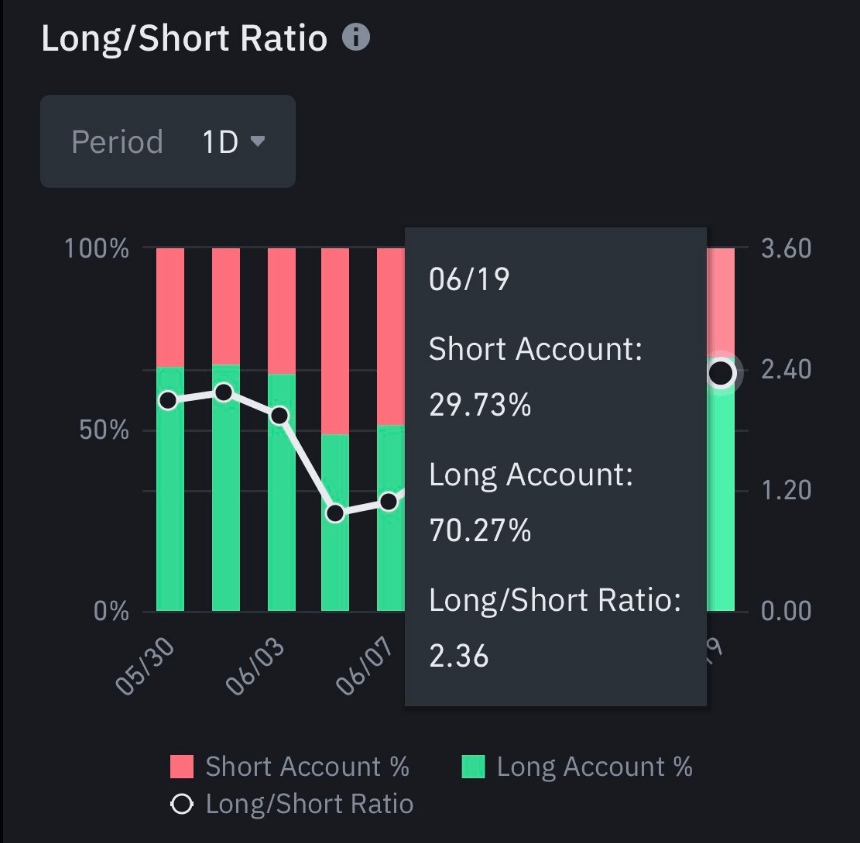

Top crypto analysts are very optimistic about Bitcoin’s future, with some predicting it could hit $100,000. Ali Martinez, a respected crypto expert, points out that over 70% of all open Bitcoin positions on Binance are bullish.

70.27% of all accounts in @binance with an open #Bitcoin position are going long! pic.twitter.com/PiGZp0rP58

— Ali (@ali_charts) June 19, 2024

Another analyst, who goes by the name Jelle, notes that Bitcoin has recently hit important support levels, like the 100-day Exponential Moving Average (EMA) and the lower edge of an ascending triangle pattern.

Jelle believes a bounce from these levels could push Bitcoin to $72,000 soon, paving the way for a potential rise to $100,000 in the long run. These predictions are in line with a broader optimistic view, as many believe Bitcoin’s current price is a good buying opportunity.

More Bullish Signs On The Horizon

Bitcoin’s recent price movement isn’t just drawing in individual investors. More big institutional investors are showing interest, which shows growing confidence in Bitcoin’s value. Large investments from well-known figures and companies signal wider acceptance and integration of Bitcoin into mainstream finance.

Meanwhile, Bitcoin price prediction for July is bullish, indicating a potential 30% rise to over $85,000, according to crypto price tracker CoinCodex. This is despite current technical indicators leaning bearish. This suggests a potential disconnect between market sentiment and price action.

The Fear & Greed Index at 60 (Greed) further highlights this dissonance. While the price has seen nearly half bullish days (47%) over the past month with relatively low volatility (2.29%), underlying technicals may be pointing to a different story. It will be interesting to see if the predicted price increase comes to fruition or if the bearish undercurrents prevail.

Investors are closely watching Bitcoin’s price movements, looking for opportunities that could signal new highs. Although the path to $100,000 is full of uncertainty, the strategic insights from market veterans and increasing institutional interest provide a solid foundation for Bitcoin’s long-term potential.

Featured image from Pexels, chart from TradingView