Bitcoin has plummeted to under $64,000, its lowest level since mid-May, driven by heightened selling pressure in the market.

BTC has mostly traded downwards or sideways after exceeding the $70,000 mark at the start of the month. Since then, the flagship asset has shed more than 10% of its gain during this period.

Why is BTC falling?

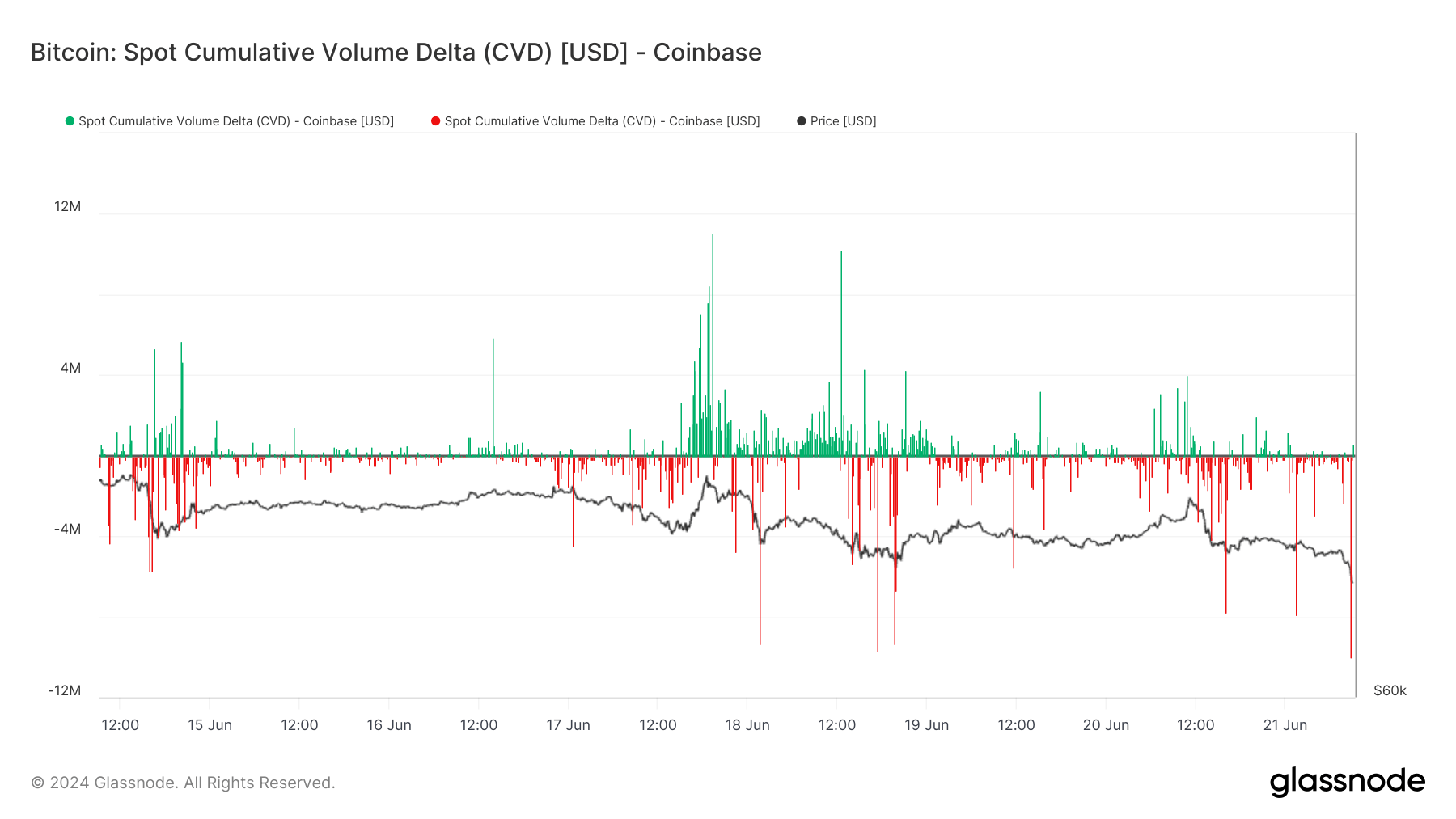

On-chain data reveals that some recent selling pressure originated from Coinbase, the largest US-based crypto exchange. Glassnode data shows that the platform experienced $10 million in spot-selling activity, marking the highest amount within a 10-minute window in a week.

Notably, the German government is also contributing to the current selling pressure, moving $600 million in BTC on June 19, with $195 million sent to four exchange addresses, including Kraken, Bitstamp, and Coinbase.

Market experts have attributed BTC’s current price weakness to increased outflows from the US-based spot Bitcoin exchange-traded funds (ETFs). While interest in these ETFs surged after their approval in January, leading to over $53 billion inflow, the past week has seen net outflows exceeding $900 million.

Additionally, BTC miners have been offloading their holdings due to the financial pressure introduced by the recent halving event. Bitcoin analyst Willy Woo said BTC’s price would only recover “when weak miners die and hash rate recovers.”

$20 million liquidation in 1 hour

Coinglass data reveals that the market downturn liquidated around $20 million in crypto positions within the past hour, totaling $150 million in the last 24 hours.

A closer look at the liquidations indicates that long traders who bet on price increases faced the most significant losses, losing $106 million. In contrast, short traders, holding a more bearish outlook, were liquidated for $44 million.

Bitcoin traders experienced the highest losses, totaling $42 million—$26 million from long positions and $16 million from short positions. Ethereum traders followed closely, with liquidations reaching approximately $28 million.

The most significant single liquidation occurred on Bybit, involving a BTCUSD transaction valued at $8.09 million.

The post Bitcoin tumbles to lowest price since mid-May under $64k appeared first on CryptoSlate.