USDT, Tether’s digital token pegged to traditional currencies, is leading a quiet revolution in the world of finance. In a landmark development, USDT has surpassed Visa’s average daily transaction volume on the Tron blockchain, underscoring its position as the undisputed leader in the stablecoin space. This surge signifies a growing confidence in stablecoins and their potential to disrupt the financial landscape.

USDT Flexes Muscles

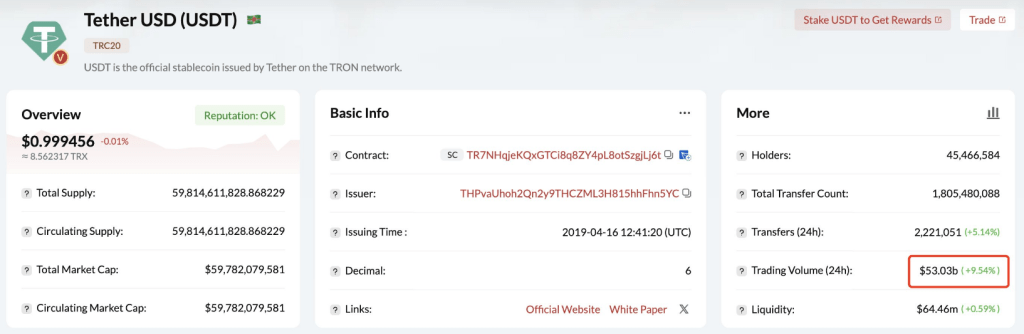

USDT’s dominance is evident. Available on multiple blockchains, it has seen its market cap explode since its inception in 2014. But the recent milestone on Tron, a blockchain known for its lower transaction fees, is particularly noteworthy. Lookonchain data reveals USDT transactions on Tron hitting a staggering $53 billion in a single day, exceeding Visa’s daily average of $42 billion. This 20% lead underscores the increasing adoption of stablecoins for everyday transactions.

The 24-hour trading volume of $USDT on #TronNetwork is $53B, exceeding Visa’s average daily trading volume.

Visa’s trading volume in Q1 2024 was $3.78T and the average daily trading volume was $42B. pic.twitter.com/jolGKIUcxE

— Lookonchain (@lookonchain) June 21, 2024

Why The Rise Of Stablecoins?

So, what’s driving this surge? Unlike traditional cryptocurrencies known for their wild price swings, stablecoins offer a haven of stability. They are typically pegged to fiat currencies like the US dollar, meaning their value remains relatively constant. This stability makes them ideal for everyday transactions, eliminating the fear of sudden price drops that plague traditional cryptocurrencies. Additionally, stablecoins leverage the power of blockchain technology, enabling faster, cheaper, and more transparent transactions compared to conventional systems.

Regulation On The Horizon

As stablecoins gain traction, governments are scrambling to establish regulatory frameworks. The Lummis-Gillibrand Payment Stablecoin Act in the US and similar initiatives in the UK highlight a global concern for ensuring user protection and financial stability in the face of this innovation. While these regulations are crucial for responsible growth, navigating the ever-changing political climate adds another layer of complexity. For instance, the UK’s crypto policy remains uncertain with a looming general election.

The Future Of Finance

Despite the challenges, the momentum behind stablecoins seems unstoppable. Their ability to bridge the gap between traditional finance and the crypto world offers undeniable advantages. While daily transaction volume can be volatile, and concerns like rising transaction fees on Tron need to be addressed, the overall trend is clear.

Stablecoins are here to stay, and their impact on the global financial system is likely to be profound. As regulations take shape and the technology matures, stablecoins have the potential to revolutionize the way we conduct everyday transactions, ushering in a new era of financial inclusion and efficiency.

Featured image from Pexels, chart from TradingView