Onchain Highlights

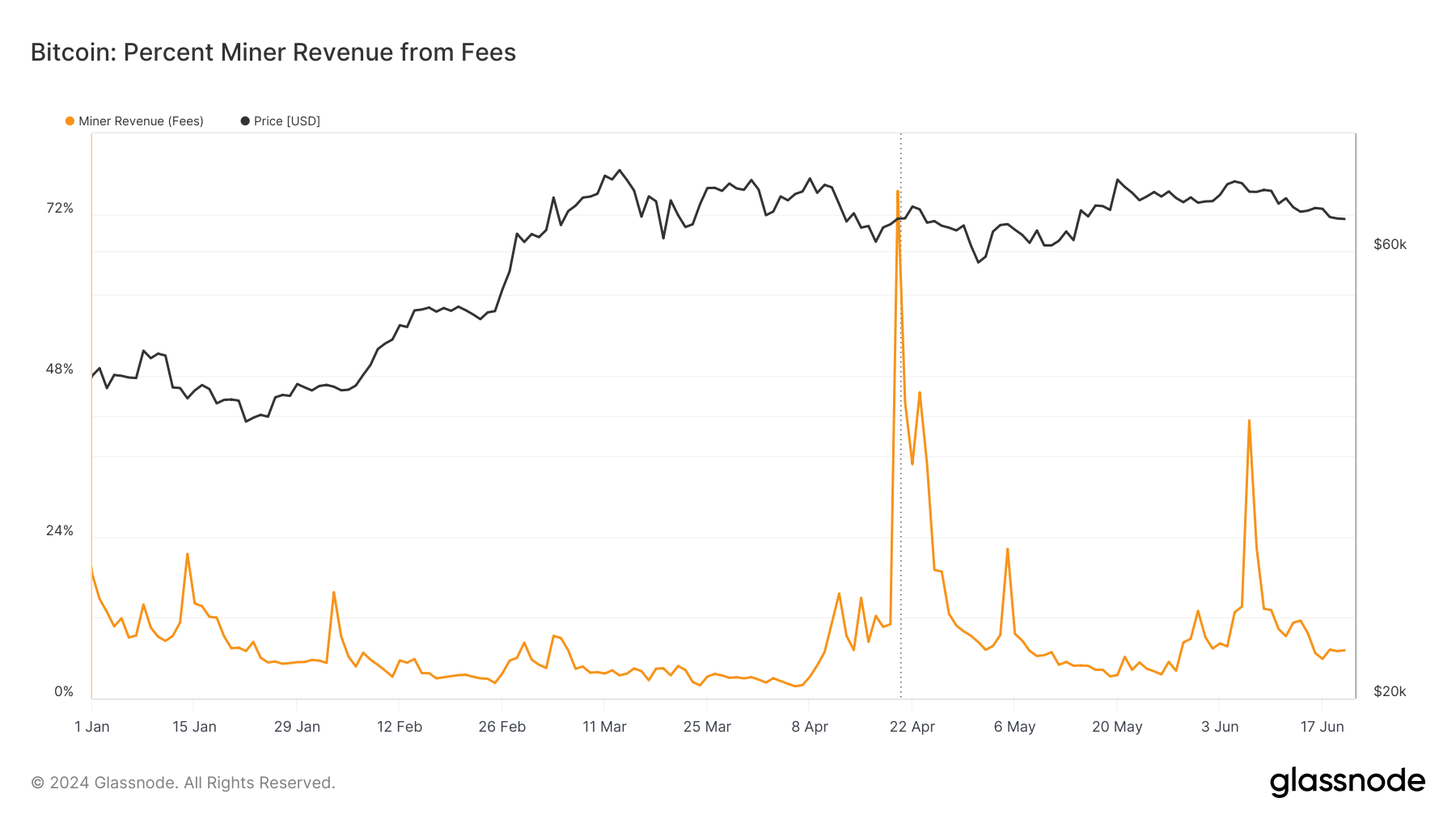

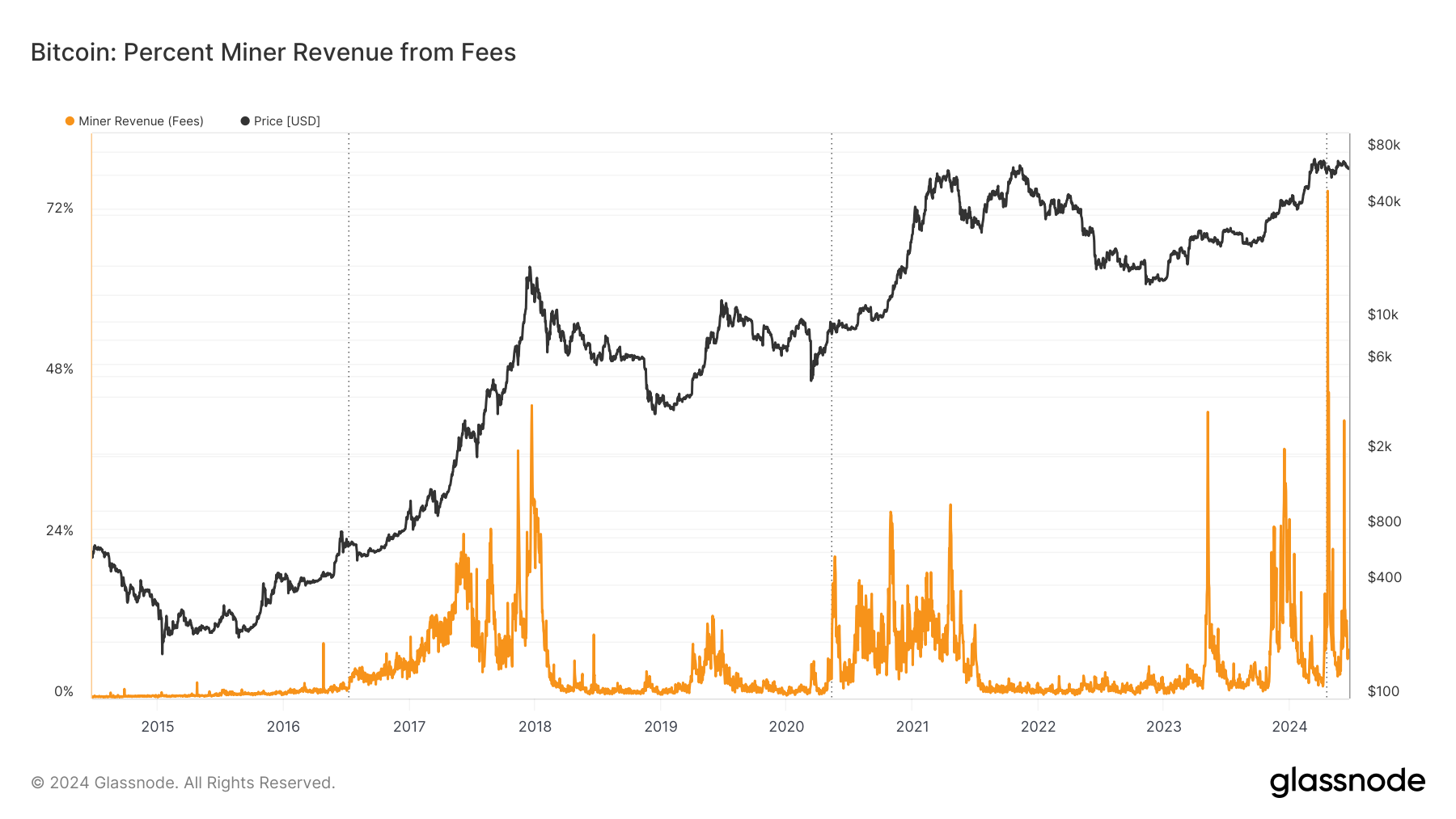

DEFINITION: The percentage of miner revenue derived from fees, i.e. fees divided by fees plus minted coins.

Bitcoin miners are experiencing a notable shift in their revenue sources, primarily driven by changes in transaction fee dynamics. Recent data from Glassnode illustrates a fluctuating trend in the percentage of miner revenue derived from transaction fees throughout the year. As of early 2024, miner revenue from fees spiked dramatically in April, reaching nearly 72%, before stabilizing around lower percentages in the subsequent months. This surge coincides with the launch of Runes during the halving causing fees to spike, indicating heightened demand for transaction processing.

Historically, such spikes in fee revenue correlate with significant price movements or network activity. For instance, the chart spanning back to 2014 shows periodic peaks in fee revenue during major bull runs and network congestion periods. The most recent trend suggests miners can profit well from transaction fees when Bitcoin prices and network activity intensify, emphasizing the pivotal role of transaction fees in miners’ revenue streams. While Inscriptions and Runes hysteria has died down for now, a potential resurgence would be extremely bullish for miners.

Per Glassnode, understanding these trends is crucial for anticipating miners’ financial health and the broader network’s economic forces.

The post Transaction fees dominate Bitcoin miner revenue at pivotal halving appeared first on CryptoSlate.